Guidelines on Tax Reporting for Referral-Users in Italy

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and are not exhaustive. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

A Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) resident in Italy must comply with the tax and social security obligations provided for by the Italian applicable legislation. More specifically, the Referral User will be liable to pay any applicable income tax, VAT and social security contributions. The Referral User may also be required to report the aforementioned taxes in the annual returns for the relevant fiscal year (on the 730 Model “Dichiarazione dei Redditi Persone Fisiche” or “UNICO” Form), thus complying with the local reporting requirements.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation, Cello is the recipient of a service.

- Supplier

- Referral Users are the suppliers of a service.

Since you are in this case the supplier by conducting a referral and receiving a payment, you are responsible for complying with the tax and social security obligations provided for by the Italian legislation. Cello gives you high-level information on how to pay and report different taxes like direct taxes (e.g. personal income tax), or indirect taxes (e.g. Value Added Tax (VAT)) which are due in Italy.

Please consider that the following information shall not be intended as a full and comprehensive tax advice, and it is advisable that you consult a professional tax advisor.

Business vs. Private

As a Referral User in Italy you are either a

- Private Individual - not professional

- If you only refer tools occasionally, you do not need to register for VAT purposes. Precisely, all 'occasional' transactions (activities carried out incidentally and in a sporadic manner) are excluded from the scope of VAT, as they lack the subjective prerequisite for the realization of a taxable transaction.

- Professional Individual or business registered for VAT purposes (sole proprietorship or company)

- You must register for VAT purposes if referrals are performed habitually in the form of a business activity, either if carried out individually (sole proprietorship – “Ditta Individuale”) or through a company. Even if you do not have to collect VAT for services provided to Cello, due to the reverse change mechanism applicable between Germany and Italy, you are subject to invoicing duties and other VAT compliance obligations.

Tax Treatment

Referral User

In the following we provide examples of Referral User’s tax treatment depending on their legal form.

Please consider that in any case, Cello creates a credit note on behalf of you two times a month listing all the referrals conducted by you and pays out your full earnings to you. It is then your responsibility to report your earnings to the local authorities in your personal tax declaration.

| Legal form of referrer | Private Individual who does not perform the referral activity professionally | Private Individual who performs the referral activity professionally | Limited Liability Company |

|---|---|---|---|

| Definition | Private Individual who does not perform the referral activity in a professional way (i.e. does not refer tools in the manner of a business activity) | Private Individual who performs the referral activity in a professional way as sole proprietorship (“Ditta Individuale”) | Exercise of the referral activity through a limited liability company (“Società per azioni, Società a responsabilità limitata e Società in accomandita per azioni”) |

| VAT | N/A | 0% (reverse charge mechanism applies) | 0% (reverse charge mechanism applies) |

| Tax Treatment | Income Tax: progressive tax rates up to 43% Reporting: file Modello Redditi PF (Unico Form) or Modello 730 (Mod. 730, a simplified income tax return) | Income Tax: progressive tax rates up to 43% Reporting: file Modello Redditi PF (Unico Form) | Income Tax: Corporate Income tax at 24% (IRES) plus regional tax at 3,9% (IRAP) Reporting: File Modello SC |

| Reporting Due Dates | 30.09 (Modello 730) or 30.11 (Unico Form) every tax year | 30.11 every tax year | 30.11. every tax year |

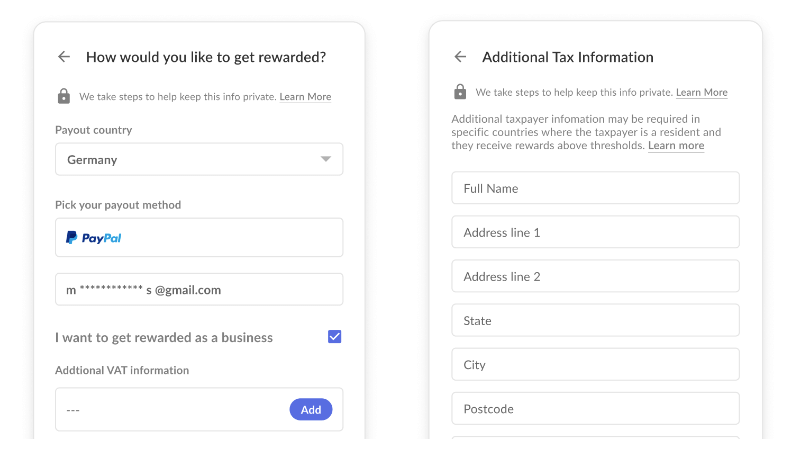

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process you can choose to be rewarded as a business or as an individual and fill in the required information. The respective information will be displayed in the credit not issued to you by Cello.

Business Registration

Deciding between a limited company or sole trader

To enroll into the Business Register, one has to e-fill in the form “Single Business Communication”; such e-procedure enables the entity to obtain the VAT number/Tax Code and to be assigned a specific insurance and social security code.

In order to send the Single Business Communication, it is necessary:

- to register on the free web service Telemaco

- to be in possession of a digital signature and

- to be in possession of a certified electronic e-mail address (PEC).

For sole proprietorship (ditta individuale) classification, the next step is to register your business with the Chamber of Commerce company register. Then you’ll need to register with the INPS (National Institute for Social Security), as well as the INAIL (National Institute for Insurance against Accidents at Work). These registrations are mandatory, so you can pay for a pension, social security, and work insurance.

What business types are there in Italy

- Limited liability company (SrL)

- Joint Stock Companies (SpA)

- Branches

- Partnerships (Ss, Snc, Sas)

VAT Registration

As a Referral User, you should register for VAT regardless of your turnover if you perform the referral activity on a professional basis or as a business.

To register for VAT purposes in Italy, the following forms must be presented to the Revenue Agency:

- Natural person: form AA9/12

- Legal entity: form AA7/10

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to register as a company?

Registering as a company is not required if the referral activity is performed by a private individual (professional or not professional).

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return.