Guidelines on Tax Reporting for Referral-Users in Israel

Disclaimer: Cello takes the tax treatment for end-users very seriously and provides country-specific information. Taxes are a complex subject. Your tax obligations may vary depending on your particular circumstances. The following summary is intended to provide initial information only and cannot and should not be relied on as a tax advice.

THE SUMMARY BELOW IS INCLUDED FOR GENERAL INFORMATION ONLY AND MAY NOT BE APPLICABLE TO YOU DEPENDING UPON YOUR PARTICULAR SITUATION. YOU ARE URGED TO CONSULT YOUR OWN TAX ADVISOR WITH RESPECT TO THE TAX CONSEQUENCES APPLICABLE TO YOU AS A CELLO USER.

Being located in Israel and using Cello, a Referral User (Users that use the Cello Platform to participate in a referral program by referring the Customer's SaaS products to their network) needs to be aware, among other things, of the following Israeli tax considerations.

Definitions

Recipient vs. Supplier

- Recipient

- In this legal relation Cello is the recipient of a service.

- Supplier

- Referral Users are the suppliers of a service.

Since you are based in Israel and in this case the supplier, by conducting a referral and receiving a payment, you are responsible for taxes in Israel.

Israeli VAT

As a Referral User in Israel, you have to register with the ITA as either a

- Business which is exempt from VAT (”OSEK PATUR”)

- You should sign up as an exempt business if your annual turnover does not exceed NIS 120,000 (as of 2024). In this context, you do not have to charge Israeli VAT on your income and you should not offset any input VAT.

- Please note that although OSEK PATUR is exempted from VAT, such an exempt business should still comply with several reporting obligations to the ITA (including VAT reporting obligations).

- Business that collects VAT (”OSEK MORSHE”)

- For businesses with annual turnover exceeding the "OSEK PATUR" threshold, or those who otherwise need to charge Israeli VAT, registration with the Israeli VAT Authority as an authorized dealer ("OSEK MURSHE") is required.

Tax Treatment

Referral User

In the following paragraphs, we provide examples of Referral User’s Israeli tax treatment.

Cello creates a credit note on your behalf two times a month listing all the referrals you have conducted and pays you your full earnings. You are responsible for reporting your earnings to the Israel Tax Authority ("ITA") and paying your taxes to the ITA.

Your tax obligations involve submitting periodic Israeli tax returns to the ITA. The OSEK PATUR (small business) must report annually (VAT statement and income tax return), while OSEK MORSHE (business subject to VAT) must report monthly or bi-monthly (VAT return) and annually (income tax return).

Please consider that if you choose to provide services as an individual, you may be required to comply with other mandatory reporting requirements (e.g., social security) regarding your income from Cello.

| Legal form of referrer | Business which is exempt from VAT (OSEK PATUR) | Business that collects VAT (OSEK MURSHE) |

|---|---|---|

| VAT Rate | Exempt from VAT | VAT on taxable sales (currently at rate of 17%) |

| Tax Treatment | Personal Income Tax - Income tax rates in Israel are progressive, starting from 10% up to 50% depending on your aggregate annual income. - You must report your income to the ITA and pay your tax liability. - Other mandatory payments could apply to you (such as social security contributions). | Corporate tax - Corporate tax rate is currently at a flat rate of 23%. - Corporate income tax returns are required to be filed annually. - Corporate tax returns can be filed online through the Israel Tax Authority's official website. The main form used for corporate tax returns in Israel is Form 1214 | | Reporting Due Dates | Semi-annual and annual tax declarations | Monthly VAT return, annual tax declarations | |

| Reporting Due Dates | While income tax returns are required to be filed annually, a monthly reporting and payment of tax advances is required. | While corporate income tax returns are required to be filed annually, a monthly reporting and payment of tax advances is required. |

More information can be found at the ITA's website here.

