Monthly Recurring Revenue (MRR) is a key metric that measures the predictable revenue generated by a subscription-based business on a monthly basis.

It provides valuable insights into a company's financial health and growth potential, making it an essential concept for businesses to understand and monitor closely.

Key takeaways:

- Monthly Recurring Revenue is a vital metric for subscription-based businesses, measuring predictable monthly revenue.

- MRR provides financial stability, informs budgeting, and aids in long-term decision-making.

- It is calculated by summing revenue from active subscriptions and understanding customer behavior trends.

- MRR's predictive capabilities help forecast business growth and manage cash flow effectively.

- Strategies to boost the Monthly Recurring Revenue include upselling, cross-selling, and reducing customer churn, while pitfalls to avoid include miscalculations and overreliance on MRR alone.

Understanding the concept of monthly recurring revenue

At its core, MRR represents the total recurring revenue that a business can expect to receive from its customer base each month.

It encompasses revenues generated through subscription plans, service fees, and other recurring payments. Companies can better gauge their ongoing financial stability and sustainability by focusing on the regular income stream rather than one-time transactions.

But what exactly does it mean for a business to have a reliable and predictable source of income? Let's dive deeper into the importance of MRR in assessing a subscription-based business's overall performance and health.

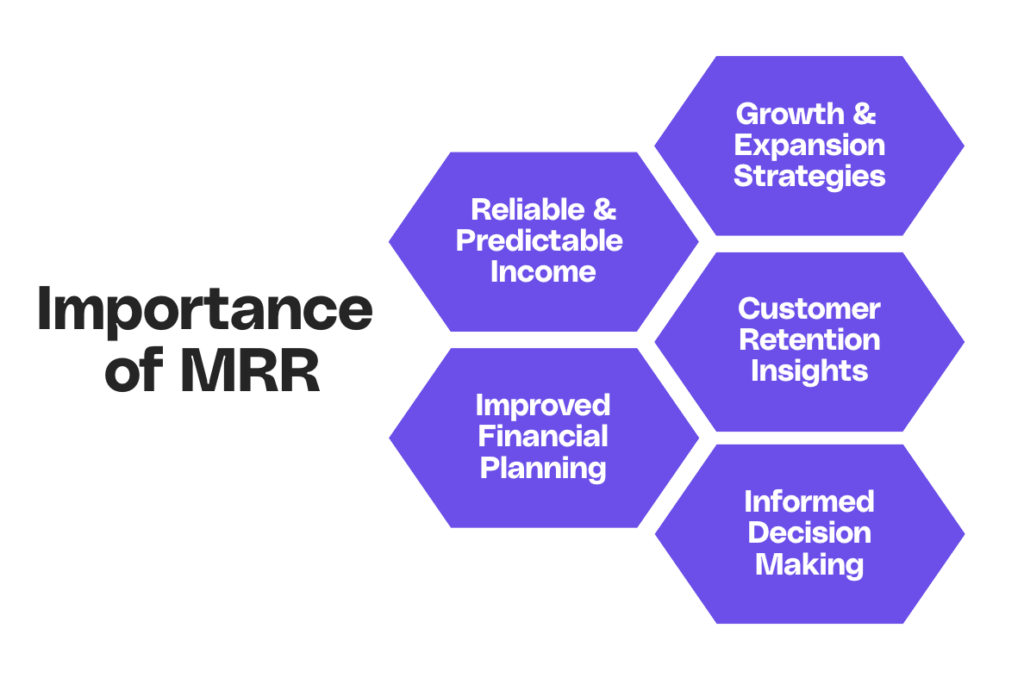

The importance of MRR in business

MRR plays a vital role in assessing a subscription-based business's overall performance and health. Unlike one-time sales, recurring revenue models offer a more reliable and predictable source of income. This stability allows companies to plan for the future and make informed decisions.

By calculating and tracking MRR, businesses clearly understand their cash flow, allowing for better budgeting, financial planning, and informed decision-making. This financial stability provides a solid foundation for growth and expansion.

Additionally, the metric is closely tied to customer retention and loyalty. By analyzing changes in MRR over time, businesses can identify trends and patterns in customer behavior.

This knowledge empowers companies to develop targeted strategies to reduce churn and increase customer lifetime value, ultimately contributing to sustainable long-term growth.

For example, if a business notices a decline in MRR, it may indicate that customers are canceling their subscriptions or reducing their usage. Armed with this information, the business can take proactive measures to address the underlying issues and retain valuable customers.

