Guidelines on Tax Reporting for Referral-Users in UK

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following information may only provide an initial guide and are not exhaustive. We therefore strongly recommend that you learn more about your obligations or consult a tax advisor for more specific information.

Being located in the United Kingdom (UK) and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware of the following UK tax rules

Definitions

Recipient vs. Supplier

- Recipient

- Recipient In this legal relation Cello is the recipient

- Supplier

- Supplier Referral Users are the suppliers

By making referrals and receiving payments in return you are essentially providing a service in respect of which you will be obliged to pay taxes. This consists of income tax (if you are an individual) or corporation tax (if you are operating through a company) and Value Added Tax (VAT). Your customer, to whom you will be making supplies for VAT purposes, will be Cello which is located in Germany.

Business vs. Private

As a Referral User in the UK you are likely to be either a

- a private Individual

- If you only refer solutions occasionally then you may not be carrying on a trade or business, but you should take advice as to whether this is the case and as to whether you must nonetheless pay income tax on any profit arising from your activity

- an individual carrying on a business; or

- You can choose to register for VAT even if your turnover is less than £85,000 (‘voluntary registration’).

- company carrying on a business

- You must register as a business, and for VAT if (a) your turnover for the 12 month period ending at the end of any month was more than £85,000 or (b) at any time, you expect to surpass this threshold within the next 30 days (information). You must pay HM Revenue and Customs (HMRC) any VAT you owe in respect of supplies made from the date that from which they register you.

However, because Cello is based outside of the UK, you will not be required to charge and account for VAT in respect of the services you provide to and the commissions you receive from Cello. (Instead, Cello will be obliged to account for VAT in Germany under the ‘reverse charge’ regime). Your services to Cello will therefore be ‘outside the scope’ for VAT purposes but if you are registered for VAT (i.e., because of other business activities), the VAT on your costs attributable to the supplies to Cello should be recoverable as ‘input tax’. You should also be aware that in some circumstances, it is possible to register for VAT in the UK, even if your turnover does not exceed the £85,000 threshold.

Tax Treatment

Referral User

Cello will create a credit note addressed to you twice a month listing your referrals and the rewards you have earned.

Your responsibility is to report your earnings to HM Revenue & Customs (HMRC) via your self-assessment tax return, which must be filed by the 31st of January following the end of the UK tax year, which runs from 6 April to 5 April the following year.

| Criteria | Private Individual | Sole trader | Company |

|---|---|---|---|

| Carrying on a business | No | Yes | Yes |

| Direct taxes applicable | Income tax at between 20% and 45% | Income tax at between 20% and 45% NICs at 9.73% on profits between £11,909 and £50,270 (2.73% on profits over £50,270 ) plus £3.15 per week (if earnings exceed £6,725) | Corporation tax at 19% (will increase to 25% as from 1 April 2023) |

| Allowances | Personal allowance £12,570 | Deduction of carried forward losses of the trade is available | Deduction of carried forward losses of the trade is available |

| Indirect taxes applicable | N/a | VAT 20% | VAT 20% |

| Thresholds | N/a | £85,000 | £85,000 |

| Reporting Due Dates | N/a | Quarterly due 1 month and 7 days after the end of the VAT quarter | Quarterly due 1 month and 7 days after the end of the VAT quarter |

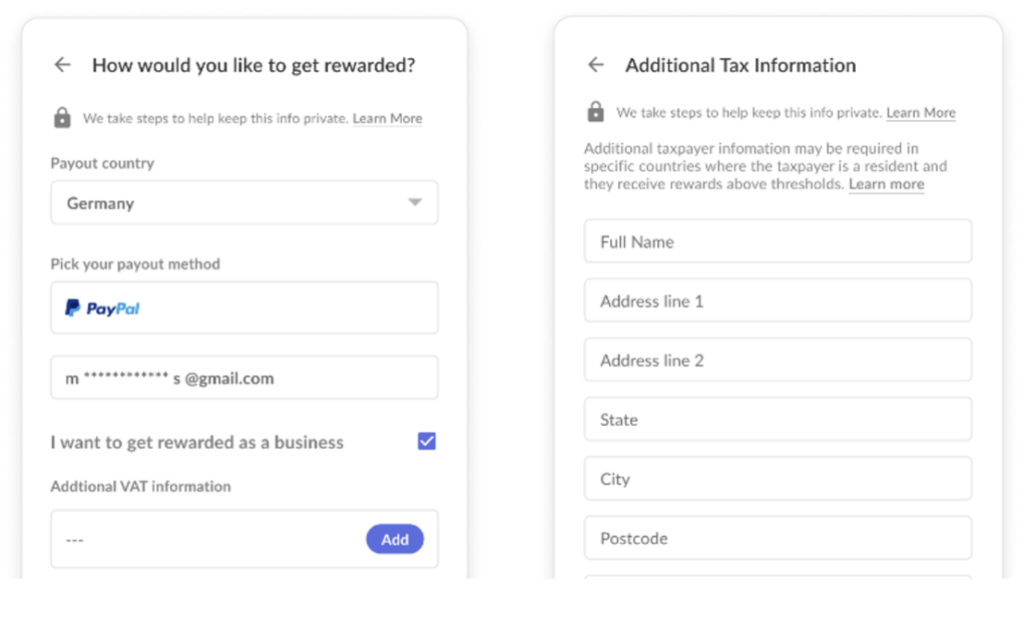

Cello is required to report to its relevant tax authorities specific Referral User information. In the payout process you should therefore indicate whether you are a private individual, or an individual or a company carrying on business. The respective information will be displayed in the credit not issued to you by Cello.

Business Registration

Deciding between a limited company or sole trader

If you are carrying on a business, you have the choice of whether to do so as a sole trader or through a company (as already noted). There are various advantages and disadvantages associated with each of these options. Which of the two you choose should depend on the industry or sector you are in, whether you plan to run your business full-time or part-time and other factors. You should also fully understand the tax implications of each option before making a decision. By operating through a limited company you will have a benefit of limited liability.

Many people start off their businesses as a sole trader and in due course incorporate the business (it is easier to convert from a sole trader to a limited company than vice a versa).

Example: Setting up an eBay shop is just the same as starting a business. If you sell more than £1,000 in a year on eBay then you will need to register a self-employed business and pay taxes depending on your income. Every country has different rules and regulations regarding the taxes you must pay on income made from an eCommerce enterprise, so please consult an accountant in your country of residence.

VAT Registration

You can usually register for VAT online. By doing this you’ll register for VAT and create a VAT online account (sometimes known as a ‘Government Gateway account’). You need this to submit your VAT Returns to HMRC.

You can appoint an accountant (or agent) to submit your VAT Returns and deal with HMRC on your behalf.

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to register as a company?

This depends on your yearly income. You must register as a business and VAT if your last annual turnover was more than £85,000.

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return