Guidelines on Tax Reporting for Referral-Users in France

Disclaimer: Cello takes the tax treatment for Referral-Users very seriously and provides country-specific guidelines on the tax treatment. Information provided by Cello is only intended to give you a general overview on the tax treatment of income generated by referrals. It may not be adapted to your personal situation, and your own tax obligations may vary depending on particular circumstances. Therefore, you remain solely responsible for the use you make of the information hereafter provided by Cello. You also remain responsible for qualifying your VAT status (i.e. Taxable person or not). We recommend that you consult a tax advisor if you have any doubts.

Being a resident in France and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) must be aware of the following tax regulations according to the applicable french law.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation Cello is the recipient.

- Supplier

- Referral Users are the suppliers of a service.

Since you are the supplier by conducting a referral and receiving a payment, you are responsible for tax claims in France. Cello gives you information on how to claim different taxes like direct taxes (e.g. personal income tax), or indirect taxes (e.g. Value Added Tax (VAT)) from income generated abroad since Cello’s legal entity is in Germany.

Business vs. Private

As a Referral-User you are either an individual or a professional entity:

- Individual

- Individual means a Referral-User who is not an Entity (i.e., private individual or sole proprietorship (entreprise individuelle)).

- Business

- Entity meaning a Referral-User, which is a legal person, such as a corporation.

Tax Treatment

Referral User

Cello delivers a credit note every month listing all your referrals and pays out the corresponding referral amount to you.

If you declare yourself a Taxable person for VAT purposes (see VAT Status & Registration below), Cello also delivers an invoice in due form on your behalf.

It is then your responsibility to report your earnings to the French tax authorities.

The following table provides an overview of the tax treatment that applies to Referral Users who are French tax residents, depending on their legal status.

| Legal form of Referral User | Individual (private individual or sole proprietorship) | Entity (*) (*) we only address corporations without consideration of other legal entities |

|---|---|---|

| VAT treatment of the Referral amount | - If you are not a Taxable person for VAT purposes (i.e. you are a private individual and your referral activity is merely occasional): no VAT - If you are a Taxable person for VAT purposes: No French VAT if your enterprise benefits from the VAT exemption regime for small enterprises whose taxable supplies are below a specificn annual limit (franchise en base), which is currently fixed at 36.800€. If not, the reverse-charge principle applies (German VAT due by Cello), and you have specific filing obligations with the customs administration (see below) | - No French VAT is due; German VAT due by Cello under the reverse-charge mechanism |

| Income Tax treatment of the Referral amount | - Personal Income Tax at progressive rates: according to the “Micro regime” or the Régime reel if business income exceeds a certain annual limit (72.600€ for 2023). - Social contributions | - Corporate Income Tax at standard rate of 25% (for SMEs a reduced rate of 15% applies on share of profit lower than 42.500€) |

| Filing obligations | - Taxpayers under the Micro-regime declare their income on the 2042-C-PRO form, which must be filed in May within the deadline for filing the 2042 general income tax return (the exact date varies depending on the region). - Under the Régime réel, business income must also be declared in a Professional Income Tax Return (form 2031 or 2035) to be filed no later than the second business day following May 1 (deadline extended by 15 days for users of the online filing procedure) - Finally, if you are a Taxable person for VAT purposes, a monthly summary statement (European declaration of services or DES) must be filed via the customs administration's electronic portal, which you can access here. | - Corporate Income Tax Return (form 2065) to be filed within four months of the closure of the fiscal year. - Monthly summary statement (European declaration of services or DES) to be filed via the electronic portal of the customs administration. |

More information regarding your tax obligations can be found on the homepages of the French tax and social security administrations.

Online platforms operating in France are required by law to report specific data to the French tax authorities on a yearly basis. This data relates to the Referral Users’ identity (including for individual Referral Users’ first and last name, date of birth, primary address, and TIN), their activity on the platform during the previous calendar year (including the total consideration paid, and number of relevant activities in respect of which it was paid), and information on the financial account to which the consideration is paid (PayPal credentials).