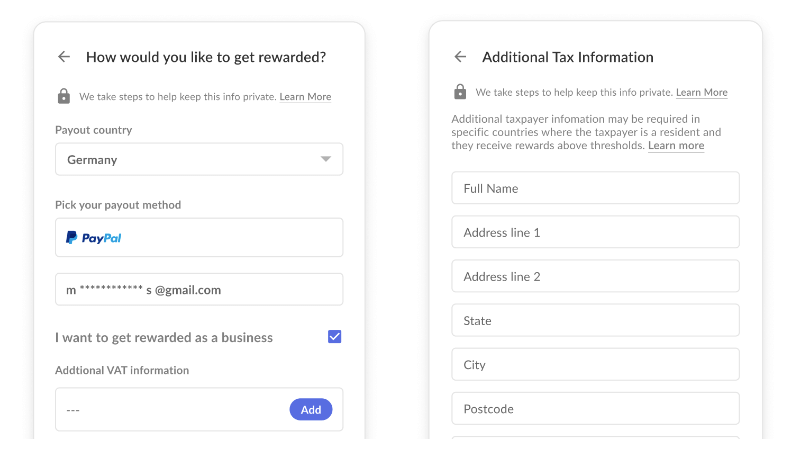

In order to ensure proper reporting to local authorities for both the Referral User and Cello, Cello is required to report specific Referral User information to local authorities. In the payout process, you can choose to be rewarded as a corporation or as an individual and fill in the required information. The respective information will be displayed in the credit note issued to you by Cello.

Business Registration

Depending on the type of business (self-employed individual or corporation), different registration formalities are applicable in Israel. Here’s a detailed breakdown:

Self-Employed Individuals

Registration with Israel Tax Authority:

- If you are producing an income from Cello, you must register with Israeli VAT office and the Israeli income tax office.

- Choosing the Type of VAT Registration:

- Exempt from VAT (OSEK PATUR): if your annual turnover (including from platforms like Cello or self-employed sources) does not exceed NIS 120,000 (as of 2024) you can register with the Israeli VAT office as OSEK PATUR.

- Suitable for small businesses, it simplifies administration and then your income should not be subject to Israeli VAT.

- Authorized Dealer (Osek Murshe): Required if your earnings exceed the OSEK PATUR threshold or you need to charge VAT.

- Professional Assistance:

- Consider getting assistance from a certified accountant or tax advisor to set up your business.

- Income Tax:

- You are required to register with the ITA and report your income for Israeli income tax purposes.

Companies

- Choosing the Type of Company:

- Private Company (Ltd): Suitable for all businesses.

- Submission Requirements:

Formation of an Israeli limited liability company is done through an on-line system which is available for any person wishing to from a company. The incorporator is required to provide articles of association, shareholders' declaration and directors' declaration, which are all created by the on-line system.

Registration with Israel Tax Authority:

If you choose to provide services as a company, you must register with Israeli VAT office and the Israeli income tax office

VAT Registration

You can register for Israeli VAT online through the Israel Tax Authority's website. Here’s a structured guide on how to do this:

Online Registration Process

- Create an Account on the Israel Tax Authority Website:

- Visit the Israel Tax Authority's website.

- Provide your personal or business tax identification number to create an account.

- Access and Complete the VAT Registration Form:

- Log in to your account.

- Access the VAT registration form.

- Complete the form by providing the following information:

- Business Details: Business name, contact information, and type of business.

- Taxable Supplies and Acquisitions: Details of your taxable supplies and acquisitions.

- Exemptions and Deductions: Information on any exemptions or deductions that may apply.

Professional Assistance

- Certified Accountant or Tax Advisor: Alternatively, you can seek assistance from a certified accountant or tax advisor to help you with the VAT registration process.

By following these steps, you can efficiently register for VAT in Israel, ensuring that your business complies with the relevant tax regulations.

FAQ

How do I know my total income from Cello?

Cello provides you a monthly overview of your earned income.

Do I need to create an invoice?

Cello will provide you with a credit-note with all required information for your local authorities. You will get a monthly tax summary overview that provides a detailed breakdown of your earnings (gross fares). This document will help you to issue an invoice to Cello and also prepare your tax return.