In today's fast-paced business world, understanding and accurately measuring financial performance is essential for organizations to thrive and grow. One critical metric that has gained significant importance is Net New Annual Recurring Revenue (NNARR). In this comprehensive overview, we will delve into the definition, calculation, and strategic implications of NNARR. Additionally, we will explore how NNARR interacts with other key business metrics, providing valuable insights into financial forecasting and growth strategies.

| Key Element | Description | Strategies for Improvement |

|---|---|---|

| NNARR Definition | Measures net increase in recurring revenue from new and existing customers. | Optimize customer acquisition and retention strategies. |

| Importance | Indicates growth potential and customer loyalty. | Analyze trends to inform business decisions. |

| Calculation | [New Acquisitions + Upgrades] - Churn. | Ensure accurate data collection and analysis. |

| Improvement Strategies | Focuses on customer retention and expanding the customer base. | Implement targeted marketing and enhance product quality. |

Defining Net New Annual Recurring Revenue (NNARR)

Net New Annual Recurring Revenue, commonly referred to as NNARR, is a financial metric that quantifies the net increase in recurring revenue generated by an organization over a specified period

It represents the revenue generated from new customer acquisitions, expansions, and upgrades, minus any revenue lost due to churn or downgrades. NNARR is particularly relevant for businesses operating on a subscription-based model, such as Software-as-a-Service (SaaS) companies.

The importance of NNARR in business

NNARR serves as a vital indicator of a company's ability to attract and retain customers while driving sustainable revenue growth. By evaluating NNARR, businesses can gauge their sales and marketing effectiveness, identify areas for improvement, and make informed decisions to optimize revenue streams.

Moreover, NNARR provides insights into customer satisfaction, market penetration, and overall business performance. It allows organizations to identify trends and patterns in revenue generation, highlighting the effectiveness of their customer acquisition, retention, and expansion strategies.

Key components of NNARR

Several components contribute to the calculation of NNARR:

- New customer acquisitions: This includes the revenue generated from new customers who have subscribed to the organization's products or services during the specified period.

- Expansions and upgrades: Revenue generated from existing customers who have upgraded their subscriptions or purchased additional products or services.

- Churn or downgrades: Revenue lost due to customer cancelations, downgrades, or non-renewals.

By analyzing each component individually, businesses can gain a holistic understanding of their revenue streams and take proactive measures to improve NNARR.

Calculating Net New Annual Recurring Revenue

Accurately calculating NNARR is crucial to assess the organization's financial performance. While the calculation method may vary slightly across industries, the basic formula remains consistent:

Factors influencing NNARR calculation

Several factors can influence the accuracy of NNARR calculations:

- Pricing changes: Adjusting product or service prices can impact the revenue generated from customer acquisitions, expansions, and upgrades.

- Seasonality: Certain industries experience fluctuating demand throughout the year, which can affect customer acquisition rates and churn.

- Contract terms: Long-term contracts with customers may lead to delayed recognition of revenue, influencing NNARR calculations.

It is essential to consider these factors while analyzing NNARR to gain a clear understanding of the underlying dynamics impacting revenue generation.

Common mistakes in NNARR calculation

When calculating NNARR, organizations must be aware of potential pitfalls that could lead to inaccurate results:

- Inconsistent data: Incomplete or inconsistent data collection can skew the accuracy of NNARR calculations. Implementing robust data management practices is essential to avoid this issue.

- Failure to account for churn: Neglecting to include churned revenue in the calculation can significantly distort NNARR metrics. It is crucial to track and accurately record churned customers.

- Ignoring compression in upgrades: When customers upgrade their subscriptions, it is important to consider any price compression that may reduce the overall revenue impact.

Being mindful of these common mistakes will ensure the accuracy and reliability of NNARR calculations, providing a solid foundation for data-driven decision making.

The role of NNARR in financial forecasting

Financial forecasting is a critical aspect of business planning and strategy development. NNARR plays a pivotal role in providing insights into revenue growth and predicting future financial performance.

