Guidelines on Tax Reporting for Referral-Users in India

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and are not exhaustive. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

Being a resident in India and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following tax regulations according to the applicable Indian law.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation, Cello is the recipient of a service.

- Supplier

- Referral Users are the suppliers of a service.

- Supplier Referral Users are the suppliers of a service.

Since you are in this case the supplier by conducting a referral and receiving a payment, you are responsible for tax claims in India. Cello provides you with information on how to assess different taxes like direct taxes (e.g. personal income tax), or indirect taxes (e.g. Goods & Services Tax (GST)) from income generated abroad since Cello’s legal entity is in Germany.

Business vs. Private

As a Referral User in India you are either a

- Private Individual - not professional

- If you only refer solutions occasionally and have an aggregated turnover of less than Rs. 20 lakh (or Rs. 10 lakh for businesses operating in northeastern states and certain hill states) you do not necessarily need to register a business (Learn more)

- A business that collects Goods and Services Tax (GST)

- Under the GST Act, businesses with an annual turnover of over Rs. 20 lakh (or Rs. 10 lakh for businesses operating in northeastern states and certain hill states) must register for GST. Please note that you since you are supplying goods or services to a German customer, you do not need to charge GST on your invoice. The GST is applicable only to businesses operating in India.

Tax Treatment

Referral User

In the following we provide examples of Referral User’s tax treatment depending on their legal form.

Cello creates a credit note on behalf of you two times a month listing all your referrals conducted by you and pays out your full earnings to you, subject to deduction or withholding of applicable taxes. For any taxes deducted or withheld, Cello shall provide you with a statement or certificate evidencing the deposit of such tax to relevant authorities in accordance with the applicable. It is then your responsibility to report your earnings to the local authorities in your personal tax declaration.

| Legal form of referrer | Private Individual | Business that collects GST (Enterprise) |

|---|---|---|

| Definition as per GST | < Rs 20 lakh (or Rs. 10 lakh for business operating in northeastern states and certain hill states) | > Rs 20 lakh (or Rs. 10 lakh for business operating in northeastern states and certain hill states) |

| GST Rate | 0% (subject to fulfilment of applicable conditions) 18%, if applicable conditions are unfulfilled | 0% (reverse charge, usually 20%)* 18%, if applicable conditions are unfulfilled |

| Income Tax Treatment | - Indian resident individuals are taxed on their worldwide income (including referral fee) at the applicable slab rates (ranging from 5% to 30%, plus applicable surcharge and cess) - Indian resident individuals are required to file their annual income tax returns in India reporting the income earned during the preceding year. To file your tax return, you will need to get a PAN and file it online on the Income Tax Department’s e-filing website | - Income tax - Corporate Income Tax (< INR 50 crores: 25% // > INR 50 crores: 30%) |

| Reporting Due Dates | 31.07. every tax year / 31.10 (if your account is subject to tax audit) | 31.10. (if you are a company or your account is subject to tax audit or you are a partner of a firm whose account is subject to tax audit) / 30.11. (If you are subject to transfer pricing compliances) |

You can learn more here.

- If you are a business registered under the Goods and Services Tax (GST) in India and you are supplying goods or services to a German customer, you do not need to charge GST on your invoice, subject to applicable conditions in law. It should be noted that no levy of GST in respect of non-resident customers requires prior fulfilment of conditions including obtaining a Letter of Undertaking. The GST is applicable only to businesses operating in India.

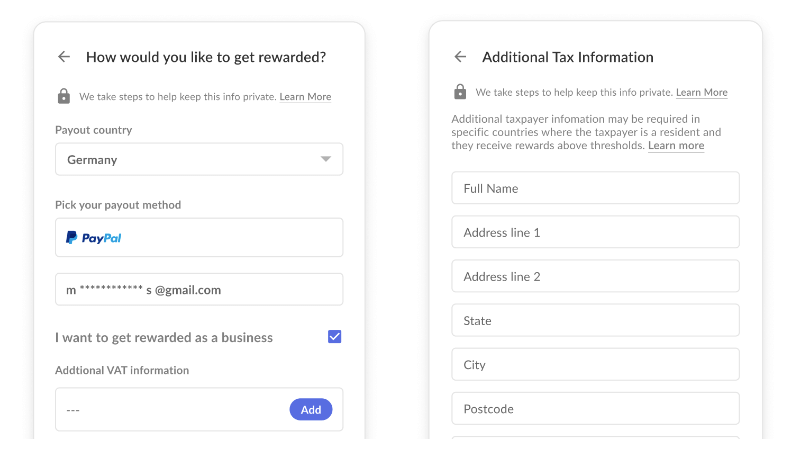

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process you can choose to be rewarded as a business or as an individual and fill in the required information. The respective information will be displayed in the credit not issued to you by Cello.

Business Registration

In India, not all businesses are required to be registered, but most of them are. The need for registration depends on the type and scale of the business you want to conduct.

Sole proprietorships and partnerships do not require registration under Indian law. However, it is recommended to obtain a license from the local municipal corporation or the state government, depending on the nature of the business.

On the other hand, if you plan to set up a private limited company, a limited liability partnership (LLP), or a one-person company (OPC), you are required to register your business with the Registrar of Companies (ROC) under the Companies Act, 2013. This registration process involves obtaining a Digital Signature Certificate (DSC), Director Identification Number (DIN), and registering your business name with the Ministry of Corporate Affairs (MCA).

Additionally, businesses that cross a certain annual turnover threshold (currently Rs. 20 lakh for goods and Rs. 10 lakh for services) are required to register for the Goods and Services Tax (GST) under the GST Act, 2017.

VAT Registration

Under the GST Act, businesses with an annual turnover of over Rs. 20 lakh (or Rs. 10 lakh for businesses operating in northeastern states and certain hill states) are required to register for GST. The registration process involves obtaining a GST Identification Number (GSTIN) from the Goods and Services Tax Network (GSTN) and filing regular GST returns.

It is important to note that even if a business does not meet the turnover threshold, they may still choose to voluntarily register for GST to take advantage of input tax credit and other benefits.

You can register for the Goods and Services Tax (GST) in India through an online portal known as the Goods and Services Tax Network (GSTN).

It is important to note that the registration process and requirements may vary depending on the type and nature of your business. It is recommended to consult a tax professional or a chartered accountant for guidance on the registration process and compliance requirements for your specific business.

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return