Guidelines on Tax Reporting for Referral-Users in Brazil

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and are not exhaustive. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

Being a resident in Brazil and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following tax regulations according to the applicable Brazilian law.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation, Cello is the recipient of a service.

- Supplier

- Referral Users are the suppliers of a service.

Since you are in this case the supplier by conducting a referral and receiving a payment, you are responsible for tax claims in Brazil. Cello provides you with information on how to claim different taxes like direct taxes (e.g. personal income tax), or indirect service taxes (e.g. ISS) from income generated abroad since Cello’s legal entity is in Germany.

Business vs. Private

As a Referral User in Brazil you are either a

- Private Individual

- You do not need to be registered as a businessIf you render services as an individual, you may be subject to collect Service Tax (ISS) You still need to report your income in your annual tax return.

- A legal entity

- You could also render refer solution by a Brazilian entity. In this case, you will be subject to issue invoices and collect ISS as well other taxes that apply to business revenues depending to the tax system elected by the taxpayer operating as a legal entity (e.g. Income Tax - “IRPJ”, Social Contribution – “CSLL” and Welfare Contribution on Revenue - “PIS/COFINS”). Depending on the case, the rendering of a service as a legal entity could be a strategy to achieve tax efficiency, but the conditions must be carefully analyzed on a case-by-case basis reason why we strongly recommend you consult your tax advisor.

Tax Treatment

Referral User

In the following we provide examples of Referral User’s tax treatment depending on their legal form.

Cello creates a credit note on behalf of you two times a month listing all your referrals conducted by you and pays out your full earnings to you. It is then your responsibility to report your earnings to the local authorities in your private tax return.

| Legal form of referrer | Private Individual | Legal Entity |

|---|---|---|

| Definition | Individual provider | An incorporated Brazilian entity |

| ISS Rate | 2 - 5%* | 2 - 5%* |

| Tax Treatment | - Income tax (tax rate depends on your overall income) - File tax returns through software provided by Receita Federal | - Income tax plus welfare contribution on revenue - effective tax rates depend on the tax regime - File tax returns through software provided by Receita Federal |

| Reporting Due Dates | Individual Income Tax Return 30.04 every tax year | Varies depending on the tax regime adopted |

*Although the services are rendered to Cello, for tax purposes, they will be considered as rendered locally, being taxable by ISS. In Brazil, the referral activity will be subject to ISS levied by the municipalities. The rates may vary between 2 to 5% and will be charged from individuals or business entities.

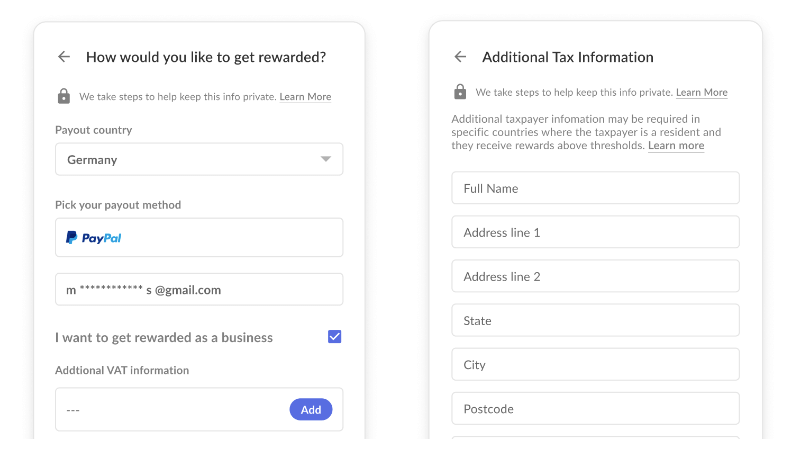

To ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process, you can choose to be rewarded as a business or as an individual and fill in the required information. The respective information will be displayed in the credit note issued to you by Cello.

Business Registration

In Brazil, you do not need to be a business entity to render services. Although it could be an alternative to increase tax efficiency. However, if you plan to operate a small business, we recommend you search for professional advice to register your business and offer your guidance about the risks and benefits.

It's worth noting that there are several types of legal entities you can choose from, and different tax regimes are applicable reasons why business registration must be guided by professional assistance.

ISS Registration

The ISS is a municipal tax and the exact rules and requirements for ISS registration can vary depending on factors such as the type of business you have, the type of services you render, and the city in which your business is located. In this sense, we reinforce our recommendations of professional advising on these matter

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return