Return on Investment (ROI) is a crucial concept that is often used to measure the profitability and efficiency of an investment. In simple terms, it is a ratio that indicates the return or profit generated from an investment relative to its cost. It is a widely-used metric that helps businesses evaluate the success of their investments and make informed decisions regarding future investments.

The basics of return on investment

ROI is a financial metric that provides insights into the financial performance of an investment by determining the net gain or loss generated over a specific period relative to the investment's cost. It is typically expressed as a percentage.

ROI is a versatile metric that can be used to evaluate the performance of various types of investments, including business growth, stocks, real estate, marketing campaigns, and more.

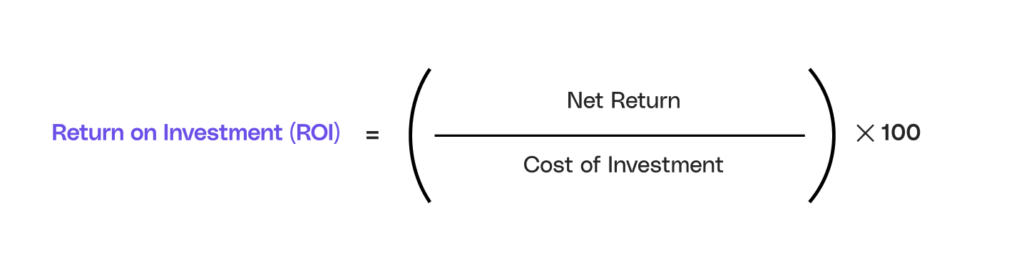

When calculating ROI, it's crucial to consider not only the financial return but also the time frame over which the return is measured.

Short-term calculations may provide a different perspective compared to long-term assessments. Understanding the time horizon is essential for making informed investment decisions and setting realistic expectations regarding returns.

Importance in business

ROI is a critical factor in business decision-making. It helps businesses determine whether an investment is worth pursuing and whether it aligns with their financial goals.

By calculating ROI, businesses can assess the profitability and effectiveness of their investments and compare them to alternative investment opportunities. This information is valuable for allocating resources and optimizing business strategies to maximize returns.

Furthermore, it provides a standardized way of evaluating the success of different investments, enabling businesses to compare the performance of various projects or initiatives.

This comparison allows businesses to identify the investments that yield higher returns and focus on strategies that generate the most significant impact.

Moreover, ROI analysis can also assist businesses in setting performance benchmarks and establishing realistic financial targets. By tracking return on investment over time, companies can monitor the progress of their investments and make data-driven decisions to enhance overall financial performance.

This proactive approach to ROI management can lead to improved efficiency, increased profitability, and sustainable growth for businesses across various industries.

Calculation: a step-by-step guide

Calculating ROI involves simple mathematical calculations. To determine this metric, you need to consider two essential components: the net gain or loss and the investment cost. The following step-by-step guide will help you calculate this effectively.

Return on Investment is a critical metric used by businesses and investors to evaluate the efficiency and profitability of an investment.

By analyzing the return on an investment relative to its cost, stakeholders can make informed decisions about future investments and assess the success of past ones.

Components needed for calculation

Before calculating ROI, gather the necessary information, including the total revenue generated from the investment and the investment cost.

It is crucial to consider all costs associated with the investment, such as expenses, fees, or maintenance costs. The more comprehensive your assessment, the more accurate your calculation will be.

Additionally, when calculating ROI for a specific period, ensure that you account for the time value of money. Adjusting for inflation and the opportunity cost of tying up capital in an investment over time provides a more nuanced understanding of its true return.

