Guidelines on Tax Reporting for Referral-Users in Belgium

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and is not exhaustive. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

Being a resident in Belgium and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following tax regulations according to the applicable Belgian law.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation, Cello is the recipient of a service.

- Supplier

- Referral Users are the suppliers of a service.

Since you are in this case the supplier by conducting a referral and receiving a payment, you are responsible for tax declaration obligations in Belgium. Cello provides you with information on how to declare different taxes including direct taxes (e.g. individual income tax and/or corporate income tax), and indirect taxes (e.g. Value Added Tax (VAT)) from income generated abroad since Cello’s legal entity is located in Germany.

Business vs. Private

As a Referral User in Belgium you are either a

- (Self-employed) individual

- Subject to certain conditions, if you only refer solutions occasionally and earn less than EUR 7.170 per year through Cello or other sharing economy platforms, you do not need to register as a business or register for VAT purposes.

- If your revenue from the sharing economy exceeds EUR 7.170 on an annual basis, you must register as a business with a business counter, the Crossroads Bank for Enterprises, and the VAT authorities.

- If you invoice less than EUR 25.000 per year (VAT excl.) for all your activities, you are not required to charge VAT, as a specific Belgian VAT exemption is applicable. If this is the case, you are not required to file periodical VAT returns. If you invoice more than EUR 25.000 per year, you do not have to collect VAT for services provided to Cello due to application of the VAT reverse charge mechanism applicable to certain services to businesses established outside Belgium. You may however need to collect Belgian VAT (standard rate of 21%) for services performed to other customers.

- Businesses with separate legal personality

- You must register your company as a business with a business counter, the Crossroads Bank for Enterprises, and the VAT authorities.

- If your company only refers solutions occasionally and invoices less than EUR 25.000 (VAT excl.) per year for all its activities, you are not required to charge VAT, as a specific Belgian VAT exemption is applicable. If this is the case, you are not required to file periodical VAT returns.

- If your company invoices more than EUR 25.000 per year, your company does not have to collect VAT for services provided to Cello due to application of the VAT reverse charge mechanism applicable to certain services to businesses established outside Belgium. You may however need to collect Belgian VAT (standard rate of 21%) for services performed to other customers.

- Regardless if your company exceeds the EUR 25.000 threshold or not, you must register for VAT purposes.

- It should be noted that two or more persons can incorporate a company without separate legal personality (e.g. partnership), but please note that such entity is subject to a different tax treatment.

Tax Treatment

Referral User

In the following we provide examples of Referral User’s tax treatment depending on their legal form.

Cello creates a credit note on behalf of you two times a month listing all your referrals conducted by you and pays out your full earnings to you. It is then your responsibility to report your earnings to the local authorities in your personal tax declaration.

| Legal form of referrer | (Self-Employed) Individual | Businesses with separate legal personality |

|---|---|---|

| Definition | Depending on whether your income from Cello or other sharing economy platforms exceeds EUR 7.170 on a yearly basis, your income will be taxed at the flat rate of 10% (plus 0-0,9% in communal taxes) or as professional income (at the rate of 25-50% plus 0-0,9% in communal taxes) subject to Belgian individual income tax. | You incorporate a company through which you will conduct your business. The company with legal personality’s income will be subject to Belgian corporate income tax (ordinary rate of 25%). |

| VAT treatment | - If your income from Cello or other qualifying sharing economy platforms does not exceed EUR 7.170 on a yearly basis, you are not required to register for VAT purposes. - If your income from Cello or other qualifying sharing economy platforms exceeds EUR 7.170 but is inferior to EUR 25.000 on an annual basis, you are required to register for VAT purposes but you are not required to invoice with VAT and you are not required to file periodical VAT returns. - If you invoice more than EUR 25.000 on an annual basis, you are required to file periodical VAT returns. By means of the VAT reverse charge mechanism, you will not be required to collect VAT | - If your company invoices less than EUR 25.000 on an annual basis, it is not required to invoice with VAT and it is not required to file periodical VAT returns. - If your company invoice more than EUR 25.000 on an annual basis, it is required to file periodical VAT returns. By means of the VAT reverse charge mechanism, it will not be required to collect VAT. |

| Income treatment | - If your income from Cello or other qualifying sharing economy platforms does not exceed EUR 7.170 on a yearly basis, 10,7% of this income is withheld by Cello, which is responsible for payment to the tax authorities. Cello will provide you with a tax slip which has to be included in your individual income tax return. - If your income from Cello or other qualifying sharing economy platforms exceeds EUR 7.170, your profits will be taxed as professional income subject to Belgian individual income tax at the progressive tax rates varying from 25% to 50%. - The individual income tax return can be submitted on paper or electronically through Tax-on-web via the governmental website myMINFIN. - If you invoice more than EUR 25.000 on an annual basis, you will have to file periodical VAT returns on a quarterly (or monthly) basis. These VAT returns have to be submitted electronically via the governmental website Intervat. | - Your company’s profits will be taxed as professional income subject to Belgian corporate income tax at the ordinary corporate income tax rate of 25%. When certain conditions are met, a reduced corporate income tax rate of 20% can be applicable for profits up to EUR 100.000. - The corporate income tax return has to be submitted electronically via the governmental website BIZTAX. - If you invoice more than EUR 25.000 on an annual basis, you will have to file periodical VAT returns on a quarterly (or monthly) basis. These VAT returns have to be submitted electronically via the governmental website Intervat. |

