This article aims to provide an in-depth understanding of the LTV:CAC ratio, its importance in business, how to calculate it, and strategies to improve it.

In the world of business, metrics and ratios hold great significance in assessing the health and profitability of a company. One such key ratio that businesses use to evaluate their marketing and sales effectiveness is the LTV:CAC ratio.

Key Takeaways:

- LTV:CAC ratio assesses customer value against acquisition cost, key for marketing efficiency.

- LTV calculation factors in purchase value and frequency; CAC is based on acquisition expenses.

- High LTV:CAC signals profitable customer acquisition; low ratios indicate inefficiencies.

- To improve the ratio, enhance customer value via personalization and lower acquisition costs.

- Regular LTV:CAC optimization supports sustainable growth and strategic decision-making.

Understanding key terms: LTV and CAC

Defining lifetime value (LTV)

Lifetime Value, commonly referred to as LTV, is a metric used to estimate the aggregate revenue a business can expect to generate from its customers during the entire customer lifespan.

In simpler terms, it represents the value customers bring to a business over time.

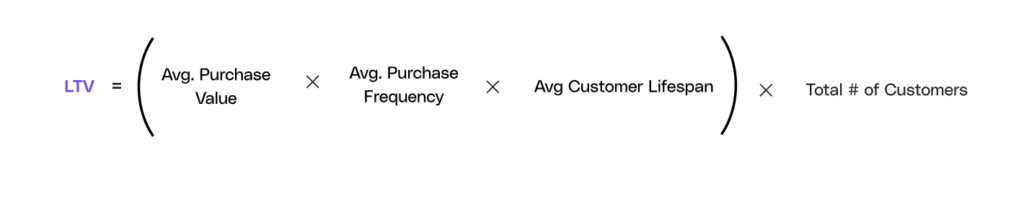

The LTV is calculated by multiplying the average customer's purchase value by the average number of times they purchase per year and the average length of the customer relationship. We then multiply this by the total number of customers.

This metric helps businesses understand the profitability of their customers and make informed decisions on customer acquisition and retention strategies.

Let's dive deeper into the components of LTV to gain a better understanding of how it is calculated.

- The average customer's purchase value refers to the amount of money a customer spends on each transaction. This can vary depending on the nature of the business and the products or services offered. For example, a luxury brand may have a higher average purchase value compared to a fast-food restaurant.

- The average number of times a customer purchases per year is another crucial factor in LTV calculation. This metric helps businesses identify the frequency at which customers engage with their products or services. A higher purchase frequency indicates a stronger customer relationship and potentially higher LTV.

- The average length of the customer relationship is an essential component of LTV. This refers to the duration of time a customer remains loyal to a business and continues to make purchases.

Understanding the average length of the customer relationship allows businesses to assess customer retention strategies and identify opportunities for improvement.

Understanding customer acquisition cost (CAC)

Customer Acquisition Cost, often abbreviated as CAC, represents the cost that a business incurs to acquire new customers. CAC includes marketing expenses, sales commissions, and other associated costs related to attracting and converting leads into paying customers.

To calculate CAC, sum up the total costs associated with acquiring each new customer, and multiply this by the number of newly acquired customers during a specific period.

CAC is an essential metric as it helps businesses determine the effectiveness of their marketing and sales efforts and assess the return on investment (ROI) for customer acquisition strategies.

Now, let's explore the different components that contribute to CAC.

- Marketing expenses play a significant role in customer acquisition. This includes costs related to advertising campaigns, social media marketing, search engine optimization, and other promotional activities aimed at attracting potential customers.

- Sales commissions are another crucial aspect of CAC. These are the incentives given to sales representatives or teams for successfully converting leads into paying customers.

- Other associated costs such as lead generation tools, customer relationship management (CRM) software, and customer onboarding expenses also contribute to CAC. These costs are necessary for efficiently managing and converting leads into customers.

By understanding the components of CAC, businesses can identify areas where they can optimize their customer acquisition strategies.

For example, if marketing expenses are high compared to the number of newly acquired customers, it may indicate the need for a more targeted and cost-effective marketing approach.

The importance of LTV:CAC ratio in business

Role of LTV:CAC ratio in profitability

The LTV:CAC ratio is a crucial indicator of a company's overall profitability. By comparing the lifetime value of customers to the cost of acquiring them, businesses can evaluate the efficiency of their marketing and sales efforts.

A high LTV:CAC ratio indicates that a company is generating significant revenue from its customers relative to the cost of acquiring them, pointing to a sustainable business model.

Business sustainability

The LTV:CAC ratio is closely tied to a company's long-term sustainability. A favorable ratio signifies that a company has found an effective balance between attracting new customers and generating revenue from existing ones.

It suggests that the business's customer base is loyal and exhibits strong retention rates, which are key drivers of business stability and growth.

Calculating the LTV:CAC ratio

Steps to determine LTV

Determining the LTV requires a clear understanding of customer behavior and purchase patterns. By following these steps, businesses can estimate the lifetime value of their customers:

- Calculate the average purchase value: Divide the total revenue from all customers by the number of customers during a specified period.

- Calculate the average purchase frequency: Divide the number of purchases made by all customers by the total number of unique customers.

- Calculate the average customer lifespan: Determine the average length of the customer relationship by subtracting the date of the first purchase from the date of the last purchase.

- Multiply the average purchase value, purchase frequency, and customer lifespan by the total number of customers to calculate the LTV.

Steps to determine CAC

Calculating the CAC requires a comprehensive analysis of the costs associated with customer acquisition. Follow these steps to determine the CAC:

- Compile all costs for each customer related to marketing and sales activities, such as advertising expenses, salaries, commissions, and software tools.

