- Guides•

- 14 min read

Chapter 1: Are user referrals for me?

This is the first in a series of posts that looks to shed light on B2B user referrals as an underutilized GTM channel.

TLDR

This is the first in a series of posts that seek to illuminate B2B user referrals as an underutilized GTM channel. In this opening post, we've collaborated with Akash Bajwa (Principal at Earlybird) to touch on how we reached this point of SaaS GTM saturation, how user referrals might be an unlock for many companies hitting a wall, and how to know if it suits you.

Future guides will cover the importance of UX and in-product integration, setting the right incentives, crafting GTM strategies, and successfully scaling and maintaining a user referral program.

- The traditional GTM mix for B2B Software?

- GTM headwinds for B2B Software?

- User referrals: definition, criteria, why now

- How do you know if referrals are the right fit for you?

- What does good look like?

Different types of GTM for B2B software

Product-Led

Product-led growth in the purest sense means relying on your product as the main vehicle to acquire, engage, and retain customers - users can try the product without talking to a human first.

Companies like Miro, Notion, Canva, Loom, and countless others have successfully scaled with a self-serve approach that enables customers to discover, onboard, and become activated.

"Although this shift has been blunted somewhat in the last two years given macro headwinds, there has been a secular tailwind behind employees being empowered to choose their own tools and pulling out their credit cards to buy the best products." (Akash Bajwa)

These early adopters not only brought these products into their companies as individual users, but also spread the product within the company, driving expansion - many PLG companies were deliberate in removing friction for wall-to-wall expansion inside a company.

In practice, most companies are on a continuum between product-led and sales-led, ideally finding the right sweet spot that combines both for their end market. Most PLG companies eventually need to adopt sales-led motions to reach other segments of the market or fully expand within their existing customer base.

Sales-Led

The sales-led growth approach of guiding prospects through several stages of a longer sales cycle has reasserted itself in the new ‘normal’ of budget tightening and software purchasing headwinds.

Sales-led organizations typically spend more on sales than marketing, while for product-led organisations, it’s the inverse. Sales-led channels are primarily outbound, inside and field sales, justified by larger ACVs. Selling into the enterprise in particular requires a mature GTM organisation that includes solutions engineering, post-sales functions, and often professional services to get customers to value.

As with the continuum of product-led to sales-led, it helps to think about the spectrum of ARPU < > CAC and the channels that become viable depending on where you are on this spectrum.

Marketing-Led

Marketing typically accounts for c. 35-40% of Sales and Marketing spend as companies scale, with product-led companies typically investing more in marketing than sales-led companies.

Marketing-led growth encompasses everything from events, content and SEO, account-based marketing and paid performance marketing. The current climate is imposing pressure on CMOs to cut spend on martech, refocusing their dollars on high ROI channels.

User-Led

User-led growth puts the onus on your users to champion your product and generate leads in the form of referrals. The most well-known example of this is PayPal’s early virality where they incentivized customers with $20 for every referred customer, later dropping to $5.

Dropbox’s success is also instructive - they invested heavily in the referral channel, embedding it into the onboarding process, amplifying the rewards users received by highlighting successful invitees, and reframed the rewards as ‘get more space’ instead of ‘invite your friends’.

Loom took this further by only incentivizing for activated referrals, (i.e. those new users who performed specific actions that signified activation with the product) and improving conversion by framing it as ‘invite your coworker’.

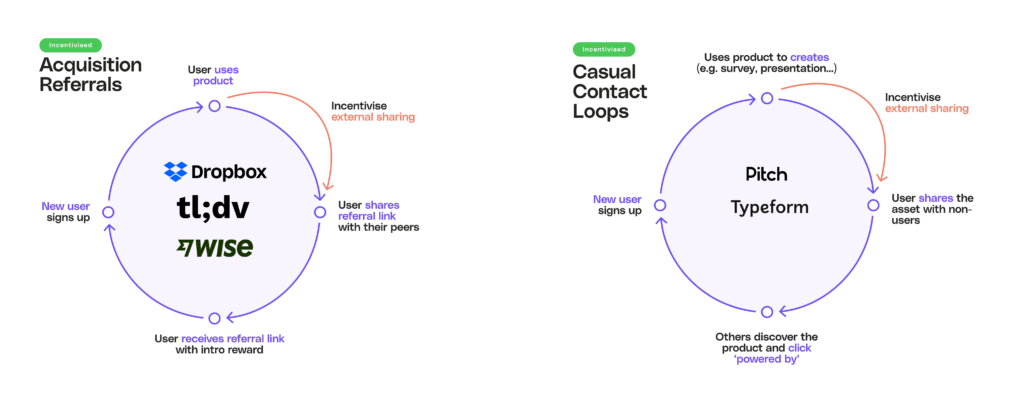

It’s important to note that user-led growth goes beyond just referrals for new users (incentivized acquisition referrals), but also includes incentivized expansion referrals (e.g. inviting co-workers), incentivized reviews (e.g. reviews for G2, Capterra), incentivized references (e.g. reference calls), incentivized casual contact loop (e.g. “powered by” tool distribution), and incentivized in-product actions (e.g. downloading mobile app). Many of these behaviors are leading indicators or proxies for customer value and, by extension, new business.