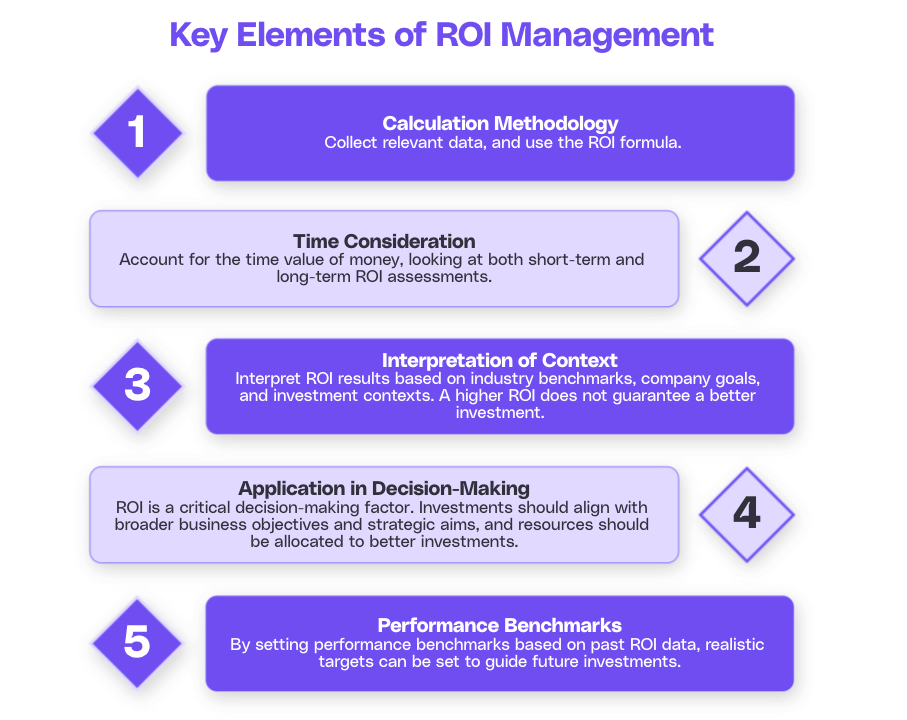

The formula explained

To calculate ROI, use the following formula:

The net gain is obtained by deducting the initial investment cost from the total revenue generated. Multiply the result by 100 to express it as a percentage. This formula allows you to evaluate the profitability of your investment accurately.

Furthermore, it's essential to interpret this figure in the context of industry benchmarks and company goals.

Comparing your ROI to industry averages can provide insights into your investment performance relative to competitors, while aligning ROI goals with broader business objectives ensures that investments contribute meaningfully to overall strategic aims.

Interpreting results

Understanding the significance of ROI results is crucial for making informed business decisions. The interpretation depends on various factors, including the industry, specific investment context, and business objectives. However, there are general principles that can guide the interpretation of results.

(Source: Cello)

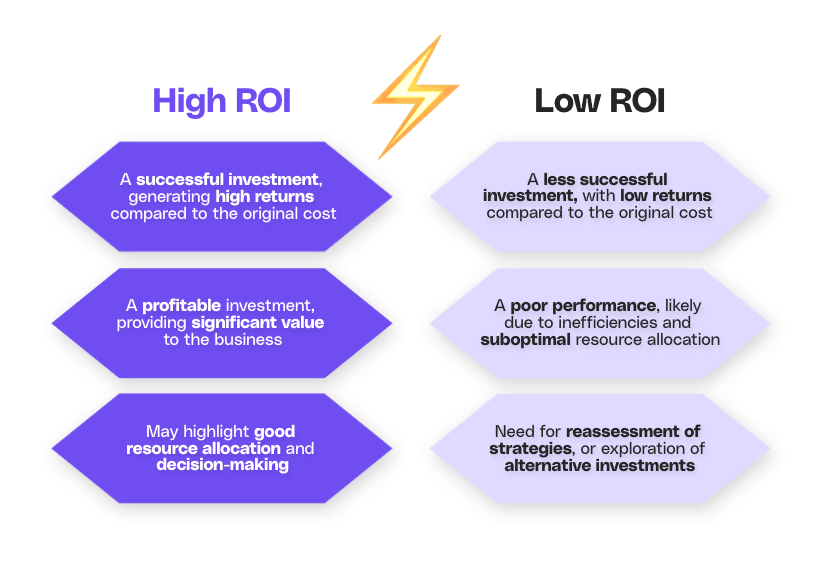

What does a high ROI mean?

A high ROI indicates that the investment has been successful in generating significant returns relative to its cost. It suggests that the investment is profitable and has provided substantial value to the business.

A high value may also indicate efficient resource allocation and effective decision-making.

What does a low ROI mean?

A low ROI suggests that the investment has not generated substantial returns compared to its cost. It may suggest poor performance, inefficiencies, or suboptimal resource allocation.

A low value could indicate the need for reassessment, adjustments in strategies, or the exploration of alternative investments to maximize returns.

ROI in different business scenarios

ROI is a versatile metric that can be applied to various business scenarios. Let's explore how this value is relevant in marketing and real estate.

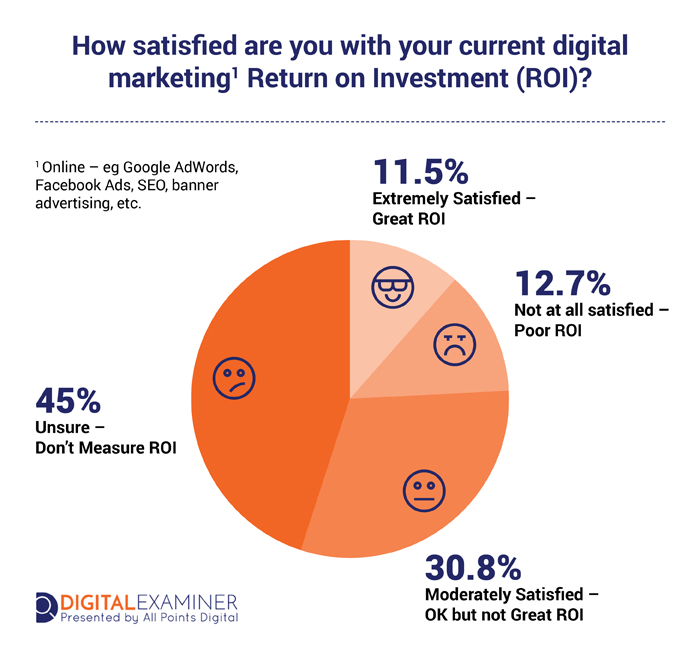

Marketing

In marketing, ROI helps determine the effectiveness of marketing campaigns and initiatives. By assessing the return generated from marketing investments, businesses can gauge the impact of their marketing efforts on revenue and customer acquisition.