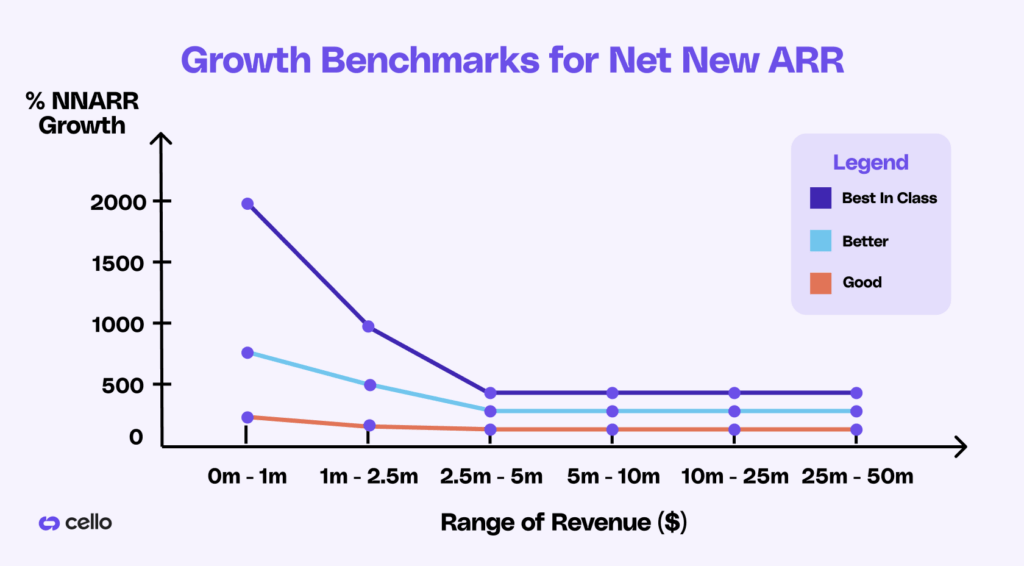

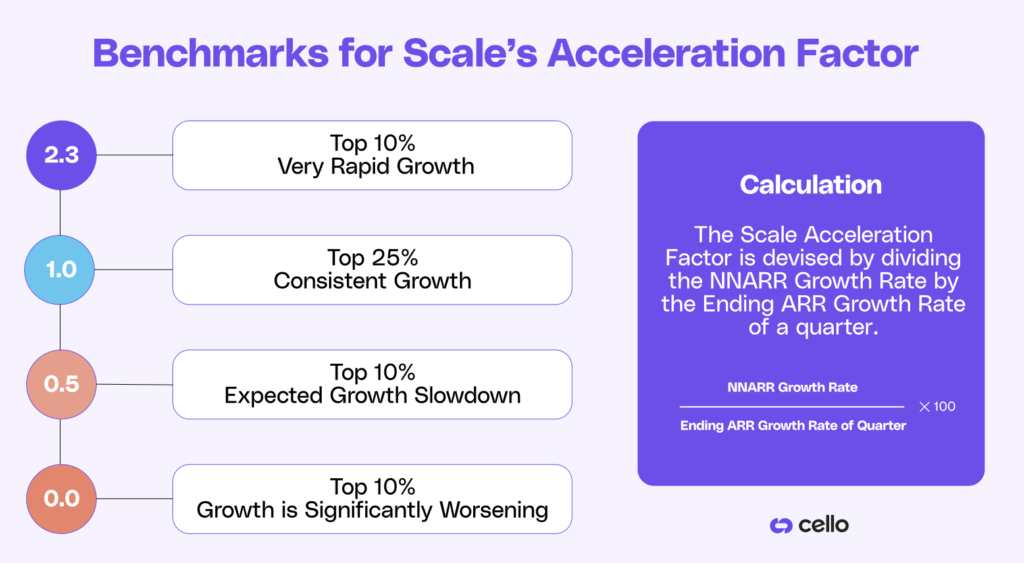

NNARR and business growth

This financial metric serves as a growth indicator by reflecting the company's ability to expand its customer base and increase revenue from existing customers. Analyzing NNARR trends can help businesses identify whether their growth strategies are effective and adjust their approach accordingly.

