The revenue retention rate is a crucial metric that every business, regardless of its size or industry, should pay close attention to. It serves as a valuable tool for evaluating the effectiveness of customer retention strategies, identifying potential areas of improvement, and measuring overall business growth. In this comprehensive guide, we will explore this concept, understand its definition and importance, learn how to calculate it, examine its impact on business growth, discuss strategies to improve it, and explore its role in financial analysis.

| Key Element | Description | Improvement Strategies |

|---|---|---|

| Revenue Retention | Measures customer loyalty by the revenue kept over time. | Improve service, launch loyalty programs, and gather feedback. |

| Calculation | Determines start/end period revenue from existing customers, excluding new sources. | Use accurate data, exclude upselling/cross-selling. |

| Business Growth | Affects sustainability and profitability through loyalty. | Allocate resources efficiently, focus on satisfaction. |

| Pricing | Important for retention; includes diverse models for different needs. | Use value-based and segmented pricing to enhance engagement. |

| Financial Analysis | Informs forecasting and valuation, aids in decision-making. | Apply historical rates for accurate financial projections. |

Understanding the concept

Definition and Importance

At its core, revenue retention rate refers to the percentage of revenue that a business successfully retains from existing customers over a specific period.

It measures the ability of a company to retain its customer base and continue generating revenue from those customers. A high revenue retention rate indicates strong customer loyalty and satisfaction, while a low rate may point to underlying issues that need to be addressed.

The importance of this metric cannot be understated. It costs significantly more to acquire new customers compared to retaining existing ones.

By focusing on retaining customers and increasing revenue from them, businesses can improve their profitability and long-term sustainability.

Monitoring the revenue retention rate allows organizations to identify trends, measure the effectiveness of customer retention strategies, and make data-driven decisions to enhance customer satisfaction.

Key components

There are two key components that play a vital role in calculating the revenue retention rate:

1. The revenue from existing customers at the beginning of a specific period

2. The revenue generated from those same customers at the end of that period.

To calculate this metric, the revenue from new customers and from upselling or cross-selling to existing customers during the period should be excluded.

This ensures that the calculation focuses solely on the ability to retain revenue from existing customers without the influence of new revenue sources.

Calculating revenue retention rate

Step-by-step guide to calculation

Calculating the revenue retention rate involves a simple but insightful process. By following these steps, you can gain a clear understanding of how well your business is retaining revenue:

- Identify the total revenue generated from existing customers at the beginning of a specific period. This figure represents the revenue base that contributes to the retention rate calculation.

- Determine the revenue generated from those same existing customers at the end of the period. This figure captures the revenue retained over the specified timeframe.

- Divide the revenue retained (step 2) by the revenue base (step 1).

- Multiply the result by 100 to convert it into a percentage.

For example, if the revenue from existing customers at the beginning of the period is $1,000,000 and the revenue from those customers at the end of the period is $800,000, the calculation would be as follows:

($800,000 / $1,000,000) * 100 = 80%

Common mistakes to avoid

While the calculation seems straightforward, it is essential to avoid common mistakes that could skew the accuracy of this metric. Here are a few pitfalls to watch out for:

- Excluding revenue from upselling or cross-selling to existing customers when determining the revenue base or revenue retained. These additional revenue streams should be accounted for separately to obtain a clearer picture of the retention rate.

- Failing to consider the impact of price changes or discounting strategies on the retention rate. It is crucial to control for such factors to ensure accurate assessment of revenue retention.

- Using incomplete or incorrect revenue data. Make sure to gather and analyze comprehensive and reliable revenue information to avoid distorting the retention rate calculation.

The impact of revenue retention rate on business growth

Revenue retention and business sustainability

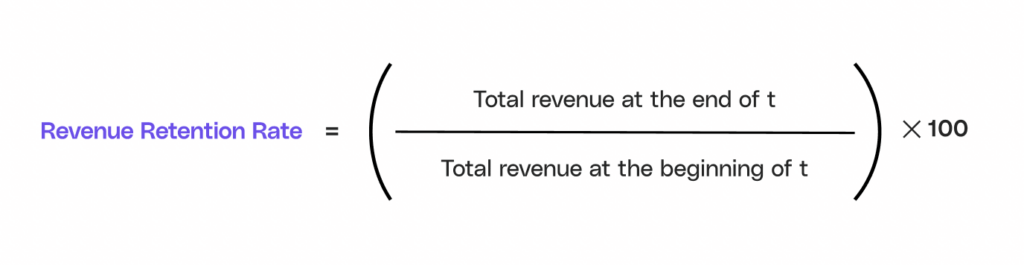

High revenue retention rates contribute significantly to the overall sustainability of a business. By retaining a larger share of revenue from existing customers, organizations can reduce their reliance on acquiring new customers to drive growth.

