Guidelines on Tax Reporting for Referral-Users in Austria

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and are not exhaustive. We, therefore, accept no liability whatsoever for the information and contributions provided, in particular for their correctness, up-to-dateness and freedom from errors. Furthermore, we do not assume any liability for any links to external websites operated by third parties. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

Being located in Austria and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following tax regulations according to the applicable Austrian law.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation, Cello is the recipient of a service.

- Supplier

- Referral Users are the suppliers of a service.

The service is the referral, which is done by the Referral User and Cello rewards this service. This classification is essential for the VAT treatment. In principle, the VAT is charged by the service provider. However, this is not the case here; more information will follow shortly.

As you are the supplier in this case by making a referral and receiving payment, you are responsible for tax claims in Austria. Cello will provide you with information on the different tax obligations, such as direct taxes (e.g. income tax) or indirect taxes (e.g. value added tax (VAT)) from income generated abroad, as Cello is based in Germany.

Business vs. Private

As a Referral User in Austria you are either a

- Freelancer

- If your turnover is below EUR 35,000 and you only make referrals occasionally, you might not need to register for a business.

- Small Business

- If your turnover is below EUR 35,000 and you engage in referrals more commercially, you might consider registering as a business and benefit from the VAT exemption under “Small business regime”. You can be registered with different legal entities.

- A business that collects VAT

- You must normally register for VAT if your last annual reporting period turnover is over EUR 35,000.

Tax Treatment

Referral User

In the following we provide examples of Referral User’s tax treatment depending on their legal form.

Cello creates a credit note on behalf of you two times a month listing all your referrals conducted by you and pays out your full earnings to you.

| Legal form of referrer | Freelancer | Small Business | Business that collects VAT |

|---|---|---|---|

| VAT Rate | 0% | 0% (reverse charge)* | 0% (reverse charge) |

| VAT Threshold | < 35.000€ | < 35.000€ | >35.000€ |

| Tax Treatment | Personal Income Tax* - 0-55% depending on total income | Partnership: Personal Income Tax - 0-55% depending on total income GmbH + AG: Corporate Tax - flat rate of 24% of profits | Corporate Tax - Depending on your type of business, but standard rate is 24% of profits |

| Reporting Due Dates | 30.04 paper filing 30.06 electronic filing | Usually 01.09. every tax year (9 months after the end of the fiscal year) | Usually 01.09. every tax year (9 months after the end of the fiscal year) |

*Reverse charge means the reversal of the tax liability. The basic rule is that the service provider is liable to pay VAT. Deviating from the basic rule, in the scope of application of the reverse charge system, the recipient of the service (Cello) and not the service provider (you) is liable for the VAT. This means that when reverse charge is applicable, you are not liable for the VAT.

*As a freelancer you are not a corporation that is subject to corporate income tax. Therefore, you will have to include your income from Cello in your tax return and pay income tax. Income tax is calculated based on the total amount of income (including Cello), and there are seven income tax brackets in Austria, ranging from 0% (up to an annual income of EUR 11,693) to 55% for incomes over EUR 1 million per year.

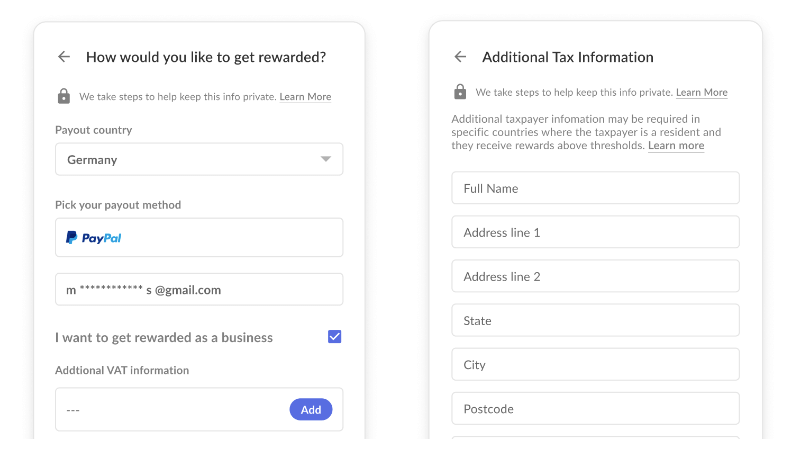

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process you can choose to be rewarded as a business or as an individual and fill in the required information. The respective information will be displayed in the credit not issued to you by Cello.

Business Registration

Registering a business in Austria involves several steps and varies depending on the legal form of the business you wish to establish. The application can be done online. Here is a general overview of the registration process:

- Determine the Legal Form: Decide on the legal form that best suits your business. Common legal forms in Austria include sole proprietorship (Einzelunternehmen), partnership (Personengesellschaft), limited liability company (Gesellschaft mit beschränkter Haftung, GmbH), and joint-stock company (Aktiengesellschaft, AG).

- Business Name: Choose a unique and suitable name for your business. Make sure it complies with Austrian naming conventions and does not infringe on existing trademarks.

- Commercial Register: For certain legal forms like GmbH and AG, you need to draft articles of association and have them notarized. Then, you must register your business with the competent Commercial Court (Handelsgericht) to be entered into the Austrian Commercial Register (Firmenbuch).

- Trade Authority Registration: Register your business with the local Trade Authority (Gewerbebehörde). This applies to sole proprietorships, partnerships, and some other legal forms. You will need to provide information about your business activities, location, and other relevant details.

- Tax Registration: Register for tax purposes with the competent tax office (Finanzamt). You will receive a tax identification number (Steuernummer) and be informed about your tax obligations, such as income tax and value-added tax (VAT), if applicable.

- Social Security Registration: If you plan to employ staff or if you are personally liable for social security contributions, you may need to register with the Social Security Institution (Sozialversicherungsträger).

- Chamber of Commerce Membership: Depending on your business activities, you may need to become a member of the relevant Chamber of Commerce (Wirtschaftskammer). Membership is mandatory for some professions, while others have voluntary membership.

It's important to note that the registration process can involve additional requirements, depending on the legal form and specific circumstances of your business. Consulting with a legal or tax professional or contacting the relevant authorities directly will provide you with accurate and up-to-date information tailored to your situation.

VAT Registration

If your last annual reporting period turnover is over EUR 35,000, you must normally register for VAT. However, remember that for tax purposes, you may need to include the turnover from any other activities you perform outside of the Cello platform. You can find relevant documents available on service.bmf.gv.at.

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return