Contract value is a critical metric that plays a vital role in determining the financial success of a business. It is the monetary worth of a contract and serves as an indicator of the revenue potential associated with each agreement. Understanding it is crucial for companies across industries as it allows them to make informed decisions, develop effective strategies, and forecast future earnings accurately.

| Key Element | Description | Tips for Optimization |

|---|---|---|

| Understanding Contract Value | Total amount of money involved in a contract between parties, encompassing all financial aspects such as goods/services cost, fees, and contract duration. | Comprehend the full scope of financial implications and commitments. |

| Factors Influencing Contract Value | Duration, nature of goods/services, and market conditions play pivotal roles. Longer contracts, high-value offerings, and market demand affect contract values significantly. | Consider contract length, complexity, and market dynamics for accurate value assessment. |

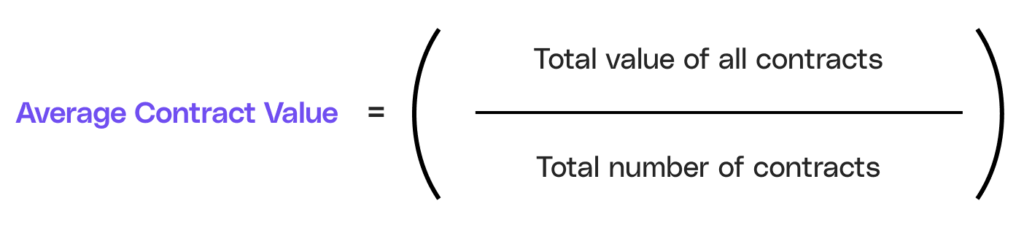

| Calculating Average Contract Value | Process involves summing up contract values and dividing by the number of contracts. Ensures a standardized metric for value assessment. | Accurately gather and analyze contract data for precise calculations. |

| Impact on Business | Critical for revenue forecasting, business strategy formulation, and alignment of sales and marketing efforts with organizational objectives. | Influence strategic decisions and resource allocation based on contract value insights. |

| Ways to Increase Contract Value | Implement upselling, cross-selling strategies, and foster long-term contracts to enhance contract values. Focus on customer satisfaction and retention for sustainable growth. | Offer additional services, incentives, and discounts to increase contract value and customer loyalty. |

Understanding contract value

Definition

Contract value refers to the total amount of money involved in a contract between two or more parties. It includes all the financial aspects outlined in the agreement, such as the cost of goods or services, any additional fees or charges, and the duration of the contract. In essence, it represents the value of the commitments made by both parties.

When calculating contract value, it's crucial to consider all components that contribute to the financial implications of the agreement. This can range from the initial investment required to start the project to the recurring costs associated with maintenance or support services. Understanding the full scope ensures that all financial obligations and benefits are accounted for accurately.

💰📝 Contract value refers to the total amount of money involved in a contract between two or more parties. It includes all the financial aspects outlined in the agreement, such as the cost of goods or services, any additional fees or charges, and the duration of the contract. Calculating the average contract value involves summing up the values of all contracts and dividing the total by the number of contracts.

Importance

The contract value is a key performance indicator that directly affects a company's financial health. By analyzing contract values, businesses can assess the overall profitability of their agreements. It helps in evaluating the return on investment, identifying potential risks, and determining the long-term viability of the contracts.

Additionally, it plays a significant role in revenue recognition, financial planning, and budgeting processes.

Finally, it serves as a basis for negotiating future agreements and partnerships. Companies can leverage their understanding of past contract values to optimize terms and conditions in new contracts, ensuring that they strike a balance between profitability and risk mitigation.

Factors influencing average contract value

Duration of the contract

The length of a contract can have a significant impact on its value. Longer contracts generally have higher values due to the extended period over which revenue can be generated. Additionally, longer contracts often result in more substantial commitments from both parties, leading to increased contractual value.

Moreover, the duration of a contract can also impact the level of trust and collaboration between the parties involved. Longer contracts provide more time for relationships to develop and for parties to align their goals and strategies.

Type of goods or services

The nature of the goods or services being provided also influences the average contract value. Complex or high-value offerings tend to have larger contract values as they involve more resources, expertise, and risks. Conversely, contracts for simpler products or services may have comparatively lower values.

Furthermore, the reputation and brand recognition of the goods or services can also impact the contract value. Well-established and reputable brands often command higher contract values as clients are willing to pay a premium for quality and reliability.

Market conditions

The prevailing market conditions can affect contract values. During periods of economic growth and high demand, contract values may increase as businesses are able to command higher prices. However, in times of economic downturn or market uncertainty, contract values may decrease as companies struggle to secure favorable terms.

Additionally, market competition plays a crucial role in determining contract values. In highly competitive markets, businesses may need to offer more competitive pricing and value-added services to win contracts, leading to lower average contract values.

Conversely, in niche markets with limited competition, businesses may be able to negotiate higher contract values due to the scarcity of alternatives for clients.

Calculating average contract value

Step-by-step guide to calculation

Calculating the average contract value involves summing up the values of all contracts and dividing the total by the number of contracts. Here is a step-by-step guide to help you:

- Gather the contract values for a specific period.

- Add up all the contract values to determine the total value.

- Count the number of contracts included in the calculation.

- Divide the total contract value by the number of contracts to obtain the average contract value.

