Guidelines on Tax Reporting for Referral-Users in the US

Disclaimer: Cello and its affiliates do not provide tax or legal advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax or legal advice. Any opinions or analyses contained herein are general. They do not consider your specific circumstances or applicable governing law, which may vary from jurisdiction to jurisdiction and be subject to change. You should always consult your own tax, legal and accounting advisors before engaging in any transaction. Any third-party information contained herein is from sources believed to be reliable, but we have not independently verified it. No warranty or representation, express or implied, is made by Cello, nor does Cello accept any liability with respect to this material. Distribution hereof does not constitute legal, tax, accounting, or other professional advice.

Referral Users (Users that use Cello to participate in a referral program by referring the Customer's SaaS products to their network) located in the US should be aware of the following tax regulations.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation Cello is the recipient.

- Supplier

- Referral Users are the providers. By conducting a referral and receiving a payment, you are responsible for certain taxes imposed on income from that referral. In this context, because you are physically located in the US, you are liable for US federal tax (and in most cases state and local tax) on your Cello income; it doesn’t matter that you generate your Cello income abroad (e.g., in Germany).

Since you are in this case the provider by conducting a referral and receiving a payment, you are responsible for tax claims. In this context, it doesn’t matter that you generate your income abroad (e.g. Germany). Cello gives you information on how to claim different taxes.

Business vs. Private

As a Referral User in the US you are likely to be either a

- a private Individual

- If you do not engage in ongoing and significant business activities, you are taxed as an individual. While you still must include your Cello income on your tax returns and remit taxes to the government, including state and local taxes, in this situation you generally do not need to register your Cello activity as a business with your state or local government, or file Schedule C or other business tax documents with your annual state and federal tax returns.

- a business

- For federal tax purposes, an activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit, and you are involved in the activity with continuity and regularity. Sporadic profit-seeking activity does not qualify as a business. Different states apply different standards for when sporadic activity qualifies as a business, but as a general principle, activity which qualifies as a business for federal tax purposes should be considered a business for state purposes as well

Tax Treatment

Referral User

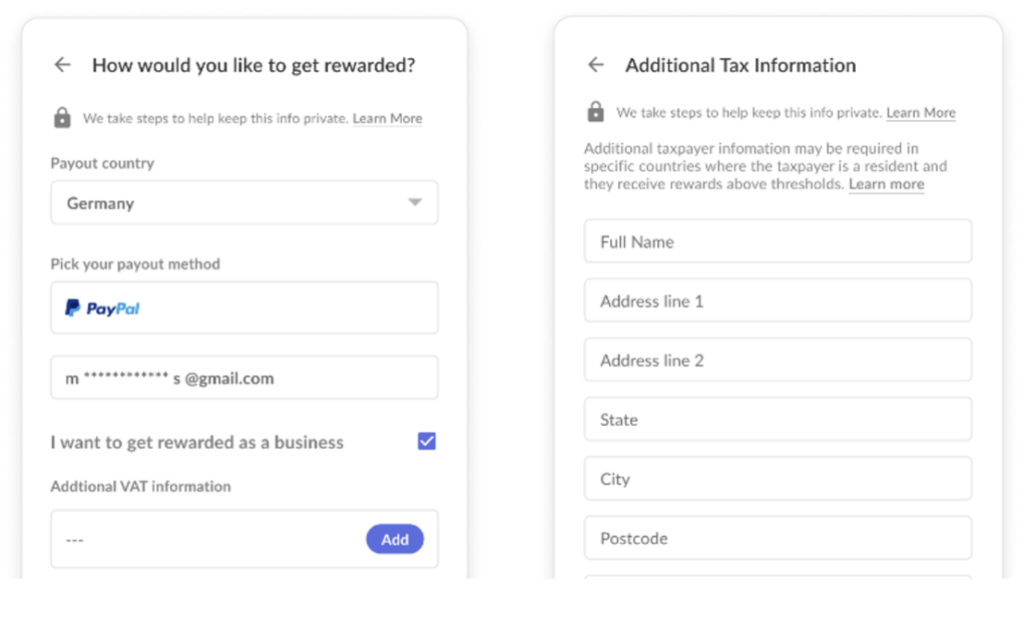

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process you can choose to be paid as a corporation or as an individual/passthrough business entity. You will then be required to fill in certain information. This information will be displayed in the credit not issued to you by Cello.

