Guidelines on Tax Reporting for Referral-Users in Germany

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and are not exhaustive. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

Being located in Germany and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following tax regulations.

Definitions

Recipient vs. Supplier

- Recipient In this legal relation Cello is the recipient (“Leistungsempfänger”)

- Supplier Referral Users are the suppliers (“Leistungserbringer”)

Since you are in this case the supplier by conducting a referral and receiving a payment, you are responsible for tax claims. This does not incline a lot of effort from your end. Cello gives you information on how to claim different taxes like direct taxes (e.g. personal income tax), or indirect taxes (e.g. Value Added Tax (VAT)).

Business vs. Private

As a Referral User in Germany you are either a

- Private Individual

- You are a private individual and do not need to register a business if you you just refer products occasionally and your annual turnover is smaller than 22.000€ in the last year. In this context you only have to declare your incomes in the personal income tax declaration.

- Small business that do not collects VAT (USt-IdNr.) (”Kleinunternehmer”)

- You are a private individual, but are advised to register a small business (”Kleinunternehmer”) if you you refer products sustainably and your annual turnover is smaller than 22.000€ in the last year or last annual turnover was smaller than 22.000€ but the estimated turnover of your current year does not exceed 50.000€ . Whether you should register as a small business at the trade office (”Gewerbeamt”) accordingly depends on the sustainability of your business and activities. As a small business you do neither have to collect VAT nor do a VAT advance return (”Vorsteueranmeldung”)

- Business that collects VAT

- You are a business that collects VAT if your annual turnover is more than 22.000€ in the last year or last annual turnover was smaller than 22.000€ but the estimated turnover of your current year exceeds 50.000€. You have to collect indirect taxes (e.g. VAT) from Cello. You are in this case responsible for compliance with German indirect tax regulations, but we support you in this context. We will provide you with a credit note incl. all relevant information.

Tax Treatment

In the following we provide examples of Referral User’s tax treatment depending on their legal form.

| Legal form of referrer | Private Individual | Small Business that does not collect VAT (”Kleinunternehmer”) | Business that collects VAT |

|---|---|---|---|

| Definition | Occasionally using Cello | Sustainably using Cello, last annual turnover <22.000€ | Frequently using Cello, last annual turnover >22.000€ or last annual turnover < 22.000€ but the estimated turnover of the current year exceeds 50.000€ |

| VAT Rate | 0% | 0% | 19% |

| Tax Treatment | Personal Income Tax - Income needs to be declared within the scope of the income tax statement (”sonstige Einkünfte”, §23EStG) - No income tax liability if income as a private individual does not exceed 256€ per year - Paid taxes depends on your overall income | | Cash accounting (Einnahme-Überschuss-Regelung (EÜR)) needs to be attached to your income tax statement (can be done online via Elster) Personal Income Tax - Income needs to be declared within the scope of the income tax statement (”Einkünfte aus Gewerbebetrieb”, §15EStG) - Tax-free amount (profit): 10.347€ for singles / 20.694€ for married | Trade Income Tax (Gewerbesteuer) Needs to be paid if your profit is more than 24.500€ VAT - VAT obligation and yearly VAT advance return - Obligation of Excise Tax - Obligation to submit annual VAT return and declaration Personal Income Tax - Income needs to be declared within the scope of the income tax statement (”Einkünfte aus Gewerbebetrieb”, §15EStG) - Tax-free amount (profit): 10.347€ for singles / 20.694€ for married |

| Documents by Cello | Credit Note (net amount of referrals) | Credit Note (net amount of referrals) | Credit Note (incl. VAT) |

| Reporting Due Dates | 31.07. every tax year | 31.07. every tax year | 31.07. every tax year |

More information can be found here.