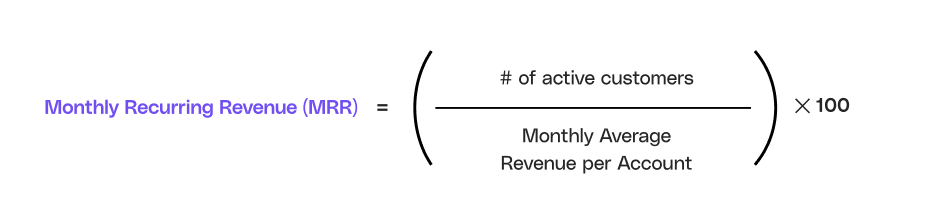

How MRR is calculated

Calculating MRR involves summing up the revenue generated from all active subscriptions or recurring transactions within a given period. To obtain an accurate measure, it is necessary to consider a few factors:

- The number of active customers: The total count of customers who are currently subscribed to the company's offerings. This includes both new and existing customers.

- The average revenue per customer: (ARPA) Calculating the average amount of revenue generated from each customer on a recurring basis. This can be determined by dividing the total revenue by the number of active customers.

- The duration of the calculation period: Monthly Recurring Revenue is typically calculated monthly, but it can also be done annually or quarterly depending on business needs. The calculation period should align with the business's reporting and analysis cycles.

Businesses can derive the monthly recurring revenue figure by multiplying the number of active customers by the average revenue per customer. For example, if a company has 200 active customers, each generating $50 in monthly recurring revenue, the MRR would amount to $10,000.

It's important to note that the metric can fluctuate over time due to customer acquisition, churn, and changes in pricing or subscription plans.

Regularly monitoring and analyzing MRR trends can provide valuable insights into the business's growth trajectory and help identify areas for improvement.

By understanding and effectively managing MRR, businesses can optimize their operations, drive customer loyalty, and achieve sustainable long-term growth.

The different types

Within the concept of MRR, various types of revenue streams exist. Understanding these different revenue categories provides businesses with deeper insights into the factors influencing their Monthly Returning Revenue growth or decline.

| Type of MRR | Definition | Calculation Method | Optimization Strategies |

|---|---|---|---|

| New MRR | Revenue from new customers. | Sum of all first-time monthly payments from new customers. | Enhance marketing efforts to attract new customers. |

| Expansion MRR | Additional revenue from existing customers. | Sum of upgrades, add-ons, and additional purchases by existing customers. | Implement upselling and cross-selling strategies. |

| Churned MRR | Revenue lost from cancellations or downgrades. | Sum of monthly revenue lost from customers who cancel or downgrade. | Improve customer retention and satisfaction. |

1) New MRR

New MRR refers to the revenue generated from new customers who have recently subscribed to the company's offerings. This revenue stream highlights the effectiveness of the business's marketing and sales efforts in attracting new clientele and expanding the customer base.

2) Expansion MRR

Expansion MRR accounts for increased revenue derived from existing customers who have upgraded their subscription plans, purchased additional products or services, or expanded their usage. It reflects the company's ability to nurture and expand relationships with its customer base.

3) Churned MRR

Churned or lost MRR represents the revenue lost due to customer cancellations, downgrades, or non-renewals. Monitoring churned Monthly Recurring Revenue enables businesses to identify points of dissatisfaction or areas requiring improvement in their product, service, or customer experience.

Furthermore, it emphasizes the importance of implementing effective customer retention strategies.

The role of MRR in predicting business growth

This metric is a powerful tool for predicting business growth and revenue trends. Its predictive capabilities can offer valuable insights into the future trajectory of a company, enabling more accurate planning and informed decision-making.

MRR as a forecasting tool

By analyzing historical Monthly Returning Revenue data, businesses can extrapolate trends to make projections and forecasts for future revenue growth. These forecasts aid in resource allocation, capacity planning, and overall business strategy alignment.

Additionally, they provide stakeholders with a clearer understanding of the growth potential and expected returns on investment.

MRR and cash flow management

MRR is closely linked to the management of cash flow within a business. Its predictable nature allows companies to estimate future cash inflow, enabling better cash flow planning.

This insight is precious when making strategic decisions such as investing in product development, scaling operations, or expanding market reach.

Strategies to increase MRR

In order to foster sustainable growth, businesses should implement strategies that actively drive Monthly Returning Revenue expansion. Here are two practical approaches:

Upselling and cross-selling

One way to increase it is by upselling and cross-selling to existing customers. By offering higher-tier plans or complementary products and services, businesses can encourage customers to spend more.

