Guidelines on Tax Reporting for Referral-Users in Japan

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and are not exhaustive. We, therefore, accept no liability whatsoever for the information and contributions provided, in particular for their correctness, up-to-dateness and freedom from errors. Furthermore, we do not assume any liability for any links to external websites operated by third parties. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

Being located in Japan and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following tax regulations according to the applicable Japanese law.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation, Cello is the recipient of a service.

- Supplier

- Referral Users are the suppliers of a service.

The service is the referral, which is done by the Referral User and Cello rewards this service.

As you are the supplier in this case by making a referral and receiving payment, you are responsible for tax claims in Japan. Cello will provide you with information on the different tax obligations, such as direct taxes (e.g. income tax) or indirect taxes (e.g. Consumption Tax (消費税, Shōhizei)) from income generated abroad, as Cello is based in Germany.

Non-registered individual or GST/VAT registered company/business

As a Referral User in Japan, you are either a GST/VAT registered entity “適格請求書発行事業者” (Including individual business) or a non-registered individual.

Whether to be a registered entity is at the discretion of the Referral User. However, if the sales exceeds 10 million yen, consumption tax must be paid regardless of registration status. Additionally, if not registered, there is a risk that the transactions may be refused by the counterparty because it is unable to claim tax deductions for the referral fee.

If you are not a GST/VAT registered entity “適格請求書発行事業者”, the treatment of taxation varies depending on whether the amount of sales for two fiscal years ago exceeds JPY 10 million or not.

| Over JPY 10 million | The company/business must collect and file consumption tax (GST/VAT) whether registered or not. |

| JPY 10 million or less | The company/business is not required to file consumption tax (GST/VAT). However, it is generally not permissible to add consumption tax on the referral fees. |

Tax Treatment

Referral User

In the following we provide examples of Referral User’s tax treatment depending on their legal form.

Cello creates a credit note on behalf of you two times a month listing all your referrals conducted by you and pays out your full earnings to you.

| Legal form of referrer | Sole Proprietor | GST/VAT Company |

|---|---|---|

| Consumption Tax Rate (e.g. GST/VAT) | GST/VAT registered individual 10% (reverse charge*1,2) Not registered individual No need to pay, however, the solo proprietor can’t charge a 10% tax on the service fee in principle. | GST/VAT registered company 10% (reverse charge*1,2) Not registered company No need to pay, however, the company can’t charge a 10% tax on the service fee in principle. |

| Consumption Tax Threshold | Even if you are not a GST/VAT individual, you must pay consumption tax where its sales exceed JPY 10 million. However, you have no need to pay consumption tax where its sales JPY 10 million or less. | Even if you are not a GST/VAT company, you must pay consumption tax where its sales exceed JPY 10 million. However, you have no need to pay consumption tax where its sales JPY 10 million or less. |

| Tax Treatment | Personal Income Tax - If the income associated with the referral fee is less than JPY 200,000, it is treated as “miscellaneous income”, and there is no need to pay income tax. (Here, income refers to the amount obtained by deducting expenses from the revenue.) However, if the income exceeds JPY 200,000, it is treated as “business income” and subject to taxation. | National Corporate Tax - Standard rate is 23.2% of taxable income. However, for ordinary companies with a share capital of less than JPY 100 million, the tax rate for income up to JPY 8 million yen per year is 15%. Local Corporate Tax - Local corporate tax is imposed at the rate of 10.3% on the amount of “National Corporate Tax”. Corporate Inhabitant Tax - Depenidng on specific locality, in Tokyo, Corporate Inhabitant Tax is imposed at the rate of 10.4% on the amount of “National Corporate Tax”. |

| Reporting Due Dates | Fiscal year end is 31. December. Required to file a tax return between Feburuary 16 and March 15 with tax office | Fiscal year end is determined at the discretion of the company. Required to file a tax return within two months after the end of the fiscal year (business year ends on March 31, tax return latest by May 31). However, it is permitted to extend one month if appling to tax office. |

*1 Reverse charge means the reversal of the tax liability. The basic rule is that the service provider is liable to pay consumption tax. Deviating from the basic rule, under the reverse charge system, the recipient of the service (Cello) is liable for the consumption tax although it is not service provider. This means that when the reverse charge is applicable, you (Referral Users) are not liable for the consumption tax unlike basic tax regulations.