Marketing ROI allows businesses to allocate resources efficiently and optimize marketing strategies to achieve better results.

Customer Lifetime Value (CLV)

In the Software as a Service (SaaS) realm, unlocking ROI hinges on strategic investments in improving several metrics, such as Customer Lifetime Value (CLV). CLV optimization involves tailoring services, fostering retention, and proactive customer success initiatives.

By aligning investments with CLV growth, businesses elevate customer loyalty and, in turn, amplify ROI. Prioritizing CLV in SaaS thus emerges as a pivotal strategy for enhancing profitability and ensuring enduring success.

Common misconceptions

While ROI is a valuable metric, there are misconceptions that need to be addressed.

ROI is the only measure of success

Although ROI provides insights into the profitability of an investment, it should not be the sole measure of success. Other factors should also be considered to make well-rounded investment decisions. These include:

- Risk Assessment

- Cash Flow

- Long-Term Potential

This value should be combined with other metrics to gain a comprehensive understanding of the investment's performance.

Higher ROI always means better investment

A higher ROI does not always indicate a better investment. The context, industry, and specific objectives should be considered when evaluating it.

Sometimes, investments with higher risks offer higher returns, but they may not align with a business's risk appetite or long-term goals. Evaluating investments solely based on ROI may overlook other crucial factors that determine overall success.

In conclusion, understanding Return on Investment is essential for businesses to evaluate the profitability and effectiveness of their investments. By calculating it and interpreting the results, businesses can make informed decisions, optimize resource allocation, and drive better financial outcomes.

Despite some common misconceptions, ROI remains a valuable metric when used in conjunction with other relevant factors in investment analysis.

Maximize your investment with Cello's P2P referral program

Understanding ROI is just the beginning. Take your SaaS product's growth to the next level by turning your users into powerful advocates with Cello. Our peer-to-peer referral program is designed to integrate seamlessly, offering a delightful sharing experience that can significantly boost your free to paid conversion rates. With Cello, you can enjoy a 0m payback period from day one and track your success in real-time. Ready to witness how Cello can transform your user base into a dynamic growth channel? Book a demo and see Cello in action today.

Resources

Related Articles

7 Best B2B Referral Software (2025 Guide)

Which referral software should I choose? In the world of referral marketing, choosing the right ...

Scaling and Maintaining a B2B User Referral Program

Learn how to set the right incentives for B2B SaaS user referral programs

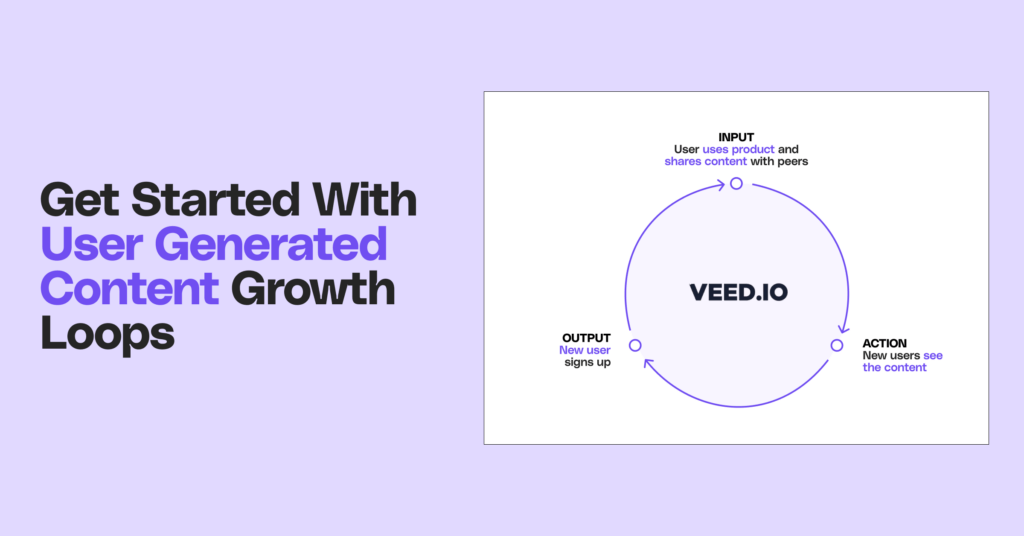

What are User Generated Content Growth Loops?

User Generated Growth (UGC) loop is a growth engine where users create content that attracts ...