| Legal form of referrer | Private Individual | Business |

|---|---|---|

| Definition | Occasionally using Cello | Frequently using Cello |

| Sales Tax | 0% | 0% due to reverse charge |

| Tax Treatment | Personal Income Tax - Need to be reported to the Internal Revenue Service (IRS) using the Form 1040. - Need to fill out Form 1099 if you receive more than 600$ payouts by referral (will be provided by payment provider) - Individual threshold for filing tax returns is $12,950, and for self-employed people, it is $400 annually | Corporate Tax + Self Employment Tax - Need to be reported to the Internal Revenue Service (IRS) using the Form 1040. - Need to fill out Form 1099 if you receive more than 600$ payouts by referral (will be provided by payment provider) - Corporate tax differs from state to state |

| Reporting Due Dates | To be defined with local authorities | To be defined with local authorities |

Payment Settlement Entity (PSE) and credit card processors and Third-Party Settlement Organizations (TPSOs) such as Venmo, PayPal, and CashApp are required to issue a year-end tax form (Form 1099) to any non-corporate Referral User who receives $600 or more from Cello annually. For your part, if you are a US taxpayer, you are required to include income earned through Cello on your personal or business tax return. Generally, income from a Cello business will be reported on Schedule C of your personal tax return, assuming you are not operating through a separate taxable entity, such as a corporation. More information can be found here and here.

Note that federal law requires you to provide the PSE with Form W-9, which includes certain essential tax information (the required information will be requested by Cello). If you do not provide an accurate Form W-9, the PSE may be required to withhold up to 24% of certain payouts to ensure your tax obligations are met. See here.

State-specific deviations: Example California

In California, taxpayers other than corporations (including individuals, sole proprietors and passthrough entities such as partnerships) are not subject to a separate business tax on their income. However, California does impose a flat $800 annual franchise tax on LLCs and partnerships. Sole proprietors are not required to pay this annual tax, and should file their taxes on Form 540, or in the case of a nonresident, Form 540NR. See here. Sole proprietors in California whose Cello activity constitutes a business should file Schedule C or C-EZ with their state tax returns. See here.

Corporations are distinct taxpaying entities, and Cello users who operate as corporations must file separate federal and state tax returns; these returns are known as Form 1120 (federal) and, in California, Form 100. Corporations are generally subject to an additional level of tax on their income at both the federal and state level. Because corporate tax is complex, we recommend that you meet with a tax adviser and an attorney if you plan to operate your Cello business through a corporation.

Note that referral services like those provided by the Providers are not subject to sales tax in California.

Business Registration

Sole Proprietorships: Businesses operating as sole proprietorships are generally not required to register with their state, as the business and the business owner are considered the same person. Some states also do not require registration for a small partnership. However, the details of who must register and who is exempt from registration vary somewhat from state to state. In California, depending on your location, certain permits may be necessary. CalGold provides information on what permits may be necessary in your area.

Note that if your sole proprietorship operates under a fictitious business name (a name other than your own), your state may expect you to register the name of your business. This is known as “Doing Business As” (DBA) registration. In California, this “fictitious business name statement” is filed with the county recorder.

Business Entities: Some business owners choose to operate through business entities, such as Limited Liability Companies (LLCs) and corporations. These entities may have certain benefits, such as limitations on liability. However, there may also be significant tax and legal compliance costs to operating through an entity. The question of when to operate through a business entity is complex and should always be discussed with a legal advisor.

Typically, you must register with your state when you operate your business through an entity. Business registration is usually done through your state’s Secretary of State. When registering, you will need to fill out forms appropriate to your type of business and provide certain information, such as the address, key officers, and the name of a contact person to receive legal notices. The state may require payment of a processing fee at the time of registration

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to register as a company?

Maybe, depending on your state of residence and how you operate your business. One-person businesses operating as sole proprietorships are generally not required to register. The business and the business owner are considered the same person. States may also not require registration for a small partnership. However, corporations, LLCs and other business entities are almost always required to register with their state (and sometimes local) government.

Do I need to create an invoice?

Cello will provide you a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you prepare your tax return.

How do I ensure my compliance?

To be compliant, you should consult your tax advisor, attorney, and/or local authorities.

What is reverse charge?

The reverse charge procedure is generally not relevant for US Providers. The reverse charge procedure is the reversal of the tax liability and has VAT consequences. According to this regulation, it is the service recipient (Cello) and not the service provider who must pay the VAT. As a US business, you do not have to state VAT in Germany.