| Reporting Due Dates | - The individual income tax return usually has to be submitted prior to 30 June for paper tax returns and on 15 July for electronic tax returns. - Quarterly VAT returns usually have to be submitted before the 20th of the month following the quarter. It is recommended to verify the exact dates annually with the Belgian Federal Public Service of Finance. | - The deadline for the filing of the corporate income tax return in Belgium varies depending on the balance sheet date of the company. The exact date can be found on the website of the Belgian Federal Public Service of Finance. - Quarterly VAT returns usually have to be submitted before the 20th of the month following the quarter. It is recommended to verify the exact dates annually with the Belgian Federal Public Service of Finance. |

You can learn more here.

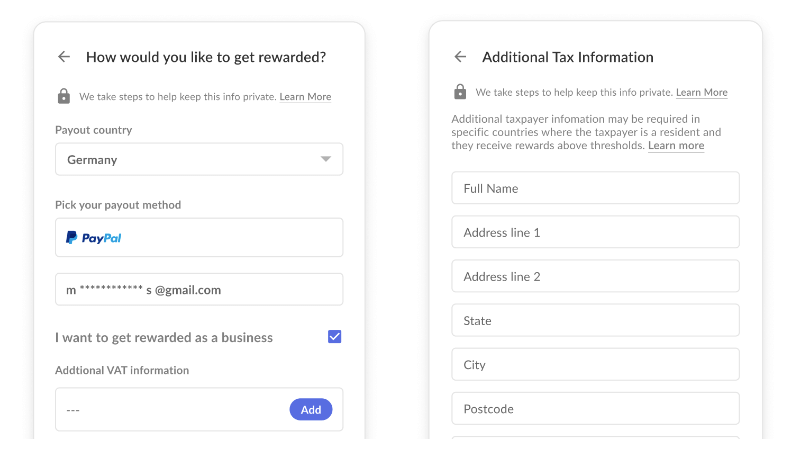

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process you can choose to be rewarded as a business or as an individual and fill in the required information. The respective information will be displayed in the credit not issued to you by Cello.

Business Registration

Depending on the type of business (business as a self-employed individual or business through a company), different registration formalities are applicable in Belgium.

When conducting a business as a self-employed individual, you will need to register with a business counter, the Crossroads Bank for Enterprises, and the VAT authorities if your income from Cello or other sharing economy platforms exceeds EUR 7.170. A business counter can assist you with setting up a business as a self-employed person.

When deciding to conduct a business through a company, the type of company has to be chosen. When opting for a company format with separate legal personality (i.e. a “Société anonyme/naamloze vennootschap” or a “société à à responsabilité limitée/besloten vennootschap”, the articles of association have to be submitted via a notary public and a financial plan has to be drawn up.

When two or more persons decide to conduct a business together, it is also possible to opt for one of the company formats without legal personality (such as a partnership “Société Simple/Maatschap”). These company formats can be incorporated by means of a contract, without the intervention of a notary public.

It should be noted that when a company hires an employee, it is required to register with the National Social Security Office.

You may also need to register with other agencies depending on the type of business you are starting and the activities you will be engaged in.

VAT Registration

You can register for VAT online through the Belgian tax authorities' website, which is called "MyMinFin." To register for VAT online, you will need to create an account on the MyMinFin website and provide your personal or business tax identification number, as well as your electronic signature. You will have to apply for a VAT number separately, by filling in form 604A.

To create an account on the MyMinFin website, you will need to provide your personal or business tax identification number, as well as your electronic signature. You will also need to choose a username and password, which you will use to access the website and complete your VAT registration.

Once you have created an account on the MyMinFin website, you can access the VAT registration form and complete it online. You will need to provide information about your business, such as your business name, contact information, and the type of business you are operating. You will also need to provide details about your taxable supplies and acquisitions and any exemptions or deductions that may apply.

Alternatively, a business counter can register your business for VAT purposes.

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to register as a company?

You are required to register with a business counter, the Crossroads Bank for Enterprises, and the VAT authorities if your income from Cello or other sharing economy platforms exceeds EUR 7.170

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return

How do I ensure my compliance as a business?

It is important to respect the reporting due dates. The exact dates should be consulted annually on the website of the Belgian Federal Public Service of Finance. It is advisable to seek advice from a tax consultant to ensure compliance.