The GTM headwinds for B2B software

The higher rate environment founders find themselves in has resulted in prolonged sales cycles, lower sales efficiency, declining quota attainment and pressure on net dollar retention.

Startups in particular are disadvantaged at the moment in the simple analysis of total cost of ownership, which naturally favours incumbent platforms that can heavily subsidise specific modules in order to retain customers - a founder’s inherent positioning as best-of-breed is diluted when budgets are tightening.

IT spending isn’t getting worse, but it’s not getting better either.

At the later stage private markets and public markets, there’s been a concerted focus on capital efficiency, with the Rule of 40 continuing to rise in significance every month since 2021.

This is reflected in the performance data for SDRs and AEs.

"AI-generated copy and outreach is further diminishing the ROI of content marketing and outbound, with buyers increasingly unable to separate noise from signal." (Akash Bajwa)

Data privacy laws have made targeted advertising significantly harder. Software penetration is significantly higher than in early years of the cloud shift.

These trends have been at work for many years, which accounts for the c. 7% CAGR of CACs in software since 2010.

User referrals

Against this backdrop, few companies are able to power growth through low-cost CAC channels like user referrals. Review sites like G2 remain a valuable input to buyer decision-making, but word-of-mouth remains the province of a minority that’s capable of truly delivering product-led growth.

User referral programs target the product's existing users and incentivize them to share it with their network of friends and business contacts, mostly on a 1-to-1 basis. As we touched on, several examples of prosumer SaaS (Dropbox, Evernote), fintech (PayPal, Robinhood), and vertical SaaS (Toast) have managed to scale this channel to great effect, but referrals as a channel for B2B SaaS remain heavily underutilized.

There are various reasons for this. A best-in-class referral experience requires

- Significant engineering effort - optimizing the flow of the referral experience

- Timing the nudges

- Gamifying the incentives (which differs in a B2B context from B2C, as the rewards are for the whole company rather an individual)

- Removing all of the overhead associated with this (local tax and legal complexities)

However, as more prominent channels have become exhausted and inefficient, more companies will look to experiment with referral-led growth.

User referrals have inherent benefits that make them addressable for a wide spectrum of B2B SaaS companies, given that when done right, it’s effectively near-zero payback. From SMB to enterprise-focused vendors, companies can use referral-led growth to add a new dimension to their channel mix that has several data points going for it.

Evidence suggests that referred users spend more, churn less, and have a higher lifetime value. Cello’s own data suggests conversion rates that are 5x better than paid and SEO marketing - it’s the lowest CAC across the marketing mix. It’s easy to reason about this - activated users at customers deriving value from the product are likely to refer other users who closely approximate the ICP - there’s a congruence between power users who are likelier to come from ICP accounts endorsing the product to others who are similar.

Here are some of the other variables to consider when you’re assessing referral-led growth.

- Set-up time is extremely fast - companies like tl; DV, sevDesk, Plancraft, or Blockpit got going in a matter of days and are adding MoM revenue growth via referrals of 10-15%. Economics is better than you’d think. As we’ve become more sophisticated in measuring activated users as a proxy for willingness to pay, incentivization for referrals has also come leaps and bounds to more closely align rewards with behaviors that are more or less guaranteed predictors of recurring revenue

- Referrals aren’t ephemeral. Done right, they can be a sustained source of growth - it’s down to the experience you deliver to your end users.

- Qualification is embedded. Compared to other channels that see constant scrutiny as to whether the leads generated are qualified, referrals have much higher conversion rates because your ICP is referring others in - you can trust your customers to know who to refer.

- Conversions are higher - as alluded to above, more qualified leads coming through the channel naturally means more conversion to signups and demos.

- Underutilized. Compared to most growth channels, this remains an opaque and less sophisticated channel - as vendors look for capital-efficient growth, it merits experimentation.

How do you know if referrals fit your product?

The team at Cello has devised a fantastic framework for testing whether referrals are likely to be a fit for you. If you meet two out of three key factors displayed in the B2B User Referral Venn diagram below, chances are high that user referrals may work well for you.

- A sufficient level of product engagement is key to amplifying existing word-of-mouth through incentives at scale. A robust referral program typically thrives on the participation of active product users, with a benchmark of >1,000 monthly active users (MAUs) being considered significant enough.

- A meaningful product lifetime value (LTV)

- Fast time to value

These variables in tandem influence the success of your incentives and referral channel.

Calculate your WoM potential

You can tick two out of three boxes of the Venn diagram. Great, but what does that mean in terms of WoM revenue potential?

WoM is quite tricky to measure, and many companies a.) do not really understand how much they are growing via WoM and b.) as a result do not understand its ROI and, therefore, are not investing further to accelerate this growth loop.

There are different ways to calculate its potential, let’s have a look at Cello’s ROI calculator and the WoM coefficient.

Calculator your ROI

Cello's PLG Referral ROI Calculator is designed to quantify the impact of a referral program on your business. This tool helps you estimate and prove the ROI of your User-Led Growth (ULG) strategy by providing tailored insights based on your unique business metrics and industry benchmarks.

