Guidelines on Tax Reporting for Referral-Users in Spain

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and are not exhaustive. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

Being a resident in Spain and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following tax regulations according to the applicable Spanish law.

Preliminary note that the mentions to “entrepreneur” or “professional” are made under the assumption that the Referral Users, in case of individuals, participate in a referral program in a habitual and recurrent basis intended to be continuous, and carried out as part of a business or professional activity. If these circumstances do not concur in your case, please see tax treatment for “Private Individual”.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation, Cello is the recipient of a service.

- Supplier

- Referral Users are the suppliers of a service.

- Supplier Referral Users are the suppliers of a service.

Since you are the supplier by conducting a referral and receiving a payment, you may be responsible for the fulfillment of tax obligations in Spain. Cello provides you with information on how to comply with these obligations as regards different taxes like direct taxes (e.g. Personal Income Tax, “PIT”) and Corporate Income Tax (”CIT”), or indirect taxes (e.g. Value Added Tax, “VAT”) due to conducting a referral for Cello, as a legal entity located in Germany.

Business vs. Private

As a Referral User in Spain you are either a private individual or an entrepreneur or professional for VAT purposes.

- Private Individual - not professional

- If you only refer solutions occasionally and outside of a business or professional activity, you will in principle not be considered as an entrepreneur or professional for the purposes of Spanish VAT and therefore the services that are deemed to have been provided to Cello will not be subject to Spanish VAT.

- Entrepreneur or professional

- In general terms, entrepreneurs or professionals are those individuals or entities that carry out business activities, meaning those activities that involve the management on their own account of material and human factors of production or one of them, with the aim of being involved in the production or distribution of goods or services.

- If you meet the above definition and you act as a business or professional for Spanish VAT purposes, the services you may provide in Spain to Cello, either on a regular or occasional basis, as part of your business or professional activity may be subject to Spanish VAT. Notwithstanding so, the services that you provide to Cello when conducting a referral will in principle not be subject to Spanish VAT bearing in mind that Cello is located in Germany, and it is Cello who must declare the VAT accrued. In any case, you may also have to declare the transaction as not subject to VAT before the Spanish Tax Authorities and hold both your intra-community trader number (VAT number) and Cello's VAT number.

Tax Treatment

Referral User

In the following we provide examples of Referral User’s tax treatment (related to both VAT, PIT and CIT) depending on their legal form.

Cello creates a credit note on behalf of you two times a month listing all your referrals conducted by you and pays out your full earnings to you. It is then your responsibility to report these transactions to the local authorities in your tax returns, where applicable.

| Legal form of referrer | Private Individual | Entrepreneur or professional |

|---|---|---|

| Definition | Individuals that do not carry out business or professional activities in the terms described in the previous section. | Individuals or entities that carry out business or professional activities in the terms described in the previous section. Mercantile corporations are considered as such unless the contrary is proven. |

| VAT treatment | N/A | Not subject to Spanish VAT due to the application of reverse charge mechanism. |

| Reporting Due Dates | N/A | Form 303: - Quarterly (from 1 to 20 of the month following the tax period and from 1 to 30 January to declare the transaction of the fourth quarter). - Monthly (from 1 to 30 of the following month and up to the last day of February to declare the transactions carried out in January). Form 390: from 1 to 30 January. Form 349: - Quarterly (from 1 to 20 of the month following the tax period, except for the tax return corresponding to July, which can be filed within August and the first 20 days of September, and the tax return related to December, which can be filed from 1 to 30 January of the following year). - Monthly (from 1 to 30 of the following month and from 1 to 30 January to declare the transactions carried out in December). |

PIT/CIT obligations

Preliminary note: Direct taxation will also depend on your status as a Referral User. However, the VAT classification (i.e., individual, and professional or entrepreneur) does not apply, but it will depend on whether you are an individual (regardless of whether you are also an entrepreneur or professional or not) or a legal entity.

On the other hand, regarding the taxation of income for individuals, as a rule, PIT taxpayers must be taxed on all their income, capital gains and losses, as well as the income allocations established by the PIT Law, wherever they were produced and irrespective of the payer’s residence.

Therefore, theoretically, every income obtained by a Referral User who meets the requirements to be a PIT taxpayer should be declared.

| Legal form of referrer | Private Individual, entrepreneur or professional | Legal entity (any of those disclosed in the Spanish CIT Law) |

|---|---|---|

| Definition | Individuals who are resident in Spain as per the conditions foreseen in the Spanish PIT Law. | Spanish legal entities disclosed in the Spanish CIT Law |

| PIT/CIT Treatment | - The income obtained shall be theoretically included in your annual PIT return (Form 100), you shall declare it as capital gains not deriving from the transfer of assets. - The tax due to be paid will vary depending on different circumstances of each individual. - In case you are a professional / self-employed worker and provided that the income you obtain as a Referral User is related to a business activity, you must declare it through Form 130 (income from business activities obtained by self-employers). | - Every income obtained by CIT taxpayers will be taxed under CIT (Form 200) being the general tax rate 25%. However, lower tax rates are foreseen for different type of entities (such as small entities or startups). Additionally, net operating losses and tax credits can be applied to reduce the taxable base. |

| Reporting Due Dates | | Form 100: up to 30 June every tax year Form 130: quarterly (from 1 to 20 of the month following the tax period and from 1 to 30 January to declare the transaction of the fourth quarter). | Within the first 25 days of the month following 6 months after the end of each fiscal year (e.g., within the first 25 days of July if the fiscal year coincides with the calendar year). |

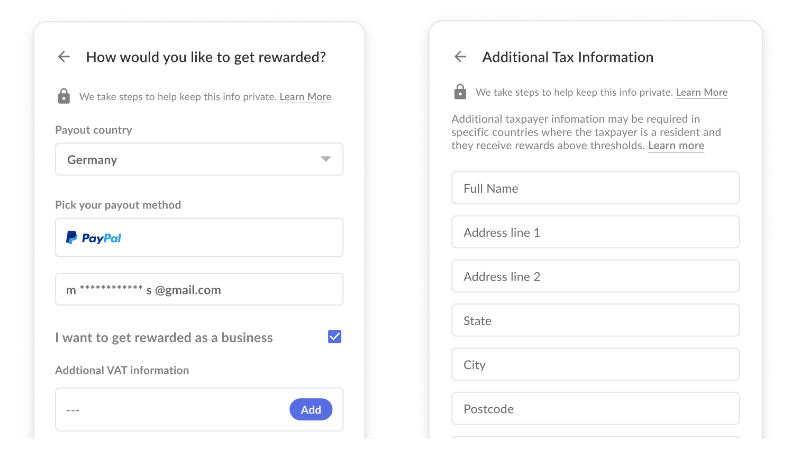

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process you can choose to be rewarded as a business or as an individual and fill in the required information. The respective information will be displayed in the credit note issued to you by Cello.

Business Registration

In Spain, you need to register your business before the Spanish and local tax authorities as soon as you start carrying out a business activity. This typically involves registering with the Spanish Tax Authorities (Agencia Tributaria) for census, VAT, PIT if you have employees or Business Activity Tax (“BAT”), among others, and obtaining a tax identification number (Número de Identificación Fiscal (“N.I.F.”)), as well as registering with the Social Security system if you have employees.

You may also need to register with other government agencies in certain cases and depending on the type of business you are operating. For example, if you are selling products or services, you may need to register with the Ministry of Industry, Trade, and Tourism. If you are providing professional services, you may need to register with the appropriate professional association or regulatory body.

FAQ

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return.

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.