- Sum up the marketing and sales costs incurred during a specific period.

- Divide the costs of sales and costs of marketing by the total number of newly acquired customers and multiply by 100.

Combining LTV and CAC for the ratio

To calculate the LTV:CAC ratio, divide the lifetime value (LTV) of a customer by the customer acquisition cost (CAC). For example, if the LTV is $500 and the CAC is $100, the LTV:CAC ratio would be 5:1.

Interpreting the ratio

What a high LTV:CAC ratio indicates

A high LTV:CAC ratio indicates that a company is generating significant revenue from its customers relative to the cost of acquiring them. It demonstrates strong customer loyalty, long-term relationships, and healthy profitability.

Such a ratio suggests that a business has found an effective formula for acquiring and retaining valuable customers, positioning it for sustainable growth and success.

What a low ratio indicates

A low ratio indicates that the cost of acquiring customers outweighs the potential revenue they generate over their lifetime. This situation may indicate ineffective marketing and sales strategies, high customer churn rates, or an unsustainable business model.

A low ratio highlights the need for businesses to reevaluate their customer acquisition and retention practices to improve profitability and sustainable growth.

Strategies to improve LTV:CAC ratio

| Variable | Impact on LTV | Impact on CAC | Overall Effect on LTV:CAC Ratio |

|---|---|---|---|

| Average Purchase Value Increase | Increases LTV | No direct impact | Increases Ratio |

| Purchase Frequency Increase | Increases LTV | No direct impact | Increases Ratio |

| Customer Retention Period Increase | Increases LTV | No direct impact | Increases Ratio |

| Reduction in Acquisition Costs | No direct impact | Decreases CAC | Increases Ratio |

Enhancing customer lifetime value

There are several strategies businesses can employ to enhance customer lifetime value:

- Offer personalized experiences and incentives to encourage repeat purchases.

- Provide excellent customer service to foster loyalty and foster positive word-of-mouth referrals.

- Upsell and cross-sell relevant products or services to increase the average purchase value.

- Implement customer retention initiatives, such as loyalty programs or exclusive membership benefits.

Reducing customer acquisition cost

To reduce customer acquisition costs, businesses can consider implementing these strategies:

- Refine and target marketing efforts to reach a more qualified audience.

- Explore cost-effective marketing channels, such as social media, content marketing, and referral programs.

- Optimize sales processes and lead nurturing tactics to improve conversion rates.

- Leverage data and analytics to identify ineffective campaigns and reallocate resources for maximum impact.

In conclusion, the LTV:CAC ratio serves as a valuable tool for businesses to evaluate their marketing and sales effectiveness.

Understanding and calculating this ratio enables organizations to assess their profitability, gauge business sustainability, and make informed decisions to enhance customer lifetime value and reduce customer acquisition costs.

By implementing effective strategies and consistently monitoring the LTV:CAC ratio, businesses can optimize their growth and profitability in the competitive marketplace.

Optimize your LTV:CAC ratio with Cello's referral programs

Maximizing your LTV:CAC ratio is pivotal for sustainable growth, and Cello can be the catalyst in this process. By turning your users into powerful advocates through peer-to-peer referral programs, Cello helps you enhance customer lifetime value while reducing acquisition costs. Experience seamless integration, automated rewards, and real-time performance tracking to supercharge your growth. Ready to see how Cello can transform your SaaS product into a self-propelling growth engine? Book a demo and witness the power of user-led growth today.

Resources

Related Articles

7 Best B2B Referral Software (2025 Guide)

Which referral software should I choose? In the world of referral marketing, choosing the right ...

Scaling and Maintaining a B2B User Referral Program

Learn how to set the right incentives for B2B SaaS user referral programs

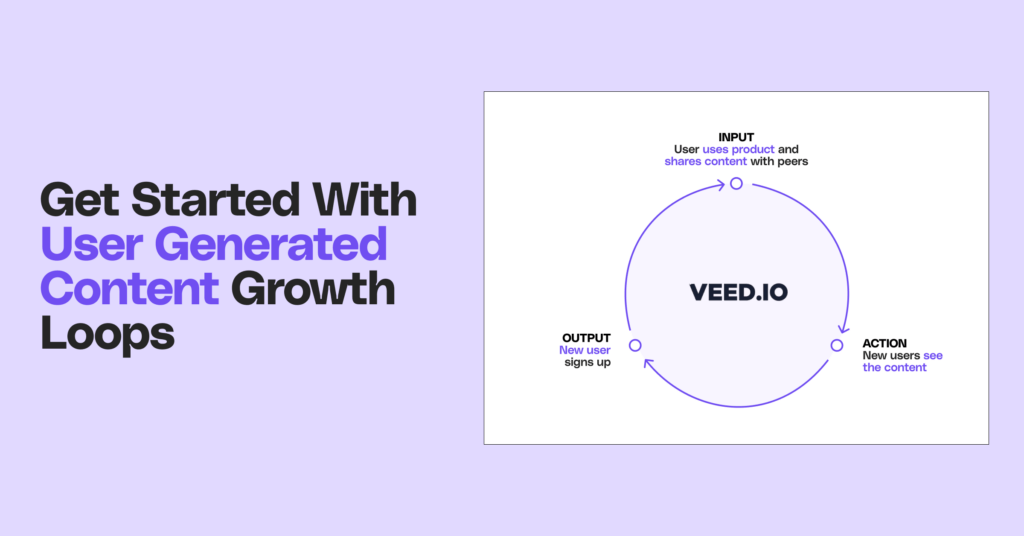

What are User Generated Content Growth Loops?

User Generated Growth (UGC) loop is a growth engine where users create content that attracts ...