Guidelines on Tax Reporting for Referral-Users in the Netherlands

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial high-level guide and are not exhaustive. We therefore strongly recommend that you learn more about your obligations or consult a (Dutch) tax advisor for more specific information.

Being a resident in the Netherlands for tax purposes and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following tax regulations -amongst others- according to the applicable Dutch law.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation, Cello is the recipient of a service (provided by the Referral User).

- Supplier

- Referral Users are the suppliers of a service.

Since you are in this case the supplier by conducting a referral and receiving a payment, you are in principle responsible for tax claims in the Netherlands. Cello provides you with information on how to handle different taxes like direct taxes (e.g. personal income tax, inkomstenbelasting), or indirect taxes (e.g. Value Added Tax (VAT), omzetbelasting) from income generated by using Cello. We note that this has an international dimension since Cello’s legal entity resides in Germany.

Business vs. Private

As a Referral User in the Netherlands the following applies to Dutch VAT registration.

- Private Individual

- If you only refer solutions occasionally and are not obligated to register in the Dutch Chamber of Commerce and your annual turnover is less than EUR 1.800 per year, you do not need to register as a business for Dutch VAT purposes (and do not have to charge VAT or submit Dutch VAT returns): Small business scheme (kleineondernemingsregeling, KOR)

- Private Individual / Small Business

- If your annual turnover is more than EUR 1.800 per year but less than EUR 20.000 you need to register as a business for Dutch VAT purposes but you can make use of the small business scheme (kleineondernenersregeling, KOR). If the KOR applies you do not have to charge VAT or submit Dutch VAT returns (we note that exceptions may apply). For more information we refer to the website of the Dutch Tax Authorities: Kleineondernemersregeling (KOR) (belastingdienst.nl)

- You can apply for the small business scheme here: Aanmelden voor de kleineondernemersregeling (KOR) (belastingdienst.nl)

- Check if you are eligible for this scheme with the Dutch-language KOR tool. If you take part in the KOR scheme, this is for at least 3 years. Does your turnover exceed EUR 20.000 in a calendar year? In that case you must notify the Tax and Customs Administration (in Dutch) immediately. You will be subject to VAT.

- If your annual turnover is more than EUR 1.800 per year but less than EUR 20.000 you need to register as a business for Dutch VAT purposes but you can make use of the small business scheme (kleineondernenersregeling, KOR). If the KOR applies you do not have to charge VAT or submit Dutch VAT returns (we note that exceptions may apply). For more information we refer to the website of the Dutch Tax Authorities: Kleineondernemersregeling (KOR) (belastingdienst.nl)

- Business

- In all other situations (i.e., the expected or last annual turnover was more than EUR 20.000) you must in principle register as a business for Dutch VAT purposes. You do not have to collect VAT for services provided to Cello due to the reverse charge between Germany and the Netherlands). You must submit Dutch VAT returns and quarterly listings of services supplied to businesses in other EU member states.

In addition to the above, we note that as a registered business for Dutch VAT purposes, you should keep a proper administration (i.e., invoices issued must be kept for a period of 7 years).

Tax Treatment

Referral User

In the following we provide examples of Referral User’s tax treatment depending on their legal form.

Cello creates a credit note on behalf of you two times a month listing all your referrals conducted by you and pays out your full earnings to you. It is then your responsibility to report your earnings to the local authorities in your personal tax declaration.

| Legal form of referrer | Private Individual | Private Individual / Small Business (applying KOR) | Business |

|---|---|---|---|

| Definition | < EUR 1.800 | >EUR 1800 < EUR 20.000 | > EUR 20.000 |

| VAT Rate | VAT exemption | VAT exemption | 0% (reverse charged) |

| Tax Treatment | - Income tax: You have to file your income tax return digitally. You can find the form in the encrypted environment of the website, Mijn Belastingdienst | - Income tax: You have to file your income tax return digitally. You can find the form in the encrypted environment of the website, Mijn Belastingdienst | - Corporate Income Tax (standard rate at 25.8%, lower rate of 19% applies to first profit up to EUR 200.000) |

| Reporting Due Dates | every tax year (before 1 May the following year) | every tax year (before 1 May the following year) | every tax year (in principle before 1 June the following year) |

How to file a VAT return

If the Small Business Regime does not apply to you, the Dutch Tax Authorities requires you to file your VAT returns and listings each quarter before the end of that month:

- January (for months October + November + December)

- April (for months January + February + March)

- July (for months April + May + June)

- October (for months July + August + September)

For more information regarding the filing of VAT returns, we revert to the website of the Dutch Tax Authorities: Btw-aangifte invullen en versturen (belastingdienst.nl)

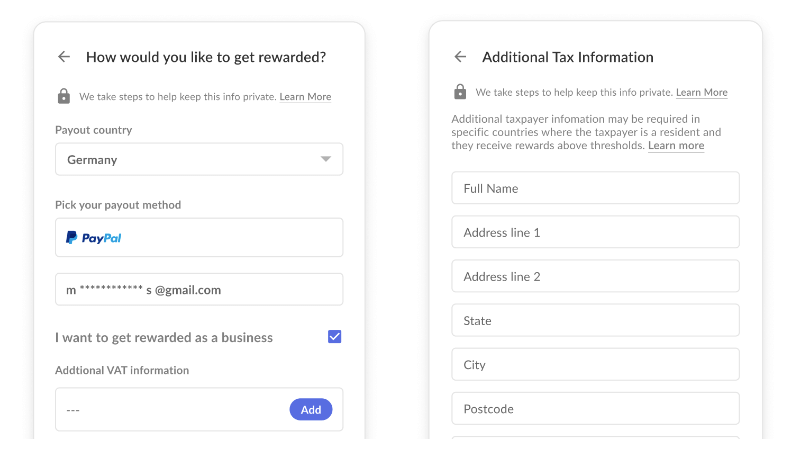

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process you can choose to be rewarded as a business or as an individual and fill in the required information. The respective information will be displayed in the credit note issued to you by Cello.

Business Registration

Finding the right legal entity

New businesses must register with the Dutch Business Register at the Netherlands Chamber of Commerce (KVK). Read the step-by-step article to find out about the registration procedure, costs, etc.

Freelancer and zzp'er are not legal structures. If you freelance in the Netherlands or if you are a self-employed professional without personnel, you have the option to register as a sole proprietor or as a private limited company (*besloten vennootschap,*bv).

VAT Registration

Step 1: Fill out the VAT registration form.

- Download & print your form to get started

Step 2: Mailing your form

- Send your completed form to Belastingdienst, Postbus 2891, 6401 DJ Heerlen

How to apply for VAT exemption (under the Small Business Regime)

Step 1: Fill out the KOR application form

- Download & print your form to get started

Step 2: Mailing your form

- Send your completed form to Belastingdienst, Antwoordnummer 21140, 6400 VX Heerlen

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return