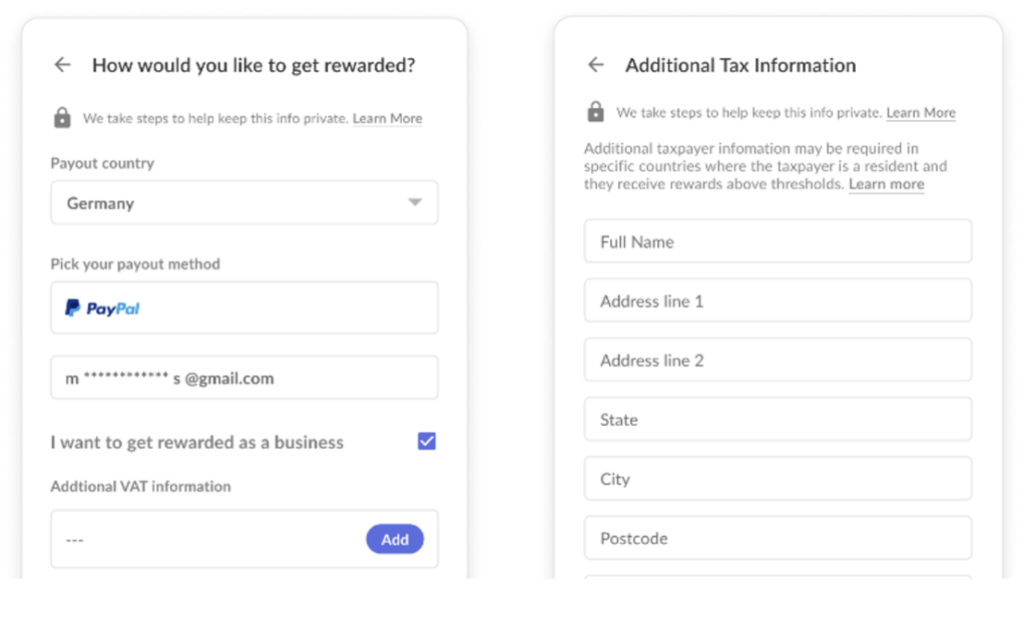

Based on this filing obligation incumbent to platform operators, Cello is required to report specific Referral Users’ information to local tax authorities, including France. Therefore, in the pay-out process, you must indicate whether you act as an Entity or an Individual and fill in the required information. The respective information will be displayed in the credit note / invoice issued to you by Cello.

Business Registration

Deciding between a limited company or sole trader

When providing paid services in the course of a business, you need to register your business with the Trade and Companies Register (RCS).

However, if you are a Referral User not acting on behalf of an already existing enterprise (e.g. you are a private individual, and the Referral amounts are your sole business income), you will have to register with the RCS onlny if your activity qualifies as a business (i.e. your activity is not merely occasional).

You can register your business online here.

When registering your business, you will be granted a unique French business identification number (SIREN/SIRET).

VAT Registration

As long as your referral activity does not qualify as a business (merely occasional activity) you do not have to register for VAT purposes.

However, if you provide paid services in the course of a business (economic activity), you are considered as a Taxable person for VAT purposes, regardless of whether you may benefit, or not, from the VAT exemption regime for small enterprises whose taxable supplies are below VAT exemption threshold (franchise en base) currently fixed at 36.800€.

As a Taxable person, you must register your business for VAT to obtain a VAT identification number.

When registering your business with the RCS, attributing a VAT identification number is not automatic (especially if you are eligible for the VAT exemption regime for small enterprises). Therefore, it may be necessary to request a VAT identification number from the tax Service on which your enterprise depends.

You can get more info on how to get a VAT identification number here.

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to create an invoice?

If you declare yourself as a taxable person for VAT purposes, Cello will issue an invoice on your behalf with all required information for your local tax authorities. You will also get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fees). This document will help you prepare your tax return

How do I ensure my compliance?

If you have any doubt about your compliance as a business, you should consult a legal or tax advisor.