This stability provides a solid foundation for weathering economic downturns, industry challenges, or competitive pressures.

Moreover, a strong revenue retention rate reflects customer satisfaction and loyalty. Satisfied customers are more likely to repurchase, use additional products or services, and recommend the business to others.

This cycle of retention, expansion, and positive word-of-mouth can fuel organic growth and contribute to the long-term success of a business.

Revenue retention and profitability

Revenue retention is closely linked to profitability. When customers continue to generate revenue over an extended period, the cost of acquiring them is spread out, and the return on investment increases.

Additionally, loyal customers are often less price-sensitive and more willing to pay for premium products or services, leading to higher margins and enhanced profitability.

Furthermore, a high revenue retention rate reduces the need for expensive marketing and promotional campaigns to attract new customers. Businesses can allocate resources more efficiently and prioritize customer satisfaction initiatives, ultimately driving profitability.

Improvement strategies

Customer retention strategies

Implementing effective customer retention strategies can significantly impact revenue retention rates. Here are a few strategies to consider:

- Provide exceptional customer service: Offer personalized support, resolve issues promptly, and prioritize customer satisfaction.

- Establish loyalty programs: Reward customers for their continued patronage and incentivize them to stay with your business.

- Regularly engage with customers: Stay top-of-mind by sending personalized communications, offering exclusive promotions, or sharing valuable content.

- Solicit feedback and act on it: Actively listen to customer feedback, make necessary improvements, and demonstrate your commitment to their needs

Pricing strategies for revenue retention

Pricing plays a critical role in revenue retention. Consider these pricing strategies to improve retention:

- Value-based pricing: Align your pricing with the perceived value that your product or service delivers to customers.

- Segmented pricing: Tailor pricing plans based on customer segments, offering different tiers and options that cater to varying needs and budgets.

- Subscription models: Introduce subscription-based pricing models that encourage ongoing engagement and provide customers with continuous value.

The Role of revenue retention rate in financial analysis

Financial forecasting

Revenue retention rate can serve as a valuable input in financial forecasting models. By incorporating historical retention rates, businesses can estimate future revenue from existing customers, plan resource allocation, and make informed projections to support strategic decision-making.

Business valuation

Business valuation often takes revenue retention rate into consideration. A higher retention rate indicates a more stable, predictable revenue stream. This can positively impact the perceived value of a business, making it more attractive to potential investors or buyers.

Conclusion

In conclusion, revenue retention rate is an essential metric for businesses to monitor and analyze. It provides insights into customer loyalty and the effectiveness of retention efforts. By understanding and calculating this rate, businesses can identify areas for improvement, implement strategies to boost retention, and drive sustainable growth. Furthermore, revenue retention rate plays a crucial role in financial analysis, contributing to forecasting accuracy and influencing the valuation of a business. Overall, prioritizing revenue retention can lead to enhanced profitability, long-term sustainability, and a loyal customer base that fuels business growth.

Unlock your business's growth potential with Cello

Maximizing your revenue retention rate is just the beginning. With Cello, you can transform your satisfied users into powerful advocates for your SaaS product. Our peer-to-peer referral program is designed to integrate seamlessly, making it the easiest way to leverage user-led growth and increase your retention rates even further. Experience how Cello can amplify your revenue streams with minimal development time and a success-based pricing model. Don't miss out on the opportunity to see how Cello can revolutionize your growth strategy. Book a demo today and witness the power of effortless viral growth.

Resources

Related Articles

Why Your SaaS Referral Tracking Is Broken (& How to Fix It in 2026)

TL;DR Cookie-based referral tracking loses 25-40% of attributions due to ad-blockers (31.5% ...

Best Referral Program Software with Recurly Integration

The best referral program software for Recurly is Cello, which provides native, server-side ...

Best Referral Program Software with Paddle Integration

The best referral program software for Paddle users is Cello, which provides direct server-side ...