This strategy relies on understanding customer needs and preferences, providing tailored recommendations, and effectively communicating the value of the expanded offerings.

Reducing customer churn

Reducing customer churn, or the rate at which customers cancel or discontinue their subscriptions, is another key strategy for growth.

By continuously improving customer satisfaction, addressing pain points, and delivering exceptional customer support, businesses can create a positive customer experience that fosters loyalty and encourages long-term subscription retention.

Pitfalls to avoid when analyzing MRR

While Monthly Recurring Revenue analysis is crucial for businesses, it is important to be aware of common pitfalls that can hinder accurate interpretation and decision-making:

Common miscalculations

Errors in calculating the Monthly Returning Revenue can lead to inaccurate conclusions and misinformed strategic choices. It is essential to use reliable data sources, ensure consistency in measurement methodology, and conduct regular audits to identify and rectify any potential miscalculations.

Overreliance on MRR

MRR provides valuable insights but should not be the sole metric to assess a business's performance.

Supplementing MRR analysis with other relevant KPIs, such as customer acquisition cost (CAC), customer lifetime value (CLTV), and churn rate, provides a more comprehensive view of the company's overall health and prospects.

In conclusion, Monthly Recurring Revenue serves as a crucial metric for subscription-based businesses, offering valuable insights into their financial stability, growth potential, and customer retention strategies.

By understanding the concept, calculating it accurately, and leveraging it as a forecasting tool, businesses can better plan for future growth and make informed strategic decisions.

Furthermore, implementing strategies to increase MRR and avoiding common pitfalls in its analysis contribute to sustainable business success in today's subscription-driven economy.

Maximize your MRR growth with Cello

Understanding your Monthly Recurring Revenue is just the beginning. Take your SaaS product's growth to the next level by turning your users into powerful growth engines with Cello. Our peer-to-peer referral program integrates seamlessly, allowing you to harness the power of user-led growth with minimal development time and immediate payback from day one. Experience the simplicity of frictionless sharing, automated rewards, and real-time performance tracking—all while ensuring compliance and security. Discover how Cello can transform your users into your most valuable growth channel and witness firsthand the impact on your MRR. Book a demo to see Cello in action and start accelerating your viral growth today.

Resources

Related Articles

7 Best B2B Referral Software (2025 Guide)

Which referral software should I choose? In the world of referral marketing, choosing the right ...

Scaling and Maintaining a B2B User Referral Program

Learn how to set the right incentives for B2B SaaS user referral programs

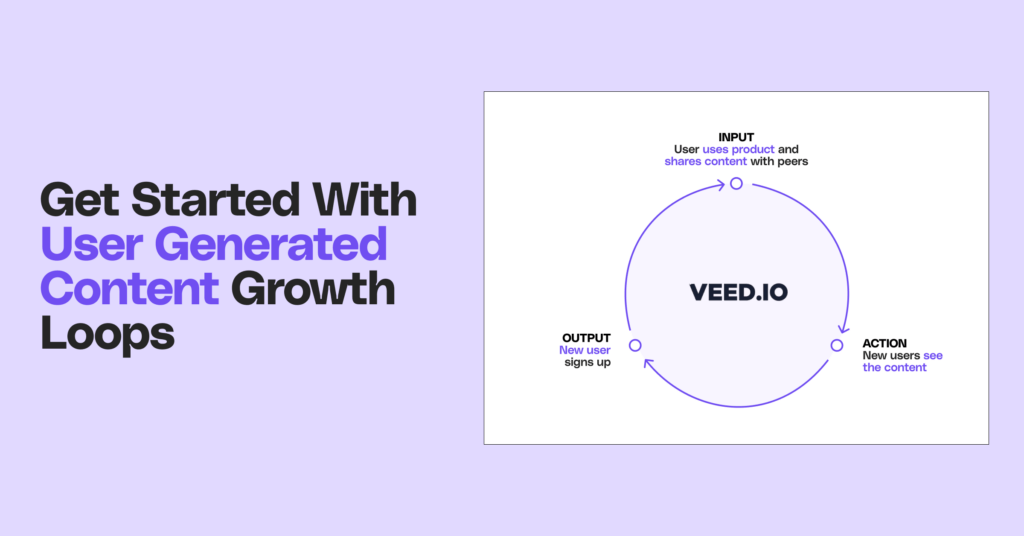

What are User Generated Content Growth Loops?

User Generated Growth (UGC) loop is a growth engine where users create content that attracts ...