Customer Acquisition Costs (CACs) are an important metric that businesses use to measure the cost associated with acquiring a new customer. Understanding and effectively managing CACs is crucial for the long-term success and profitability of any business.

| Key Element | Description | Tips for Optimization |

|---|---|---|

| Defining CAC | Encompasses all expenses in attracting a new customer, including marketing, sales, and overhead costs. | Track and analyze all costs involved in customer acquisition to identify efficiency improvements. |

| Crucial for Business Strategy | Vital for optimizing resource allocation and evaluating ROI from marketing channels. | Regularly review and adjust marketing strategies based on CAC to maximize profitability. |

| Insights into Consumer Behavior | Helps in understanding consumer preferences and refining target audiences. | Leverage CAC data to fine-tune marketing efforts and target the most profitable customer segments. |

| Impact on Growth and Profitability | Key to forecasting future growth and assessing business model sustainability. | Use CAC insights for strategic planning and investment to support sustainable growth. |

| CAC and Social Media | Social media platforms amplify the impact of social proof, influencing CAC. | Optimize social media strategies to enhance customer acquisition efficiency. |

Understanding the concept of customer acquisition costs

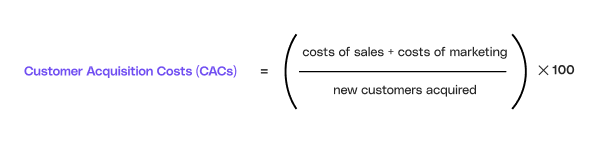

In order to fully grasp the concept of Customer Acquisition Costs, it is important to first define what it means.

Customer Acquisition Costs refer to the total amount of money a business spends to acquire a single customer.

This includes all marketing and advertising expenses, sales team expenses, and overhead costs associated with attracting new customers.

Customer Acquisition Costs, also known as CACs, can be defined as the total cost incurred by a business to acquire a new customer. This includes all expenses related to marketing, advertising, sales efforts, and other overhead costs directly attributed to bringing in new customers.

But why is understanding and managing Customer Acquisition Costs crucial for businesses of all sizes? Let's delve deeper into the importance of CACs in business.

Importance of customer acquisition costs in business

Understanding and managing Customer Acquisition Costs is crucial for businesses of all sizes. By analyzing and optimizing CACs, businesses can ensure that they are using their resources effectively and efficiently to attract new customers.

Knowing the cost associated with acquiring a customer allows businesses to make informed decisions and allocate their marketing budget wisely.

CACs and marketing channel effectiveness

One of the key benefits of understanding CACs is the ability to evaluate the effectiveness of different marketing channels. By tracking the costs associated with each channel, businesses can identify which ones are delivering the highest return on investment (ROI) and allocate their resources accordingly.

This helps businesses avoid wasting money on ineffective marketing strategies and focus on the ones that generate the most value.

Moreover, analyzing CACs can provide valuable insights into customer behavior and preferences. By understanding the cost of acquiring a customer, businesses can identify patterns and trends that can help them refine their target audience and tailor their marketing efforts to attract similar customers more efficiently. This data-driven approach allows businesses to optimize their customer acquisition strategies and maximize their chances of success.

CACs as an indicator of growth and profitability

Another advantage of managing CACs is the ability to forecast future growth and profitability. By analyzing historical data and trends, businesses can estimate their future CACs and use this information to set realistic goals and projections.

This helps businesses plan their resources and investments more effectively, ensuring sustainable growth and profitability in the long run.

Furthermore, understanding CACs can also help businesses evaluate the lifetime value of their customers. By comparing the cost of acquiring a customer with the revenue generated from that customer over their lifetime, businesses can determine the profitability of their customer acquisition efforts.

This information is essential for making strategic decisions on customer retention, upselling, and cross-selling, as well as identifying opportunities for improving customer loyalty and increasing customer lifetime value.

It is essential for businesses to continuously monitor and analyze their CACs to stay competitive in today's dynamic and ever-changing business landscape.

Components of customer acquisition costs

The components that make up Customer Acquisition Costs can vary depending on the industry and specific business model. However, there are several common elements that contribute to CAC.

These components include marketing and advertising expenses, sales team expenses, and overhead costs associated with customer acquisition.

Marketing and advertising expenses

Marketing and advertising expenses are a significant component of Customer Acquisition Costs. This includes costs associated with running marketing campaigns, creating advertisements, sponsoring events, and other activities aimed at attracting new customers.

These expenses can include online advertising, television and radio ads, print media, and other promotional efforts.

Sales team expenses

The expenses related to the sales team are also an important component of Customer Acquisition Costs.

This includes salaries, commissions, travel expenses, and other costs associated with the sales team's efforts to acquire new customers. Training and development expenses for the sales team can also contribute to CAC.

Overhead costs

In addition to marketing and sales team expenses, overhead costs play a role in determining Customer Acquisition Costs.

Overhead costs refer to the expenses that are indirectly related to acquiring new customers, such as rent, utilities, office supplies, and other administrative expenses.

These costs are necessary for the overall functioning of the business, but they also contribute to CAC.

