Guidelines on Tax Reporting for Referral-Users in Denmark

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and are not exhaustive. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

Being located in Denmark and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following tax regulations according to the applicable Danish law.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation, Cello is the recipient of a service.

- Supplier

- Referral Users are the suppliers of a service.

Since you are in this case the supplier by conducting a referral and receiving a payment, you are responsible for tax claims in Denmark. Cello provides you with information on how to claim different taxes like direct taxes (e.g. personal income tax), or indirect taxes (e.g. Value Added Tax (VAT)) from income generated abroad since Cello is located in Germany.

Business vs. Freelancer

As a Referral User in Denmark you are either a

- Freelancer

- You are a freelancer if you expect to earn an annual turnover smaller than 50.000 DKK (4.166 DKK per month). In this context, you only have to declare your income in the B-indkomst.

- As a freelancer, just like any other self-employed person, you can deduct amounts before paying tax on your profits.

- Business that collects VAT

- You have to formally register your sole proprietor business with the Danish Business Authority to get a CVR number which is the business identification number (incl. Nem ID & CPR Number) if you expect to earn an annual turnover more than 50.000 DKK (4.166 DKK per month)

- You should assess whether your referral activities constitute a business for VAT purposes. A business (referred to as a “taxable person”) for VAT purposes is any person that independently carries out an economic activity. The economic activity should have some degree of permanence, meaning that you are likely not a taxable person for VAT purposes if you expect to make one or two referrals. You are obligated to register your business for VAT in Denmark, if you are a taxable person. You can obtain a VAT registration online via virk.dk. The service you provide to Cello is subject to the reverse charge VAT mechanism, which entails that Cello is responsible for accounting for the chargeable sales VAT. This does not impact your obligation to register for VAT in Denmark.

Tax Treatment

Referral User

In the following we provide examples of Referral User’s tax treatment depending on their legal form.

Cello creates a credit note on behalf of you two times a month listing all your referrals conducted by you and pays out your full earnings to you. It is then your responsibility to report your earnings to SKAT via your “forskudsopgørelse” or “årsopgørelse” and choose how you want to pay your taxes.

Your “forskudsopgørelse” is a preliminary tax assessment of your expected income and taxes. The “årsopgørelse” is the final tax assessment where your final tax liability is calculated, and any unpaid taxes are collected including interest and penalties. You should adjust your “forskudsopgørelse” to match your earnings so that you pay the right amount of taxes and avoid paying interest and penalty for late payment of taxes.

| Legal form of referrer | Freelancer | Business that collects VAT |

|---|---|---|

| VAT Rate | 0% (reverse charge) | 0% (reverse charge) |

| Tax Treatment | Personal Income Tax - Pay your taxes on the B-income in field 210 of your prelim income assessment (bi-weekly cadence is recommended) - Standard tax rate is approx. 40% (labor market contribution + B-Tax) | - Taxation E-Income A-Tax Labour Market Contribution |

| Reporting Due Dates | 01.07. every tax year | 01.07. every tax year |

More information can be found here.

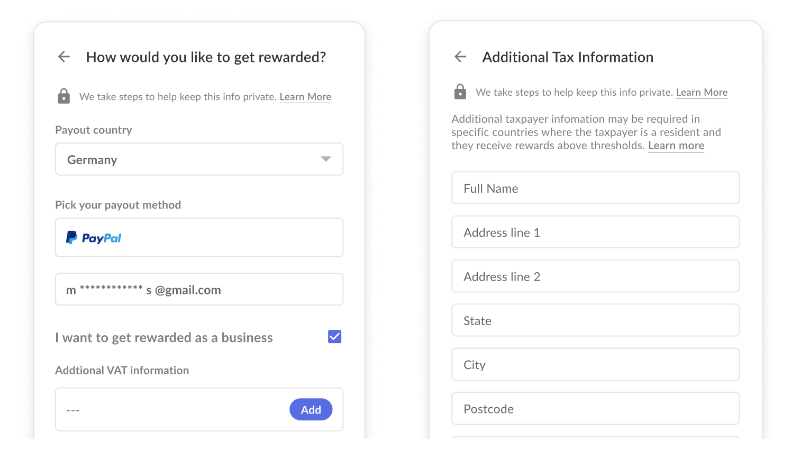

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process you can choose to be rewarded as a business or as an individual and fill in the required information. The respective information will be displayed in the credit not issued to you by Cello.

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to register as a company?

You are advised to register with the local authorities. Registration as freelancer: You have to formally register your sole proprietor business with the Danish Business Authority (incl. Nem ID & CPR Number). Register as a business in the States Central Registry of Companies (CVR).

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return