Guidelines on Tax Reporting for Referral-Users in Switzerland

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and are not exhaustive. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

Being located in Switzerland and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following tax regulations according to the applicable Suisse law.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation, Cello is the recipient of a service.

- Supplier

- Referral Users are the suppliers of a service.

Since you are in this case the supplier by conducting a referral and receiving a payment, you are responsible for tax claims in Switzerland. Cello provides you with information on how to copmly with different taxes like direct taxes (e.g. personal income tax), or indirect taxes (e.g. Value Added Tax (VAT)) from income generated abroad since Cello is located in Germany.

Business vs. Private

As a Referral User in Switzerland you are either a

- Private Individual

- If your annual turnover is below CHF 100,000 and you only make referrals occasionally, you might not need to register for a business. If you make referrals more frequently establishing a business, such as a sole proprietorship, partnership, limited liability company (LLC), or stock corporation (AG), can provide benefits such as limited liability, credibility, and access to certain services or markets.

- A business that collects VAT

- You must normally register for VAT if your global turnover from providing supplies (within or outside Switzerland) reaches CHF100,000 or more. The turnover threshold is to be estimated at the beginning of the activity for the next twelve months. If it is not reached, the obligation to register for VAT begins once the threshold is exceeded according to the last annual reporting period (business year) of your company.

Tax Treatment

Referral User

In the following we provide examples of Referral User’s tax treatment depending on their legal form.

Cello creates a credit note on behalf of you two times a month listing all your referrals conducted by you and pays out your full earnings to you.

| Legal form of referrer | Private Individual | Business that collects VAT |

|---|---|---|

| Swiss VAT Rate | N/A | 0% (export of services) |

| Swiss VAT Threshold | < CHF 100.000 | =/> CHF 100.000 |

| Swiss Tax Treatment | Personal Income Tax - depends on the canton you are based in | - For legal entities: Corporate Income Tax, depending on your place of registration, between 12% - 24% (Federal, Cantonal and Municipal Corporate Tax combined) - For sole proprietorships and partnerships: Personal Income Tax depending on the canton you are based in plus Social Security Contributions of approx. 10% |

| Reporting Due Dates | Together with annual tax return, usually first filing date on 31.03. (some cantons have different due dates) | - For legal entities: Varies on cantonal level - For sole proprietorships and partnerships: Together with annual tax return |

| Swiss Federal Withholding Tax | N/A | N/A |

| Swiss Federal Stamp Duties | N/A | N/A |

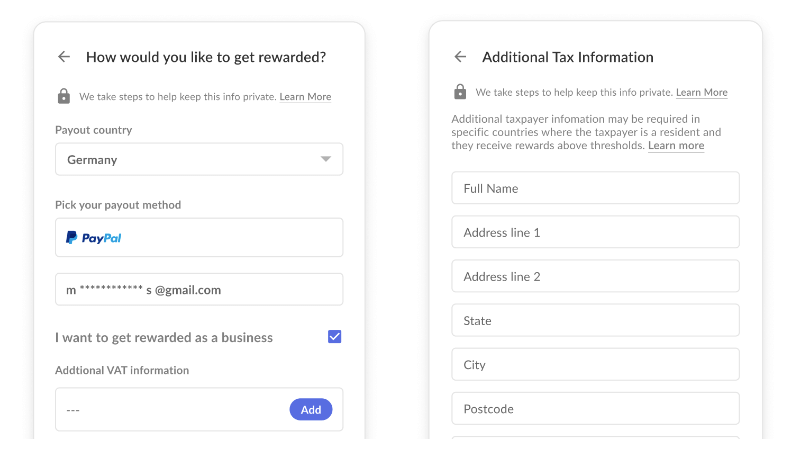

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process you can choose to be rewarded as a business or as an individual and fill in the required information. The respective information will be displayed in the credit not issued to you by Cello.

Business Registration

To register a business in Switzerland, you need to register with the commercial register (Handelsregister) in the canton where your business will have its headquarters. The registration process is conducted at the local commercial registry office (in some cantons you can apply through online registration) in the respective canton.

Here are the general steps to register a business in Switzerland:

- Determine the Canton: Choose the canton where you want to establish your business. The choice of canton can depend on various factors such as taxation, business environment, and accessibility to your target market.

- Gather Required Documentation: Prepare the necessary documentation according to the legal form of your business. This may include articles of association, identification documents, proof of address, and any specific documents required for the chosen legal structure (e.g., GmbH, AG).

- Complete the Registration Form: Fill out the registration form provided by the commercial registry office in the chosen canton. The form may be available online or as a physical document.

- Submit the Application: Submit the completed registration form along with the required supporting documents to the commercial registry office in the chosen canton. You may need to submit physical copies or complete an online submission, depending on the canton's procedures.

- Pay Registration Fees: Pay the applicable registration fees, which vary depending on the canton and the legal form of your business.

- Await Confirmation and Publication: Once your registration application is processed and approved, your business will be officially registered in the commercial register. The registration details will be published in the Swiss Official Gazette of Commerce (SOGC) or a similar publication.

VAT Registration

To register for VAT (Value Added Tax) in Switzerland, you need to follow these steps:

- Determine Eligibility: Evaluate whether your business activities meet the criteria for mandatory or voluntary VAT registration. Mandatory registration is required if your annual turnover from taxable supplies exceeds or is expected to exceed CHF 100,000 in Switzerland. Voluntary registration is also possible even if your turnover is below this threshold.

- Obtain a Swiss Tax Identification Number: A Swiss tax identification number (UID) will be automatically awarded for businesses which are registered on the commercial registry. If you do not have an UID number, it is still possible to proceed with VAT registration. An entry in the UID register will be made as a result of the application for VAT registration.

- Gather Required Information and Documents: Prepare the following information and documents for the VAT registration process:

- Business details: Legal name, business address, contact information.

- Business activities: Description of the goods or services you provide.

- Turnover information: Estimate or provide the anticipated turnover for the upcoming tax period.

- Choice of reporting method: based on turnover invoiced vs. payments recevied; effective reporting method vs net reporting method (for small businesses)

- Supporting documents: Depending on your specific circumstances, you may need to provide additional documents such as contracts, invoices, or financial statements.

- Submit the VAT Registration Application: You must register for VAT in Switzerland by completing and submitting the appropriate VAT registration form through the online portal of the Swiss Federal Tax Administration (FTA), available under the following website: https://www.estv.admin.ch/estv/de/home/mehrwertsteuer/mwst-an-abmeldung/mwst-anmeldung.html

- Await Confirmation and VAT Number: Once your application is processed and approved by the Swiss Federal Tax Administration (FTA), you will receive a confirmation of your VAT registration along with a VAT number.

- Comply with VAT Obligations: After receiving your VAT number, you must comply with the VAT obligations, including invoicing requirements, record-keeping, filing periodic VAT returns, and remitting VAT payments to the tax authorities. This is handled fully electronically through the portal of the Swiss Federal Tax Administration (FTA).

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return