Calculating customer acquisition costs

Calculating Customer Acquisition Costs is crucial for businesses to understand the effectiveness of their marketing and sales efforts. By accurately calculating CAC, businesses can make informed decisions and adjust their strategies accordingly.

Step-by-step guide to calculate CAC

Calculating CAC involves a step-by-step process to determine the total costs associated with acquiring a new customer.

Here are the steps:

- Identify all marketing and advertising expenses incurred during a specific period.

- Determine all sales team expenses, including salaries, commissions, and travel costs.

- Total up all overhead costs that directly contribute to acquiring new customers.

- Divide the total costs by the number of new customers acquired during the same period.

- The resulting value is the Customer Acquisition Cost.

Common mistakes in calculating CAC

While calculating CAC, there are some common mistakes that businesses often make. One such mistake is not including all relevant expenses in the calculation.

It is important to take into account all marketing, sales, and overhead costs to get an accurate picture of CAC.

Another common mistake is using inaccurate customer acquisition numbers, resulting in an incorrect CAC calculation. Ensuring accurate data and thorough analysis is essential to avoid these mistakes.

Strategies to reduce customer acquisition costs

Reducing Customer Acquisition Costs can greatly benefit businesses by improving overall profitability and efficiency. Here are some strategies to consider:

Improving marketing efficiency

One way to reduce CAC is to improve marketing efficiency. This can be achieved by targeting the right audience, optimizing advertising campaigns, using data-driven marketing strategies, and focusing on high-converting channels.

By using resources effectively and reaching the right audience, businesses can maximize the return on their marketing investments.

Enhancing customer retention

Another strategy to reduce CAC is by focusing on enhancing customer retention. This involves nurturing existing customers, providing excellent customer service, and creating loyalty programs to encourage repeat business.

By retaining customers and increasing their lifetime value, businesses can reduce the need for constant customer acquisition efforts.

See all strategies to reduce CAC in this table:

| Strategy | Description | Impact on CACs | Examples |

|---|---|---|---|

| Optimize Targeting | Refine marketing campaigns to focus on high-conversion audiences. | Decreases CAC by improving conversion rates. | Use of customer data platforms to segment audiences. |

| Content Marketing | Develop valuable content to attract and engage potential customers organically. | Lowers CAC by reducing reliance on paid media. | Blogging, SEO, informative videos. |

| Customer Referral Programs | Encourage existing customers to refer new ones in exchange for rewards. | Reduces CAC through leveraging existing customer networks. | Referral discounts or free months of service. |

| Improve Conversion Rates | Optimize website and landing pages to convert more visitors into customers. | Directly decreases CAC by increasing efficiency. | A/B testing landing pages, clear CTAs. |

| Retargeting Campaigns | Re-engage visitors who didn't convert through targeted ads. | Increases conversion rates, lowering overall CAC. | Use of retargeting ads on social media. |

The relationship between CAC and customer lifetime value (CLV)

Understanding the relationship between Customer Acquisition Costs (CAC) and Customer Lifetime Value (CLV) is crucial for businesses to achieve profitability and growth.

Understanding customer lifetime value

Customer Lifetime Value (CLV) refers to the total value that a customer brings to a business over their entire relationship.

By understanding CLV, businesses can determine the maximum amount they can spend to acquire a customer and still generate a profit.

CLV takes into account repeat purchases, cross-sell and upsell opportunities, and the overall value generated by a customer over time.

Balancing CAC and CLV for business profitability

The relationship between CAC and CLV is essential for long-term business profitability. Ideally, businesses should strive to keep their CAC below their CLV.

This means that the revenue generated by acquiring a customer should exceed the cost associated with acquiring that customer. By carefully managing CAC and maximizing CLV, businesses can ensure sustainable growth and profitability.

In conclusion, Customer Acquisition Costs (CACs) play a crucial role in the success and profitability of a business. By understanding and effectively managing CACs, businesses can optimize their marketing and sales efforts, reduce costs, and improve overall profitability.

By following the steps to calculate CAC, avoiding common mistakes, and implementing strategies to reduce costs, businesses can achieve a balance between CAC and Customer Lifetime Value for long-term success.

Maximize your customer acquisition strategy with Cello

Ready to transform your customer acquisition and turn your users into powerful growth drivers? Discover how Cello can seamlessly integrate a peer-to-peer referral program into your SaaS product, making it effortless for users to promote your brand. With Cello, you can enjoy a rapid development time, zero payback period from the start, and impressive conversion rates that enhance your Customer Lifetime Value. Experience the simplicity of our platform with a demo and see how Cello can help you achieve sustainable growth and a better balance between CAC and CLV.

Resources

Related Articles

Why Your SaaS Referral Tracking Is Broken (& How to Fix It in 2026)

TL;DR Cookie-based referral tracking loses 25-40% of attributions due to ad-blockers (31.5% ...

Best Referral Program Software with Recurly Integration

The best referral program software for Recurly is Cello, which provides native, server-side ...

Best Referral Program Software with Paddle Integration

The best referral program software for Paddle users is Cello, which provides direct server-side ...