Furthermore, NNARR allows companies to set realistic growth targets and evaluate their progress against these objectives. By monitoring NNARR, organizations can proactively address potential issues and make data-informed decisions to drive sustainable business growth.

NNARR and revenue predictability

Stable and predictable revenue streams are crucial for effective financial planning. NNARR contributes to revenue predictability by providing insights into the recurring aspect of revenue generated from existing customers as well as the potential revenue from new customer acquisitions.

Financial forecasts heavily rely on accurate NNARR projections. By analyzing NNARR trends and understanding the factors influencing revenue generation, businesses can enhance the reliability and confidence in their financial forecasts.

Strategies to increase Net New Annual Recurring Revenue

Increasing NNARR requires strategic planning and thoughtful execution. Here are some effective strategies to boost NNARR:

Improving customer retention for higher NNARR

Retaining existing customers is crucial for sustainable revenue growth. By providing remarkable customer experiences, addressing their pain points, and continuously delivering value, organizations can ensure higher customer retention rates.

Implementing customer success programs, proactive support systems, and tailored engagement strategies can significantly enhance customer satisfaction, minimizing churn rates, and increasing NNARR.

Expanding customer base to boost NNARR

Acquiring new customers is vital for NNARR growth. To attract a broader customer base, organizations should focus on enhancing marketing and sales strategies. By targeting relevant audiences, optimizing lead generation processes, and leveraging data-driven marketing campaigns, businesses can increase customer acquisition rates, ultimately boosting NNARR.

NNARR and other key business metrics

NNARR vs. Monthly Recurring Revenue (MRR)

While NNARR focuses on the net increase in revenue generated from new customer acquisitions, expansions, and upgrades, Monthly Recurring Revenue (MRR) measures the total recurring revenue from all customers every month.

MRR provides a snapshot of a company's immediate revenue stream, highlighting changes in monthly sales and subscription-based revenue. While NNARR offers insights into revenue growth drivers, MRR reflects the company's current revenue generation performance.

NNARR and Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) evaluates the potential revenue that a customer can generate throughout the entire relationship with a business. NNARR complements CLV by providing insights into the annual revenue increments from customers.

By understanding the relationship between NNARR and CLV, businesses can make informed decisions regarding customer acquisition costs, retention strategies, and overall revenue optimization.

In conclusion, Net New Annual Recurring Revenue (NNARR) is a vital metric for businesses operating on a subscription-based model. By understanding NNARR's definition, calculation methods, and strategic implications, organizations can improve their financial forecasting, drive sustainable growth, and make data-informed decisions.

Unlock your SaaS growth potential with Cello

As you strive to enhance your Net New Annual Recurring Revenue (NNARR) and maximize Customer Lifetime Value (CLV), consider the power of peer-to-peer referrals. Cello transforms your users into a dynamic growth channel, seamlessly integrating a referral program into your SaaS product. With minimal development time, immediate payback, and impressive conversion rates, Cello is designed to amplify your viral growth and optimize revenue. Experience a user-led growth strategy that integrates effortlessly with your existing tools, backed by robust management and performance tracking. Ready to see how Cello can revolutionize your growth? Book a demo today and witness the impact of frictionless sharing and automated rewards on your business.

Resources

Related Articles

Why Your SaaS Referral Tracking Is Broken (& How to Fix It in 2026)

TL;DR Cookie-based referral tracking loses 25-40% of attributions due to ad-blockers (31.5% ...

Best Referral Program Software with Recurly Integration

The best referral program software for Recurly is Cello, which provides native, server-side ...

Best Referral Program Software with Paddle Integration

The best referral program software for Paddle users is Cello, which provides direct server-side ...