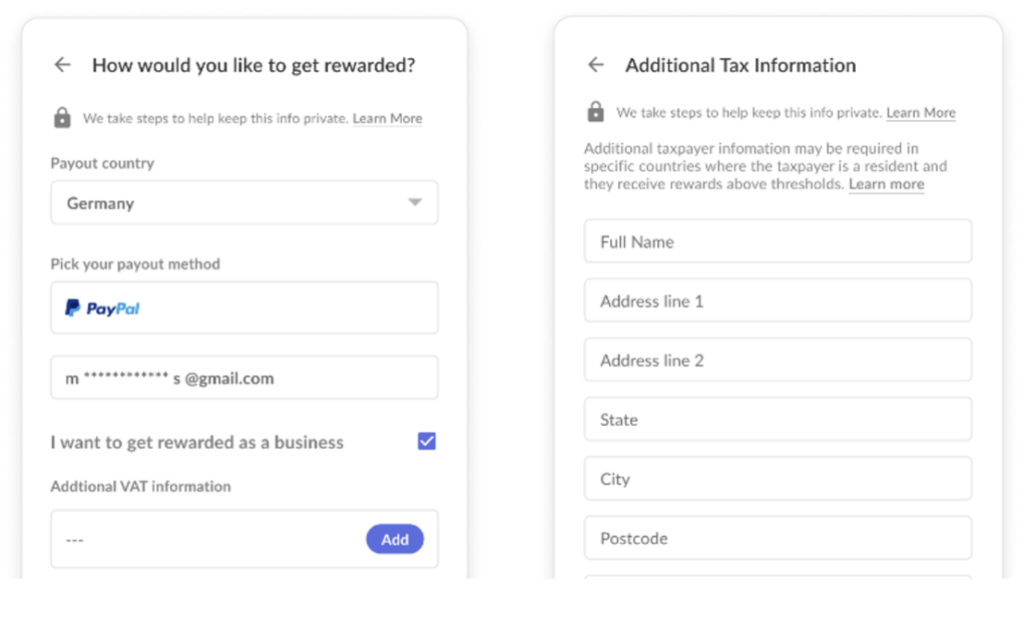

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process you can choose to be rewarded as a business or as an individual and fill in the required information. The respective information will be displayed in the credit not issued to you by Cello.

Business Registration

As a rule, the responsible authorities (local trade office “Gewerbeamt”) provide the relevant form (Gewerbeanmeldung) on their website, which you must fill in and send to the responsible authority. If you already have a registered sole proprietorship, you must notify the responsible authorities that you are starting a new business activity using the appropriate form (”Gewerbeummeldung”). The legal form of your business should be discussed with your tax advisor.

The duration of the registration process is 2 to 4 weeks.

You can learn more about the requirements at the following website: https://www.ihk.de (you can find the information by clicking on your local Chamber of Commerce representative).

Once you have completed your company registration, you are not automatically also VAT -registered. You must apply for a VAT number separately.

VAT Registration

Business that collects VAT from Cello:

You must pay the VAT you earn from the sale of your services (referral of solutions) to the German tax authorities with your annual VAT declaration and with your periodic VAT advance return. Regarding the declaration obligations, please refer to the section "How do I ensure compliance?”

Small Business that do not collects VAT from Cello (”Kleinunternehmer”):

Unlike a full VAT registration, you:

- do not charge VAT on your services,

- do not reclaim VAT as input tax on your purchases

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to register as a company?

You are a private individual, but are advised to register a small business (”Kleinunternehmer”) if you you refer products sustainably (> 10 referrals per year*) and your annual turnover is smaller than 22.000€ in the last year or last annual turnover was smaller than 22.000€ but the estimated turnover of your current year does not exceed 50.000€ . Whether you should register as a small business at the trade office (”Gewerbeamt”) accordingly depends on the sustainability of your business and activities. As a small business you do neither have to collect VAT nor do a VAT advance return (”Vorsteueranmeldung”)

How do I sign-up for VAT?

You can sign-up for VAT at your local collection office (”Finanzamt”)

How do I ensure my compliance as a business?

To be compliant for your VAT registration, you should:

- Submit the periodic advance returns VAT online via Elster (form USt 1 A).Submit the annual VAT return online via Elster (form USt 2 A 501).