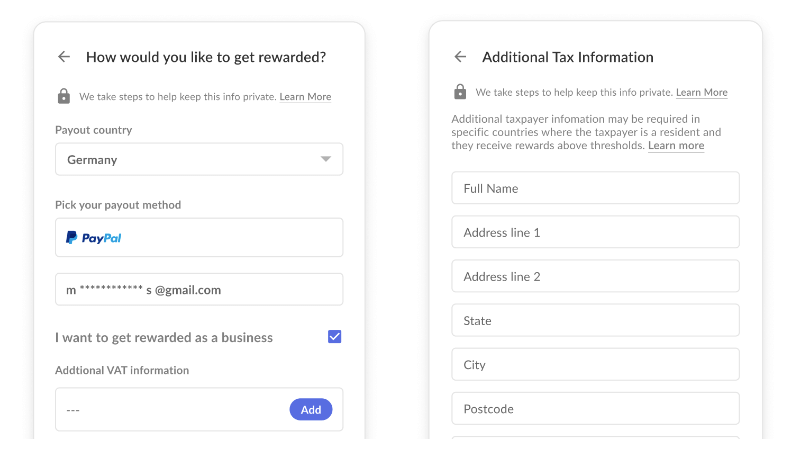

*2 In order for Cello to ensure proper tax filing of consumption tax under reverse charege system, Cello is required to report specific Referral User information to tax office. In the payout process you can choose to be rewarded as an individual (sole proprietor)or as a company. However, Cell is required to keep records regarding information of Referral User such as the name of the Referral User, the transaction date, and other relevant details in order to claim tax deductions. The respective information will be displayed in the credit note issued to you by Cello.

Business Registration

To register a company (godo kaisha ”合同会社”, or kabushiki kaisha ”株式会社” ), you must file an application with the Legal Affairs Bureau (Houmu-kyoku ”法務局”). This involves preparing articles of incorporation, obtaining a company seal, and completing other administrative steps.

Here’s a general guide on how to register a business, focusing on the most common types of business entities: the sole proprietorship (kojin jigyo-nushi “個人事業主”).

Business Plan: If you start a business as a sole proprietor, there is no need to go through registration procedures at the Legal Affairs Bureau. However, having a clear business plan is crucial for success.

Tax Office Notification:

Within one month of starting your business as a solo proprietor, you must submit a ‘Notification of Opening a Business (開業届) ’ to the tax office. And then, if submitting an ' Application for approval of filing a blue form tax returns (所得税の青色申告承認申請書) ' simultaneously, individual businesses can benefit from a deduction of JPY 650,000 from taxable income. Furthermore, you also have to ‘Notification of establishment of an office paying salaries (給与支払事務所等の開設届出書) ’ to the tax office if you plan to hire employees.

Local Tax Government Notification:

As well as procedures to submit necessary documents to a tax office, ‘Notification of incorporation or establishment of branch (法人設立・設置届出書)’ is required to submit to the local tax government.

Commercial Registration:

(Optional for Sole Proprietors): Sole proprietors typically do not need to register with the Legal Affairs Bureau unless they wish to secure a commercial registration for more formal business operations.

National Health Insurance:

If you're leaving an employer's health plan and start your business as a sole proprietor, you'll need to join the ‘National Health Insurance (国民健康保険, Kokumin Kenko Hoken). However, after resigning from the company where you were previously employed, you may choose to continue the health insurance from your former workplace for up to two years.

Pension System:

If yon run your business as a sole proprietor, you also have to join the ‘National Pension Plan(国民年金, Kokumin Nenkin’).

Industry-Specific Licenses:

Obtain any necessary permits or licenses for your specific industry.

VAT Registration

- Notification of Taxable Business: If you're starting a new business and expect to be a registered GST/VAT business, , you must submit a "Application form for registered GST/VAT business " (適格請求書発行事業者の登録申請書) to your local tax office.

- Application Form: The form can be obtained from the local tax office or downloaded from the National Tax Agency's website. And then, it is possible to apply the form through the online system named of “e-tax”. The application form requires to fill in information about your business, such as the name, address, type of business, and the start date of your fiscal year.

- Submission: Submit the completed application to the local tax office. The submission can typically be done by e-tax, mail or in person.

- After Registration: Once registered, you'll be required to collect Consumption Tax from your customers on taxable sales and can claim credits for the Consumption Tax paid on your business purchases.

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to register as a company?

This depends on the nature of your referral activity and the income you generate through referrals. Please consult a tax advisor for more information

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return