Customer Lifetime Value (CLV) is a crucial metric that businesses use to determine the long-term profitability of their customer base. It quantifies the potential revenue that a customer can generate throughout their interaction with the company.

By understanding Customer Lifetime Value, businesses can make informed decisions and formulate effective strategies to maximize customer value and drive sustainable growth.

| Key Element | Description | Tips for Optimization |

|---|---|---|

| CLV's Role in Profitability | Measures the long-term revenue potential of a customer to inform strategic decisions for growth. | Enhance customer retention and focus on high-value segments to maximize CLV. |

| Strategic Decision Making | CLV insights guide resource allocation, marketing strategies, and customer retention efforts. | Utilize CLV data to prioritize and tailor marketing efforts for maximum impact. |

| Components of CLV | Incorporates revenue, costs, customer lifespan, and purchase behaviors to estimate value. | Regularly update and analyze CLV components to reflect current customer dynamics. |

| Calculating CLV | Involves analyzing variables like purchase value, frequency, acquisition costs, and retention rates. | Adopt both traditional and predictive modeling to gain accurate insights into CLV. |

| Benefits of CLV | Facilitates enhanced customer segmentation and improved marketing strategy effectiveness. | Leverage CLV insights for targeted marketing campaigns and resource allocation to high-value customers. |

| Limitations of CLV | Relies on accurate data and must be adapted to reflect changing customer behavior. | Ensure high data quality and regularly recalibrate CLV to maintain accuracy and relevance. |

Understanding the Concept of CLV

CLV, also known as Customer Lifetime Value, refers to the total revenue a business can expect to generate from a customer over the entire duration of their relationship.

It is a forward-looking measure (output metric) that takes into account the customer's purchasing behavior, repeat purchases, and the length of their association with the brand.

When businesses analyze Customer Lifetime Value, they are able to gain insights into the profitability of their customer base. By understanding the long-term value of each customer, companies can make informed decisions about resource allocation, marketing strategies, and customer retention efforts.

Definition of CLV: What does Customer Lifetime Value mean?

CLV can be defined as the predicted net profit a company can expect to earn over the entire lifespan of a customer. It considers not only the revenue generated by the customer's purchases but also factors in the costs associated with acquiring, serving, and retaining the customer.

Calculating CLV involves taking into account various factors such as the average purchase value, purchase frequency, customer acquisition costs, customer retention rate, and the average lifespan of a customer.

By considering these variables, businesses can estimate the future value of a customer and make strategic decisions accordingly.

Importance of CLV in Business

CLV serves as a valuable tool for businesses as it helps in understanding the long-term value of each customer. By focusing on maximizing CLV, companies can prioritize customer satisfaction and loyalty, leading to a higher customer retention rate.

When businesses prioritize customer retention, they can reduce customer churn and increase the lifetime value of their customers. This not only leads to increased revenue but also helps in building a strong and loyal customer base.

Moreover, CLV helps in identifying valuable segments of customers. By analyzing Customer Lifetime Value across different customer segments, businesses can identify which segments are most profitable and allocate their resources accordingly.

This allows companies to tailor their marketing and retention strategies to specific customer segments, maximizing the return on investment.

Furthermore, Customer Lifetime Value provides insights into the effectiveness of marketing campaigns and customer acquisition efforts. By comparing the CLV of customers acquired through different channels or campaigns, businesses can identify which channels are bringing in high-value customers and adjust their marketing strategies accordingly.

Components of Customer Lifetime Value

CLV calculation involves various components that capture different aspects of a customer's value to the business. These components help businesses gain a better understanding of customer behavior and allocate resources wisely.

Monetary Value

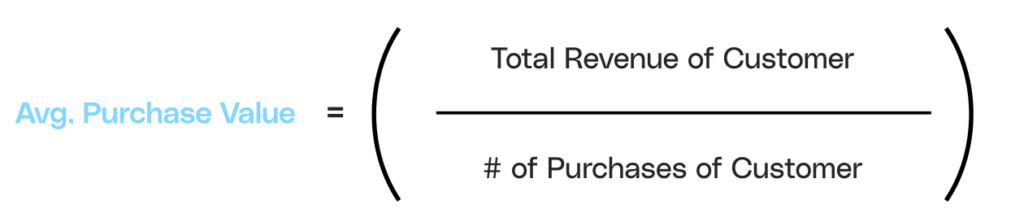

The monetary value component of CLV reflects the revenue generated by a customer through their purchases. It takes into account both the average transaction value and the number of transactions made by the customer, giving businesses a clear picture of the financial impact a customer has on their bottom line. The below shows an example formula.