By simply inputting key data - like your product access (Freemium or Free Trial), Annual Contract Value (ACV), and Monthly Active Users (MAUs) - the calculator delivers a comprehensive analysis of potential returns from your referral program. It leverages data from over 4 million referral users to provide accurate predictions on user engagement, sign-ups, and revenue growth.

You can access the tool for free.

Calculating your WoM coefficient

Another way to look at it is by calculating your WoM coefficient. The WoM Coefficient by Reforge offers a stable, actionable metric linked to active users to help track and boost WoM growth.

The WoM Coefficient assumes that active users predict new word-of-mouth users. To test this, we will perform a simple correlation analysis. A high R² value (close to 1) would confirm the metric's reliability for forecasting realistic goals. If the R² is low, further refinement will be needed.

Here’s a condensed step-by-step guide:

- Choose Your Approach:

Select a calculation method based on your marketing mix complexity:

- Light Version: Uses tools like Google Analytics to measure basic WoM metrics.

- Medium Version: Refines user definitions and metrics.

- Heavy Version: Uses advanced econometrics for complex businesses.

2. Start with the Light Version:

- Define the Denominator (Returning Users): Segment repeat visitors using Google Analytics.

- Define the Numerator (Direct and Brand Search): Identify new users from direct traffic and brand searches.

- Run the Analysis: Export data, create a pivot table, and calculate the WoM Coefficient.

3. Validate the Coefficient:

- Create a Scatter Plot: Plot 'Non-WoM users' vs. 'New WoM users.'

- Calculate R²: A value above 0.7 indicates a strong model

4. Advance to the Medium Version if Needed:

If the Light Version isn't predictive, refine your user definitions. Focus on meaningful actions that likely generate WoM.

5. Use the Heavy Version for Complexity:

For mature businesses with complex marketing, apply advanced models like multivariate regression to separate the impact of different factors.

6. Start Simple, Then Scale:

Begin with the Light Version for basic insights. If needed, move to advanced methods for greater accuracy.

The complete guide can be found here

Last but not least, let’s have a look at what good looks like.

What does good look like?

First, let’s have a look at implementation metrics.

An effective program should be quick and cost-efficient while minimizing risks. For example, tl;dv could launch within a day, requiring only minimal development resources (around 4 hours of developer time) to create the first version. By streamlining the implementation process and keeping initial costs low, programs can reduce barriers to launch and quickly start delivering value.

Now moving on to the performance data of a state-of-the-art referral program.

The above table shows proprietary data of more than 4m Cello users (Free Trial and Freemium tool users), demonstrating the strong potential of referral programs to drive growth and engagement. Let’s have a look at the metrics:

- Sharing Rate = % of users sharing a link with potential new users

- Unique clicks per shared link = # of potential new users who click the referral link

- Sign-Up Rate = % of potential new users clicking on the signup link for the referred tool

- Purchase Rate = % of new users converting to a paid plan

- Annualized User to Customer Conversion (AUCC) = % of new customers generated via referrals based on the total number of existing tool users (base is 1000 users)

Best-in-class B2B SaaS solutions have high conversion rates, such as a 49.03% annualized user-to-customer conversion.

This metric means that the number of paid users grows by 50% throughout a year via referrals, demonstrating how effective referral models can significantly boost customer acquisition. Companies such as tl;dv, blockpit, Typeform, Fellow and Co achieve monthly additional revenue growth via referrals between 10-15%.

The delta in conversion between free trial and freemium users can be attributed to the higher value delivered to customers in the free trial - time-based and usage-based free trials convert twice as effectively as feature-based and seat-based free trials. The conversion rate and AUCC rate is therefore higher compared to freemium solutions

Those metrics are one side of the model. A successful program generates significant secondary upside effects, such as branding benefits from users referring your product and increased visibility through social media posts. Additionally, it supports channel diversification, lowers onboarding and support efforts (as referrers handle some of this), and improves retention among referred-in users, further amplifying growth and efficiency.

Conclusion

To recap, we’ve covered how established B2B growth channels have become increasingly saturated. The data is only heading in one direction - lower quota attainment, fewer meetings, and higher CACs. Investors across public and private markets are placing greater emphasis than they have in a long time on capital/sales efficiency, which is forcing CROs to exhaust every possible avenue to grow more efficiently.

User-led growth, in its many forms, is one potential solution that can meaningfully contribute to B2B software growth. As we’ve touched on, user-led growth can be as explicit as referring new customers or as derivative actions that indirectly contribute to top-line growth.

Lastly, we’ve discussed how to test whether this channel suits your company and what best-in-class looks like. The next chapter will cover UX and in-product integration's role in successfully launching a user referral program.

Resources

Related Articles

4 Categories of Referral Programs for B2B SaaS

Learn how to get started with referral programs for B2B SaaS. Understand what type of referral ...

Complete Guide to your Affiliate Program for B2B SaaS

Learn how to get started with affiliate referral programs for B2B SaaS. Understand if affiliate ...

The Ultimate Guide to B2B Influencer Referral Programs

Discover actionable tips & the complete process to launch your own influencer referral program