Guidelines on Tax Reporting for Referral-Users on the Philippines

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and are not exhaustive. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

Being a resident in the Philippines and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following tax regulations according to the applicable Philippine law.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation, Cello is the recipient of a service.

- Supplier

- Referral Users are the suppliers of a service.

- Supplier Referral Users are the suppliers of a service.

Since you are in this case the supplier by conducting a referral and receiving a payment, you are responsible for tax claims in the Philippines. Cello provides you with information on how to claim different taxes like direct taxes (e.g. personal income tax), or indirect taxes (e.g. Value Added Tax (VAT)) from income generated abroad since Cello’s legal entity is in Germany.

Business vs. Private

As a Referral User in Italy you are either a

- Private Individual

- In any case you will need to register as a business taxpayer with the Bureau of Internal Revenue (BIR). The type of registration (whether new or an update of an existing one) that you will need to undertake will depend on whether or not you are currently employed by another local employer and registered as such. If you are currently or are expected to earn over PHP 3,000,000 during the current taxable year, you are also required to register as a VAT taxpayer.

- A corporate entity

- You will also need to register as a business taxpayer (if you are not currently registered), or update your current registration (if you are already registered), with the BIR. If you are currently or are expected to earn over PHP 3,000,000 during the current taxable year, you are also required to register as a VAT taxpayer.

Tax Treatment

Referral User

In the following we provide examples of Referral User’s tax treatment depending on their legal form.

Cello creates a credit note on behalf of you two times a month listing all your referrals conducted by you and pays out your full earnings to you. It is then your responsibility to report your earnings to the local authorities in your personal tax declaration.

| Legal form of referrer | Private Individual | Business that collects VAT (Enterprise) |

|---|---|---|

| Definition | < PHP 3,000,000 | > PHP 3,000,000 |

| VAT Rate | exempt | 0%* |

| Tax Treatment | - Subject to income tax at the graduated rates, from 0% to 35% (depending on total taxable income) | - Subject to income tax at 25% or, if a domestic corporation, 25% or 20% |

| Reporting Due Dates | - Quarterly income tax returns due every 15.05 (for Q1), every 15.08 (for Q2) and every 15.11 (for Q3) of the current taxable year. Annual income tax returns due every 15.04 of the year subsequent to the current taxable year. - VAT returns due quarterly (within 25 days from close of every quarter) | - Quarterly income tax returns due every 60 days following close of Q1, Q2 and Q3 of current taxable year. Annual income tax returns due every 15th day of the fourth month following the close of current taxable year. - VAT returns due quarterly (within 25 days from close of every quarter) |

*If you are a business registered for VAT in the Philippines and you provide services to Cello being based in Germany, there is a possibility that you need not collect VAT for services provided to Cello based in Germany, as your services to Cello may qualify as “zero-rated” sale of services. However, note that zero-rating is not automatic. In this case, please consult a tax advisor who can provide proper advice as to whether such services provided to Cello are indeed “zero-rated” and the procedure on how to avail benefits of zero-rating including the required documentation.

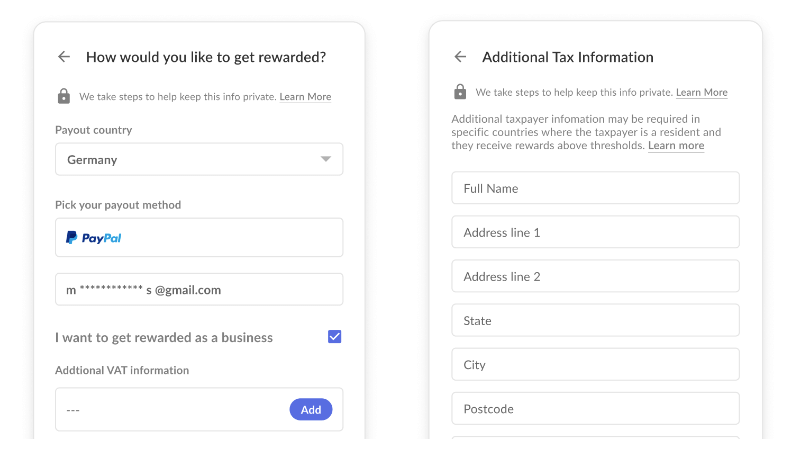

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process you can choose to be rewarded as a business or as an individual and fill in the required information. The respective information will be displayed in the credit not issued to you by Cello.

Business Registration

You are required to register your business with the appropriate government agencies before commencing operations. This is a legal requirement under Philippine law, and failure to register your business can result in penalties, fines, and legal issues.

The specific agency you need to register with depends on the nature and size of your business. If you are a sole proprietorship with a total capitalization of less than PHP 3 million, you can register with the Department of Trade and Industry (DTI) through their Business Name Registration System (BNRS). If you are a partnership or corporation, you need to register with the Securities and Exchange Commission (SEC).

VAT Registration

In the Philippines, businesses are generally required to register for Value Added Tax (VAT) if their gross annual sales or receipts from the sale of goods and/or services exceed PHP 3,000,000.

If your business is required to register for VAT, you need to file an application with the Bureau of Internal Revenue (BIR) and obtain a Taxpayer Identification Number (TIN). Once registered, you are required to issue VAT invoices or official receipts, file quarterly VAT returns, and pay the VAT due on or before the 25th day from the close of the quarter.

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to create an invoice?

If you are a VAT-registered taxpayer (or are required to register as such), you will need to secure from the BIR an authority to print VAT-registered official receipts (VAT OR) and to issue the same in the name of Cello upon receipt of payments from Cello.

Cello will provide you a credit note with all the required information for your local authorities. You will get a monthly tax summary overview with a detailed breakdown of your earnings (gross fares). This document will help you prepare your VAT as well as your tax returns.