Frequency of Purchase

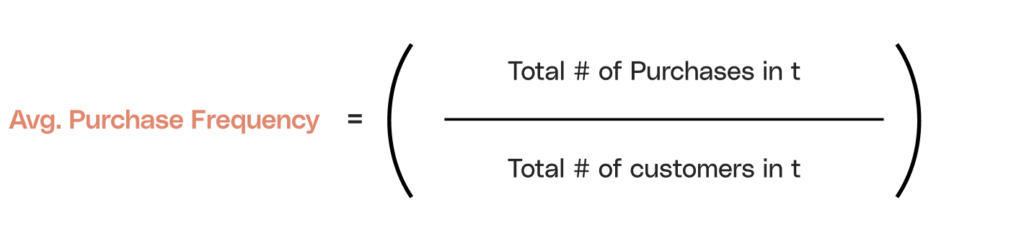

The frequency of purchase component focuses on how often a customer makes a purchase. By identifying the regular customers who make repeated purchases, businesses can develop strategies to encourage more frequent buying behavior and nurture customer loyalty. The below shows an example formula.

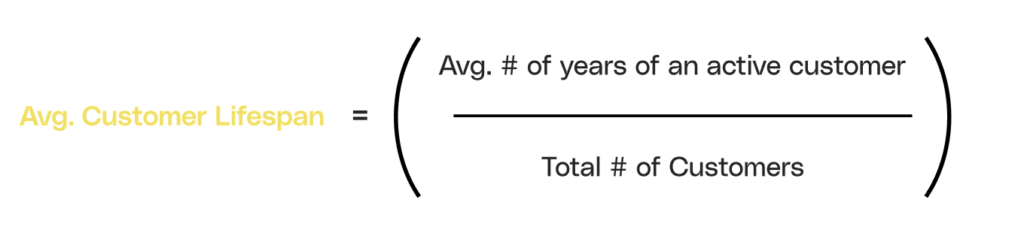

Customer Lifespan

The customer lifespan component represents the duration of a customer's association with the business. Longer customer lifespans indicate higher customer loyalty and can be an opportunity for businesses to deepen their relationship with the customer through personalized marketing, loyalty programs, and exceptional customer service. The below shows an example formula.

Calculating CLV

There are different methods to calculate CLV, r anging from traditional approaches to more advanced predictive models. These calculations provide businesses with insights into the future value of each customer, enabling them to make data-driven decisions.

Traditional Calculation

The traditional Customer Lifetime Value calculation involves aggregating historical data on customer transactions and applying established formulas to estimate future revenue. This method requires accurate data on customer purchases, length of association with the brand, and average profit margins.

Predictive Calculation

Predictive CLV models leverage advanced analytics and machine learning algorithms to predict the future value of customers based on their behavior, preferences, and other relevant data.

These models take into account factors such as customer demographics, past interactions, and external market trends to generate more accurate and actionable insights.

Benefits of Using CLV

Integrating CLV into business strategies can yield several benefits, helping businesses improve their marketing efforts and enhance customer experiences.

Enhanced Customer Segmentation

Understanding Customer Lifetime Value allows businesses to segment their customer base effectively. By categorizing customers based on their estimated value, companies can tailor their marketing campaigns and communication to address the specific needs and preferences of each group, resulting in higher customer engagement and improved conversion rates.

Improved Marketing Strategies

CLV enables businesses to optimize their marketing strategies by focusing on high-value customers. By allocating marketing resources to those customers who are more likely to generate significant revenue over time, companies can maximize their return on investment and improve overall marketing effectiveness.

Limitations of CLV

While CLV is a valuable metric, it is essential to consider its limitations to gain a comprehensive understanding of a customer's value to the business.

Data Accuracy Issues

Accurate CLV calculations rely on robust and accurate data. Inaccurate or incomplete data can lead to flawed predictions and inaccurate estimations of a customer's lifetime value.

Therefore, it is crucial for businesses to invest in data management and ensure data quality to obtain reliable CLV insights.

Changing Customer Behavior

Customer behavior is dynamic and can change over time. Factors such as evolving market trends, competitor offerings, or changes in customers' needs and preferences can impact their purchasing behavior. Therefore, CLV should be regularly monitored and recalibrated to account for these changes in customer behavior.

In conclusion, CLV provides businesses with a comprehensive view of a customer's long-term value. By studying the components and implementing strategies based on these insights, companies can enhance customer experiences, optimize marketing efforts, and drive sustainable growth.

It is crucial for businesses to recognize the importance of CLV and leverage it as a strategic tool to gain a competitive edge in today's dynamic business landscape.

Maximize Your CLV with Cello's Peer-to-Peer Referral Program

Understanding and enhancing Customer Lifetime Value is just the beginning. Take the next step in amplifying your SaaS product's growth by integrating Cello's seamless P2P referral program. With Cello, you can transform your users into powerful advocates, driving conversions with minimal development time and immediate payback from day one. Experience the simplicity of our platform with automated rewards, real-time performance tracking, and easy integration with your existing tools. Ready to witness how Cello can revolutionize your user-led growth? Book a demo to see Cello in action and start turning your users into your most valuable growth channel today.