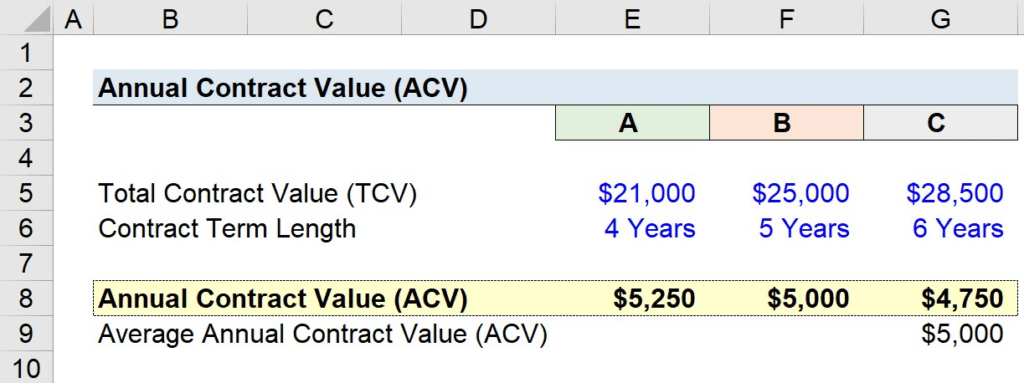

An example of calculating average contract value, which has taken into account the specific time period of the different contract values:

Common mistakes in calculating contract value

There are several common mistakes to avoid when calculating contract value. These include:

- Not including all relevant contract components, such as add-ons or recurring revenues.

- Overlooking the impact of discounts or concessions offered to clients.

- Failure to account for any contract modifications or amendments that may have altered the original value.

- Incorrectly calculating the number of contracts to be included or excluding certain contracts by mistake.

Impact of average contract value on business

Effect on revenue forecasting

The average contract value is an indispensable tool for accurate revenue forecasting. By analyzing past contract values and trends, businesses can make reliable projections concerning future revenues. This information is vital for effective resource allocation, budget planning, and assessing the overall financial health of the company.

Influence on business strategy

It directly impacts business strategy development. Businesses with higher average contract values often focus on attracting and retaining high-value clients. On the other hand, companies with lower average contract values might adopt strategies aimed at increasing volume or migrating customers to higher-value products or services.

Analyzing average contract value allows companies to align their sales and marketing efforts with their overall business objectives.

Ways to increase average contract value upselling and cross-selling strategies

One effective approach to increasing the average value is through upselling and cross-selling strategies. By offering additional products, features, or services that complement the original offering, companies can increase the overall value of the contract. This not only boosts revenue but also enhances customer satisfaction and loyalty.

Long-term contracts and retention

Encouraging long-term contracts and prioritizing customer retention can have a significant impact on the average value of a contract. By offering incentives or discounts to clients for longer commitments, businesses can secure more substantial contracts and build enduring relationships.

This approach is mutually beneficial as it provides stability and predictability for the business while offering clients added value and cost savings.

In conclusion, understanding and accurately measuring the average contract value is crucial for businesses to make informed decisions, plan strategically, and achieve financial success. By evaluating the factors that influence average contract values, utilizing proper calculation methods, and recognizing its impact on revenue forecasting and business strategy, companies can strive to increase average contract values and maximize their bottom line.

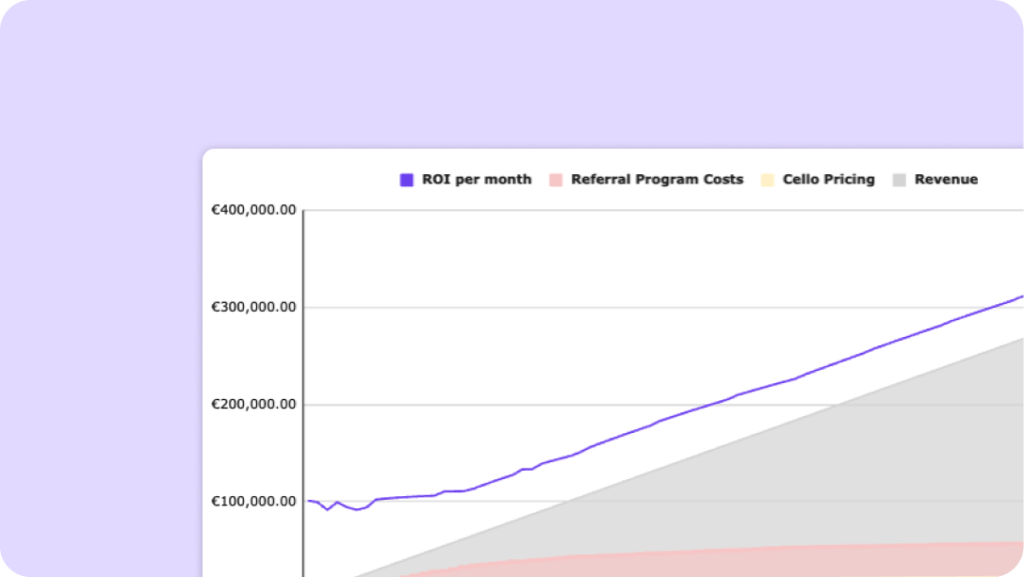

Maximize your growth with Cello's referral programs

As you focus on increasing your average contract value, consider leveraging the power of peer-to-peer referrals with Cello. Our platform is designed to transform your users into a potent growth channel, seamlessly integrating into your SaaS product to drive conversions and user-to-customer rates. With minimal development time, no upfront costs, and a success-based pricing model, Cello empowers you to kickstart viral growth and enhance customer loyalty. Experience the simplicity of our referral program and witness your business thrive. Book a demo today to see Cello in action and take the first step towards harnessing user-led growth.

Resources

Related Articles

4 Categories of Referral Programs for B2B SaaS

Learn how to get started with referral programs for B2B SaaS. Understand what type of referral ...

PLG SaaS Referral ROI Calculator

Learn how to estimate and prove the ROI of your PLG Referral Program

Complete Guide to your B2B Referral Program

Want to get started with B2B referrals? Check out our complete guide to your B2B referral ...